NRC’s Extraordinary General Meeting 2025 held on October 25th afternoon

|

In his opening speech at the meeting, Chairman of the Board of Directors Le Thong Nhat stated that to implement the business plan approved by the 2025 Annual General Meeting, the company has accelerated its investment and business strategies, yielding promising results. Specifically, the company has established subsidiaries such as NRC High-Tech Agriculture Company, NRC Pharma LLC, and Netland Real Estate JSC. Consequently, the company’s business operations have shown significant improvement, with several key performance indicators on track to meet year-end targets.

“Amid the current macroeconomic landscape, while challenges persist, new opportunities have emerged, particularly in the demand for real estate products with genuine value and alignment with modern urban development trends. Therefore, this extraordinary general meeting aims to approve critical solutions, enabling NRC to expand its investment and optimize business performance in the upcoming period,” added Mr. Nhat.

Chairman Le Thong Nhat delivering the opening speech at the meeting

|

The NRC General Meeting approved the investment plan for The Welltone Luxury Residence project (located in Con Tan Lap residential area, Xuong Huan Ward, Nha Trang City), with a maximum investment value of 1,000 billion VND. The investment focuses on fully legalized condominium units.

The investment will be executed through a contract with VHR Investment JSC, a company affiliated with NRC’s insiders. According to NRC’s 2025 semi-annual governance report, Mr. Le Thong Nhat currently serves as both the Chairman of the Board and CEO of VHR.

Regarding the legal status of The Welltone Luxury Residence project, NRC’s Chairman confirmed that the developer has submitted all necessary documents and is awaiting approval from relevant authorities. The project is expected to receive its sales permit by early November 2025.

Replacement of the 93 million share issuance plan approved at the 2025 Annual General Meeting

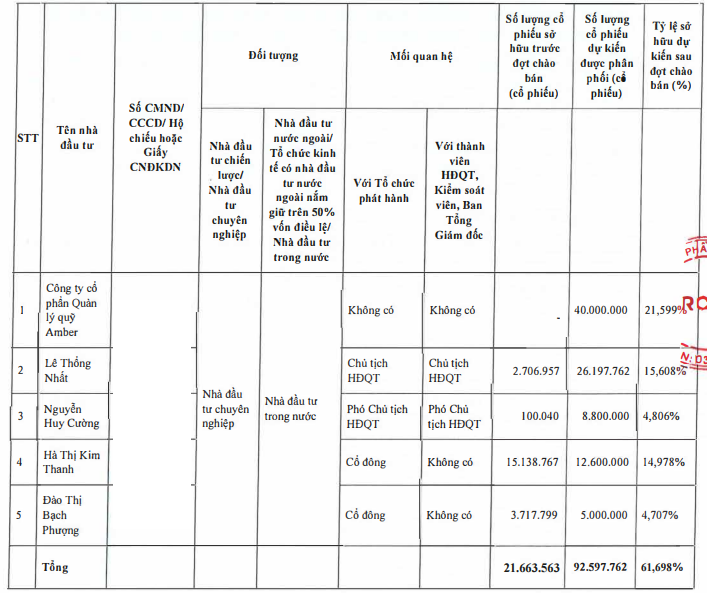

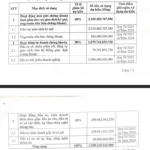

Another significant decision made at the NRC General Meeting was the approval of a private placement plan for up to 92.6 million shares at 10,000 VND per share, targeting professional securities investors. The issuance is scheduled for Q4/2025 to Q2/2026, pending approval from the State Securities Commission. The issued shares will be subject to a one-year transfer restriction.

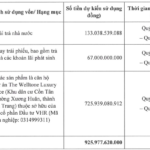

With a potential capital raise of nearly 926 billion VND, NRC plans to allocate funds for repaying state taxes (over 133 billion VND), settling bond principal and interest (67 billion VND), and investing in The Welltone Luxury Residence project (approximately 726 billion VND).

NRC announced five prospective investors for this private placement: Amber Fund Management JSC, Chairman Le Thong Nhat, Vice Chairman Nguyen Huy Cuong, and two company shareholders, Ms. Ha Thi Kim Thanh and Ms. Dao Thi Bach Phuong.

|

Number of shares registered by the five investors in the private placement

Source: Meeting materials

|

In conjunction with this issuance plan, NRC canceled the previous private placement of up to 93 million shares approved at the 2025 Annual General Meeting, citing incompatibility with current conditions.

What did NRC Chairman Le Thong Nhat say about the 2025 loss recovery plan?

9-month profit equals 40-50% of annual target

On the personnel front, the General Meeting approved the resignation of Ms. Han Thi Quynh Thi from the Board of Directors, effective October 25th. Ms. Thi had submitted her resignation on October 16th, citing her intention to better support the company’s strategic business direction and align with her personal career goals.

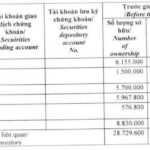

Mr. Tran Dai Duong, born in 1987, was elected to replace Ms. Thi on the Board. He previously served as Financial Management Director at Danh Khoi Holdings Investment JSC from May 2021 to May 2024. Currently, neither Mr. Duong nor his affiliates hold any shares in NRC.

Mr. Tran Dai Duong (right) introduced at the NRC General Meeting

|

On the sidelines of the meeting, Chairman Le Thong Nhat shared that Q3 business results were positive. Notably, after the first nine months, the company achieved 40-50% of its 2025 profit target. With revenue and profit peaks expected in Q4, NRC’s leadership believes meeting the 2025 business plan is feasible.

– 08:01 27/10/2025

NCB Officially Completes Third Capital Increase in Four Consecutive Years, Boosting Total Capital to VND 19,280 Billion

National Citizen Commercial Joint Stock Bank (NCB) has successfully completed a private placement of 750 million shares, officially increasing its charter capital to 19,280 billion VND, one year ahead of the schedule outlined in the PACCL roadmap.

New Crypto “Player” Enters the Digital Asset Arena, Aiming for $42 Million Annual Revenue: Just 2 Employees, Accumulated Losses in the Hundreds of Millions

The company seeks shareholder approval for a private placement of 10 million shares at an offering price of 20,000 VND per share.