OCB Reports Q3/2025 Profit Tripling YoY

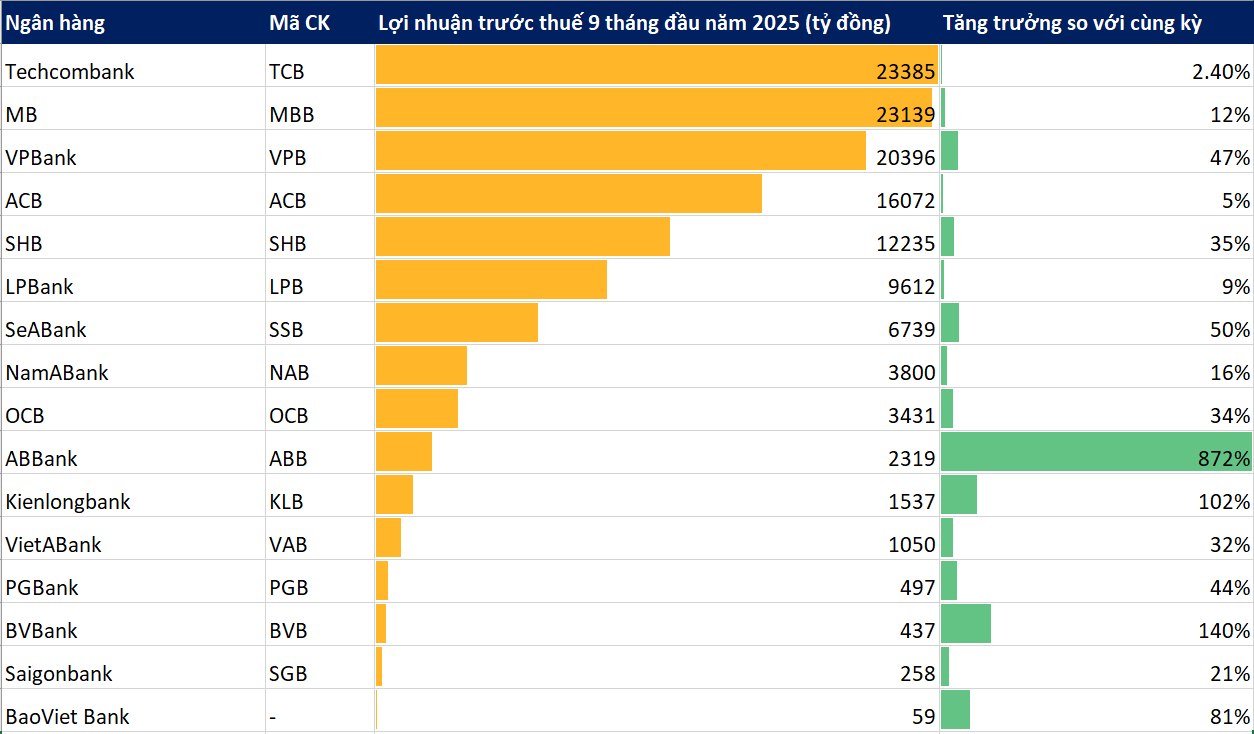

Orient Commercial Joint Stock Bank (OCB) has announced its Q3/2025 financial report, revealing a pre-tax profit of VND 1,538 billion, a threefold increase compared to the same period last year. The cumulative profit for the first nine months reached VND 3,431 billion, up 34.4% year-on-year.

As of September 30, 2025, OCB’s total assets stood at VND 315,162 billion, marking a significant growth and achieving 99% of the annual plan. Market deposits reached VND 219,998 billion, a 14.3% increase from the beginning of the year. Outstanding loans in the market were VND 202,863 billion, up 12.4% year-to-date.

SeABank Surpasses Annual Profit Target Early

Southeast Asia Commercial Joint Stock Bank (SeABank) reported a pre-tax profit of VND 6,739 billion for the first nine months of 2025, a 49.5% increase year-on-year, surpassing its annual target by 104%.

The bank’s total assets exceeded VND 380,808 billion, up 16.92% from the end of 2024, achieving 106% of the annual plan. Customer loans increased by 11.6% to VND 233,562 billion, while deposits and securities rose by 6.5% to VND 211,674 billion. Equity capital grew by over 15% to nearly VND 40,268 billion, with chartered capital at VND 28,450 billion. The non-performing loan ratio remained at 1.95%.

