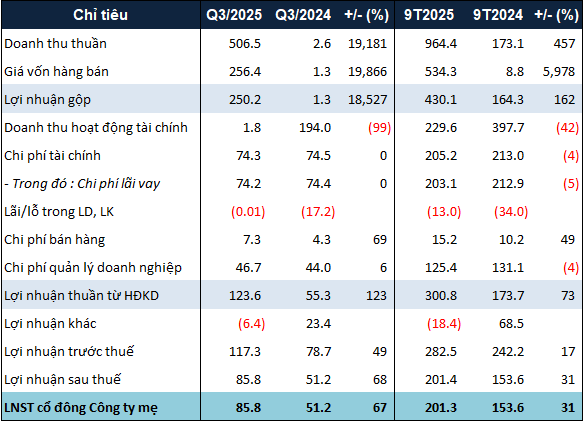

Specifically, PDR reported a Q3 net revenue of nearly VND 507 billion, surpassing the combined total of the first two quarters, while the same period last year was only approximately VND 3 billion. This remarkable revenue surge stems from nearly VND 405 billion in real estate transfers and over VND 101 billion in service provision.

PDR disclosed that during the period, the company transferred the Bắc Hà Thanh project (Quy Nhơn Iconic) and the Kỳ Đồng project (Ho Chi Minh City).

In contrast, financial activities saw a decline, with revenue dropping to under VND 2 billion due to the absence of the VND 193 billion profit from investment liquidation recorded in the same period last year.

Regarding expenses, while the cost of goods sold increased in line with net revenue, other costs such as financial and management expenses saw minimal growth. Selling expenses rose by 69% to over VND 7 billion, representing a small portion of total expenses.

As a result, PDR achieved a net profit of nearly VND 86 billion in Q3, a 67% increase year-over-year. Over the first nine months, net revenue and net profit reached over VND 964 billion and VND 201 billion, respectively, marking a 5.6-fold and 31% rise.

Compared to the 2025 post-tax profit target of VND 728 billion, PDR has achieved nearly 28% of this goal in the first nine months.

|

Business results for the first 9 months of 2025 of PDR. Unit: Billion VND

Source: VietstockFinance

|

On the balance sheet, PDR‘s total assets as of September 30, 2025, stood at over VND 24.2 trillion, unchanged from the beginning of the year. Short-term cash holdings decreased by 75% to VND 116 billion. Inventory value increased by 6% to nearly VND 15 trillion, due to the addition of over VND 1 trillion in real estate assets from land use rights and associated assets at 61 Cao Thắng (nearly VND 601 billion) and 41-43 Nguyễn Trãi (nearly VND 401 billion) in Ho Chi Minh City.

Meanwhile, total liabilities decreased by 5% to over VND 12.3 trillion. Outstanding loans increased by 10% to nearly VND 5.9 trillion, primarily from bank loans. With revenue recognition commencing, customer deposits for the Bắc Hà Thanh project decreased by 87% to over VND 17 billion.

– 11:11 28/10/2025

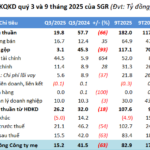

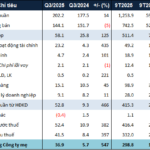

BV Land’s Short-Term Holdings Surge Past 421 Billion, Over 21 Times Higher Than Year-Start

Following two consecutive quarters surpassing the 100 billion VND mark, BV Land Joint Stock Company’s (UPCoM: BVL) consolidated net profit in Q3/2025 showed a slight cooldown but still remained over six times higher than the same period last year.

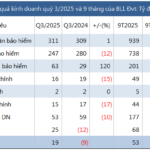

Bảo Long Insurance Escapes Q3 Loss Despite Stagnant Premium Revenue

Baoviet Insurance Corporation (UPCoM: BLI) has reported a remarkable turnaround in its financial performance for Q3 2025. The company achieved a net profit of nearly VND 25 billion, a significant improvement from the VND 9 billion loss incurred during the same period last year, which was primarily attributed to the impact of natural disasters and severe flooding. This positive result is largely due to the reduction in overall operating expenses related to insurance business activities.