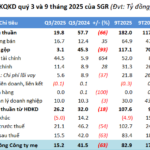

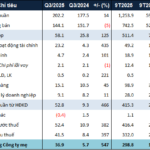

In Q3, PTSC’s gross profit reached VND 323 billion, a slight 3% decrease year-over-year, despite a significant surge in revenue. Operating expenses rose sharply by 44%, totaling nearly VND 321 billion.

Net profit for the quarter saw a substantial increase, primarily driven by higher financial revenue and a notable reduction in financial expenses. These fluctuations are attributed to foreign exchange rate differentials.

|

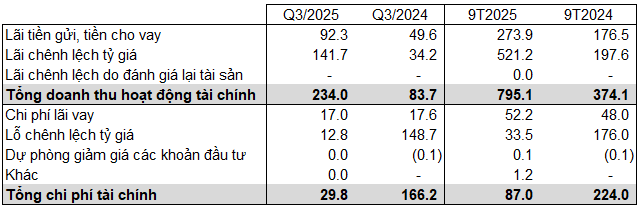

Financial Activities Revenue and Expenses at PVS

Unit: Billion VND

Source: Consolidated Financial Statements of PVS

|

For the first nine months of the year, PTSC recorded a consolidated net revenue of nearly VND 23 trillion and post-tax profit of VND 950 billion, surpassing the annual targets by 2% and 22%, respectively.

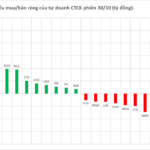

On the stock market, PVS shares have underperformed compared to the overall market this year. As of the close on October 27th, the stock price declined by 8.8%, while the VN-Index rose by 30.5%.

– 10:58 28/10/2025

Quy Nhơn Iconic Drives PDR’s Q3 Net Profit Up 67%

Despite the absence of investment liquidation proceeds compared to the same period last year, Phat Dat Real Estate Development Corporation (HOSE: PDR) reported a rise in net profit for Q3/2025, driven by a significant surge in net revenue.

Novaland Posts Fourth Consecutive Quarterly Loss as Financial Costs Surge

The widening forex gap, amounting to a staggering 712 billion VND, has sent No Va Land Investment Group Corporation’s (HOSE: NVL) financial costs soaring. As a result, the company reported yet another quarterly loss in Q3 this year, marking the fourth consecutive quarter of negative results since Q4 2024.

Saigonres Achieves 26% of Profit Plan After 9 Months

Plummeting revenue and soaring costs left Saigonres with a meager Q3 net profit of just over VND 15 billion, a staggering 63% decline. After nine months, the company has achieved a mere 26% of its annual profit target.