BVBank Posts VND 437 Billion Pre-Tax Profit

Vietnam Public Bank (BVBank) reported a pre-tax profit of VND 437 billion for the first nine months of 2025, a 2.4-fold increase year-on-year, achieving 79% of its annual target. Credit growth was 14.1% compared to the beginning of the year.

As of September 30, 2025, BVBank’s total assets reached VND 122,600 billion, up 18% from the end of 2024, meeting the annual plan. Outstanding loans were nearly VND 78,000 billion, a 14.1% increase year-to-date. Total deposits grew by 23% year-on-year and 18.4% from the beginning of the year, reaching VND 113,000 billion. Individual and corporate deposits increased by 24% to nearly VND 92,800 billion.

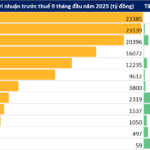

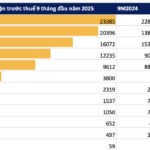

MB Records VND 23,000 Billion in 9-Month Pre-Tax Profit

Military Commercial Joint Stock Bank (MB) reported a Q3/2025 consolidated pre-tax profit of VND 7,250 billion, down 0.8% year-on-year, primarily due to a 132% increase in provisioning costs to VND 3,801 billion, despite a 23.5% rise in net profit from operations.

For the first nine months, MB’s consolidated pre-tax profit reached VND 23,139 billion, up 11.6% year-on-year, ranking second among the 13 banks that have announced their 9-month profits as of October 26, 2025.

In the first half of 2025, MB ranked fourth in terms of profit among the banking system, following Vietcombank, VietinBank, and BIDV.

As of September 30, 2025, MB’s total assets surpassed VND 1,300 trillion, up 17.7% from the beginning of the year. Customer loans increased by 19.9% to VND 931,498 billion, and deposits grew by 10.3% to VND 788,030 billion.

MB’s bad debt by the end of September was over VND 17,400 billion, up 38.4% from the beginning of the year, with the bad debt ratio rising from 1.62% to 1.87%.

ABBank Profits Nearly 10x YoY

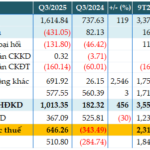

An Binh Commercial Joint Stock Bank (ABBank) announced its Q3/2025 financial report, with consolidated pre-tax profit exceeding VND 2,300 billion, a 9.7-fold increase year-on-year, achieving 128% of its annual profit target. In Q3 alone, the bank’s pre-tax profit was over VND 646 billion, a significant improvement from the VND 343 billion loss in the same period in 2024.

By the end of Q3/2025, ABBank’s total assets reached VND 204,576 billion, up 15.8% from the end of 2024. Customer loans were VND 107,573 billion, up 9%, and deposits were VND 118,712 billion, up nearly 31% in the first nine months.

ACB Reports VND 16,072 Billion Pre-Tax Profit

Asia Commercial Bank (ACB) reported a pre-tax profit of VND 16,072 billion for the first nine months of 2025, up 4.8% year-on-year. In Q3/2025, the bank’s pre-tax profit was VND 5,382 billion, up 11%.

ACB’s foreign exchange business saw strong growth, with net profit from foreign exchange reaching VND 1,595 billion in the first nine months, up 93% year-on-year.

As of September 30, 2025, ACB’s total assets were VND 948,549 billion, up 9.8% from the beginning of the year. Customer loans reached VND 669,188 billion, up 15.2%, and deposits were VND 571,029 billion, up 6.3%.

