Mr. Nguyễn Duy Hưng – Chairman of the Board of Directors, PAN

|

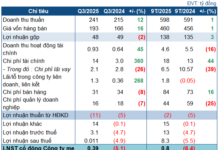

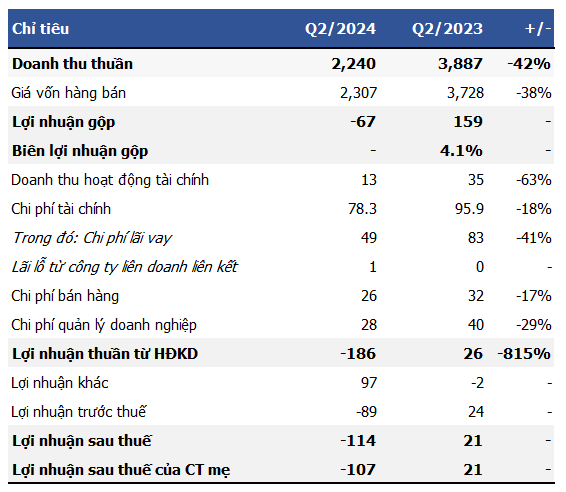

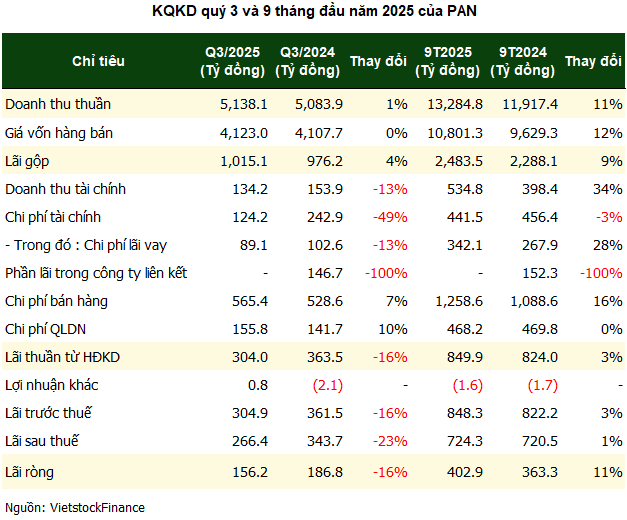

PAN Group, an agribusiness, food, and seafood conglomerate chaired by Mr. Nguyễn Duy Hưng, reported Q3 2025 revenue of VND 5.138 trillion, a 1% increase year-on-year, setting a new record. However, net profit declined by 16% to VND 156 billion, despite being the highest quarterly profit of the year, up 44% from Q1. Gross margin improved to 19.8% from 19.2% in the same period last year.

According to PAN, in Q3 2024, the group recorded a one-time gain of nearly VND 147 billion from a newly consolidated subsidiary, which significantly boosted profits. This quarter, there were no similar gains, and financial revenue decreased by 13% to VND 134 billion, while selling and administrative expenses rose by 7% and 10%, respectively, impacting overall profitability.

|

Strong Export Growth, 9-Month Profit Nearing 2023 Full-Year Level

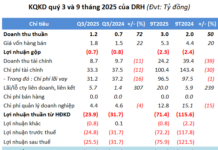

In the first nine months of 2025, PAN achieved revenue of VND 13.285 trillion and net profit of VND 403 billion, both up 11% year-on-year, fulfilling 77% of the annual revenue target and 60% of the profit goal. This is the best 9-month performance in the company’s history, nearly matching the full-year 2023 profit (VND 406 billion) and just below the record VND 609 billion in 2024.

| PAN’s Business Results from 2016 to 9M2025 |

Within the revenue structure, the seafood segment led with VND 7.385 trillion, accounting for 56% of total revenue, followed by agriculture at VND 4.174 trillion (31%) and packaged food at VND 1.736 trillion (13%).

Despite revenue disparities, the after-tax profits of the agriculture and seafood segments were relatively similar, at VND 363 billion and VND 375 billion, respectively. Compared to 2024, the seafood segment grew strongly, with revenue and profit up 23% and 25%, while agriculture saw slight declines of 2% in revenue and 9% in profit.

Export revenue for the nine months reached VND 6.363 trillion, representing 36% of total revenue and a 39% increase year-on-year. Domestic revenue, though still dominant, fell by 40% to VND 11.523 trillion.

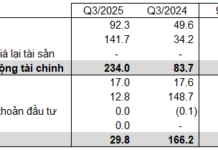

Significant Reduction in Deposits and Debt

As of September, PAN held nearly VND 6.3 trillion in bank deposits, down over 50% from the beginning of the year, accounting for 35% of total assets. Inventory increased by 22% to VND 3.807 trillion, primarily finished goods and merchandise, up 36% and 45%, respectively. Conversely, the company significantly reduced its debt to over VND 6.4 trillion, with short-term debt of nearly VND 5.9 trillion, down 49% from the start of the year.

On the HOSE, PAN shares traded at VND 30,700 per share on October 27, down 8% over the past three months but up 32% year-on-year, with average liquidity of nearly 1.5 million shares per session. From a low of nearly VND 20,000 per share in early April, the stock surged nearly 75% to over VND 35,000 per share in mid-September, the highest since 2022.

| PAN Stock Price Over the Past Year |

Notably, the stock’s recovery followed Chairman Nguyễn Duy Hưng‘s statement at the Annual General Meeting in late April 2025, where he expressed optimism that “PAN‘s stock price would improve in 2025.” Since then, the stock has risen as predicted, though it has corrected over 11% from its peak.

– 10:57 27/10/2025

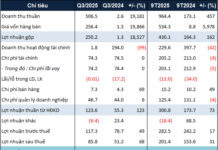

“German Chemicals Aims for $38 Million Profit in Q3 2025”

The Duc Giang Chemical Group has announced its financial plans for the third quarter of 2025, with an impressive projected revenue of VND 2,907 billion and an expected profit after tax of VND 880 billion, reflecting a significant 19.2% increase compared to the same period last year.