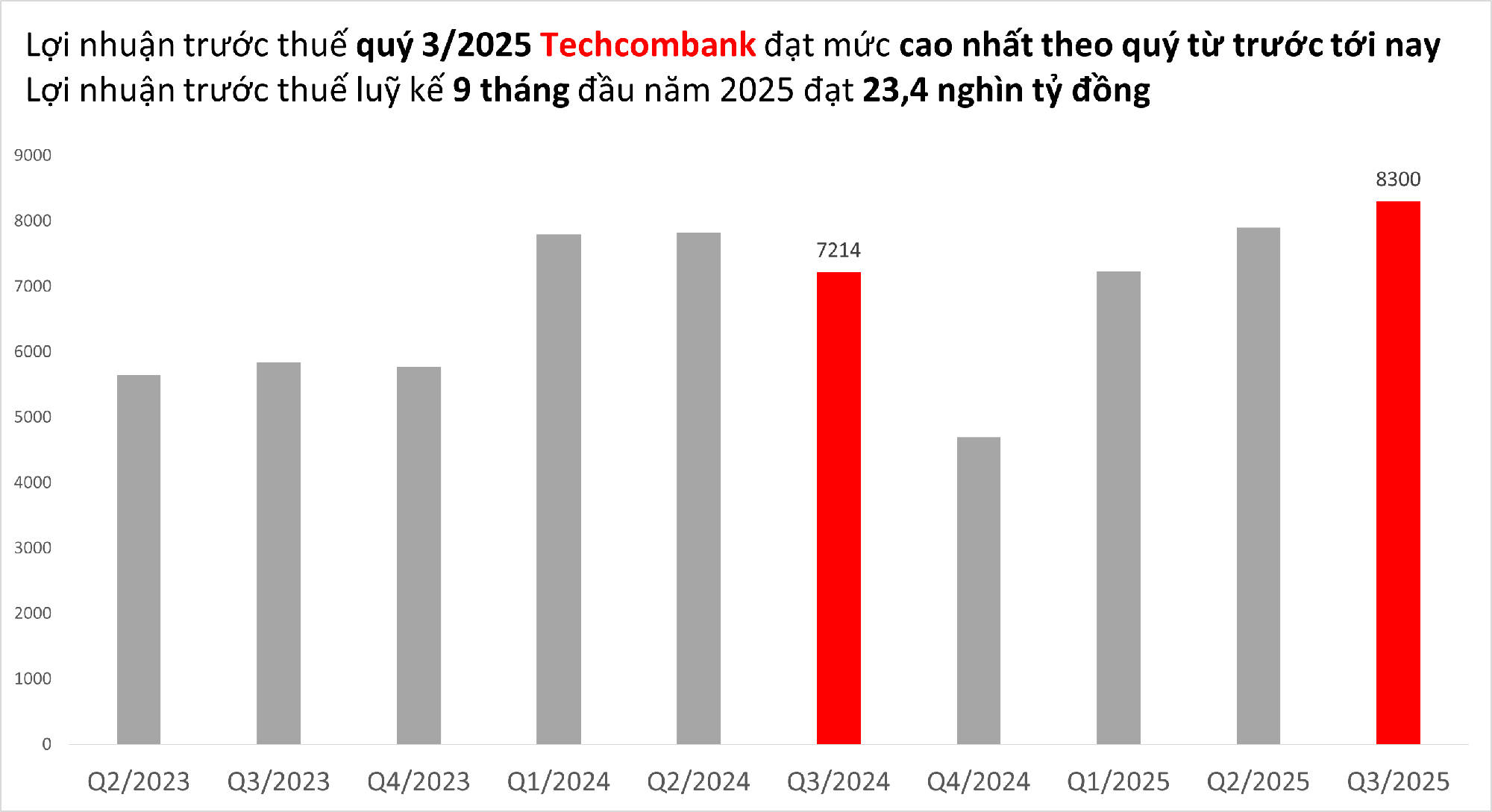

Techcombank Reports VND 23,400 Billion Pre-Tax Profit

In the first nine months of 2025, Techcombank’s pre-tax profit reached VND 23,400 billion, up 2.4% year-on-year. Q3/2025 pre-tax profit was VND 8,300 billion, up 14.4%, the highest quarterly profit in the bank’s history.

As of September 30, 2025, Techcombank’s total assets exceeded VND 1,130 trillion. Credit growth was stable at 16.8% year-to-date.

Customer deposits reached VND 638,500 billion by the end of September, up 24.1% from the beginning of the year. The CASA ratio (current accounts and savings accounts) was 42.5%, among the highest in the industry.

Techcombank maintained strong asset quality, with the non-performing loan ratio improving from 1.32% to 1.23%. The loan loss coverage ratio was 119.1%, marking the eighth consecutive quarter above 100%.

SHB Profit Surges 36%

Saigon-Hanoi Commercial Joint Stock Bank (SHB) announced its 9-month 2025 business results, with pre-tax profit reaching VND 12,307 billion, up 36% year-on-year, achieving 85% of the annual plan.

As of September 30, 2025, SHB’s total assets were VND 852,695 billion, up 14% from the end of 2024. Outstanding loans reached nearly VND 616,600 billion, up 15% year-to-date.

Capital adequacy ratios exceeded regulatory requirements and international standards, with CAR above 12%, significantly higher than the 8% minimum under Circular 41/2016/TT-NHNN.

LPBank Reports VND 9,600 Billion Profit

Vietnam Post and Telecommunications Joint Stock Bank (LPBank) announced its 9-month 2025 financial report, with cumulative pre-tax profit reaching VND 9,612 billion, up 9% year-on-year. Q3/2025 pre-tax profit was VND 3,448 billion, up 15.3% quarter-on-quarter and 18.9% year-on-year.

As of September 30, 2025, LPBank’s total assets were VND 539,149 billion, up 18.3% year-on-year and over 6% from the beginning of the year. Outstanding loans reached VND 387,898 billion, up 17% year-to-date, and deposits were VND 389,638 billion, up 15% since the beginning of the year.

PGBank Profit Up 44%

Petrolimex Group Commercial Joint Stock Bank (PGBank) reported a 9-month 2025 pre-tax profit of nearly VND 497 billion, up 44% year-on-year.

As of September 30, 2025, PGBank’s total assets were nearly VND 79,838 billion, up 9.3% from the end of 2024. Customer loans reached VND 44,349 billion, up 7.5%, and the bad debt ratio under Circular 31 was 2.84%.

Customer deposits were VND 44,375 billion, up 2.4%, while deposits from other credit institutions and bond issuances increased significantly.

BAOVIET Bank Profit Skyrockets

BAOVIET Bank reported a 9-month 2025 pre-tax profit of VND 58.6 billion, up 81% year-on-year.

As of September 30, 2025, the bank’s total assets exceeded VND 89,700 billion. Customer loans grew by 16.54% to over VND 55,625 billion, and deposits increased by 12.34% to VND 66,743 billion.

Kienlongbank Reports Record Profit

Kienlong Commercial Joint Stock Bank (Kienlongbank) reported a 9-month 2025 pre-tax profit of VND 1,537 billion, double the same period last year, achieving 112% of its annual plan, marking the highest profit in its 30-year history.

With these results, Kienlongbank aims to reach 150% of its 2025 profit plan.

As of September 2025, Kienlongbank’s total assets were VND 97,716 billion, deposits reached VND 87,491 billion, and outstanding loans were VND 70,922 billion, up VND 5,500 billion, VND 7,300 billion, and VND 9,400 billion, respectively, from the beginning of the year.

Asset quality remained strong, with the bad debt ratio below 2% and loan loss coverage exceeding 80% for three consecutive quarters.

NCB Surpasses All 2025 Business Targets

National Citizen Bank (NCB) reported strong Q3/2025 performance, with after-tax profit estimated at nearly VND 190 billion. Cumulative 9-month after-tax profit was over VND 652 billion, a significant improvement from the VND 65 billion loss in Q3/2024 and VND 59 billion loss in the first nine months of 2024.

NCB surpassed its 2025 business targets after just nine months. As of September 30, 2025, total assets were over VND 154,100 billion, up 30% from the end of 2024 and exceeding the plan by 14%. Deposits (excluding bond issuances) reached nearly VND 119,326 billion, and customer loans were over VND 94,956 billion, up 24% and 33% from the end of 2024, respectively, and exceeding the 2025 plan by 1% and 3%.

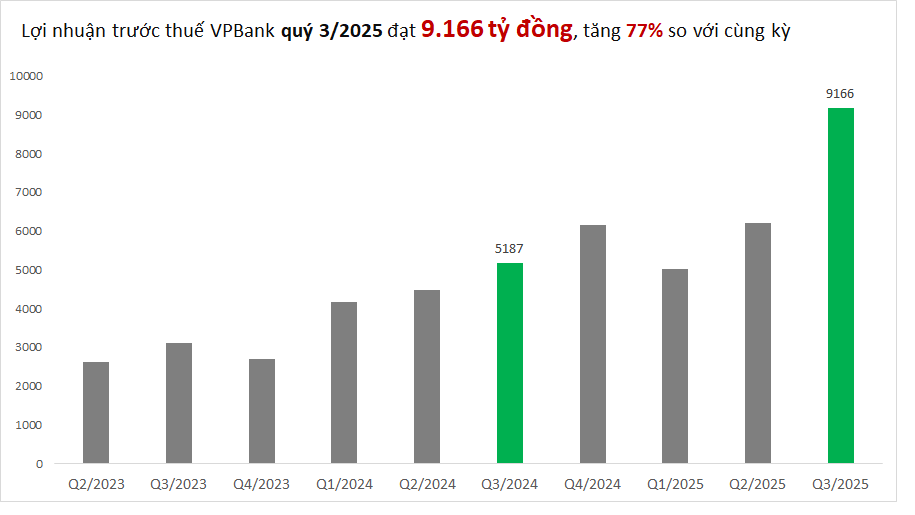

VPBank Reports VND 20,400 Billion Profit After 3 Quarters

Vietnam Prosperity Joint Stock Commercial Bank (VPBank) announced its 9-month 2025 business results, with consolidated pre-tax profit reaching VND 20,396 billion, up 47.1% year-on-year. Q3/2025 profit was VND 9,166 billion, up 76.7%, the highest in the last 15 quarters. Cumulative 9-month profit exceeded the 2024 result and achieved 81% of the 2025 plan.

As of September 2025, VPBank’s consolidated total assets surpassed the target set at the Annual General Meeting, reaching VND 1,180 trillion, up 27.5% year-to-date. Individual bank assets were over VND 1,100 trillion.

Consolidated outstanding loans were nearly VND 912,000 billion, up 28.4%, contributed by both the parent bank and subsidiaries. Individual bank loans were VND 813,000 billion.

As of Q3/2025, the consolidated bad debt ratio under Circular 31 was tightly controlled below 3%, and individual bank bad debt continued to improve to 2.23%.

VietABank Profit Up 32%

Vietnam Asia Commercial Joint Stock Bank (VietABank) reported a Q3/2025 pre-tax profit of VND 336 billion, up 46% year-on-year. Cumulative 9-month pre-tax profit was VND 1,050 billion, up 32% year-on-year.

As of September 30, 2025, VietABank’s total assets were VND 134,614 billion, up 12.3% year-to-date. Customer loans reached VND 85,811 billion, up 8.4%, and deposits were VND 97,984 billion, up 8.5%.

NamABank Reports VND 3,800 Billion Pre-Tax Profit

Nam A Commercial Joint Stock Bank (Nam A Bank) reported a 9-month 2025 pre-tax profit of over VND 3,800 billion, up nearly VND 520 billion year-on-year (16%), achieving 77% of the annual plan. Total assets as of September 30, 2025, were over VND 377,000 billion, up over VND 132,000 billion year-to-date.

Deposits from organizations and individuals increased by over VND 35,000 billion, up 20% year-to-date. Outstanding loans grew by over VND 30,000 billion, up 17.88%, and bond investments increased by nearly VND 14,000 billion.

The bad debt ratio was 2.53% (pre-CIC) and 2.73% (post-CIC), down from 2.85% in June 2025. The loan loss coverage ratio increased from 39% in June 2025 to nearly 46% in September 2025. The liquidity reserve ratio was nearly 20%, double the minimum requirement set by the State Bank of Vietnam.

Steady Growth: BVBank Achieves 79% of Annual Profit Target in First 9 Months

Adhering closely to its retail strategy and maintaining efficient operational control, BVBank sustains steady growth momentum, progressively achieving its 2025 objectives.

ABBank Surpasses 30% Annual Profit Target in 9 Months, Approved to Increase Capital to VND 13,973 Billion

ABBank (UPCoM: ABB) reported pre-tax profits of over VND 646 billion in Q3/2025, bringing its nine-month total to VND 2,319 billion, surpassing its annual target by 30%. Additionally, the State Bank of Vietnam approved a capital increase of VND 3,622 billion for ABBank.