I. MARKET ANALYSIS OF THE BASE STOCK MARKET ON OCTOBER 28, 2025

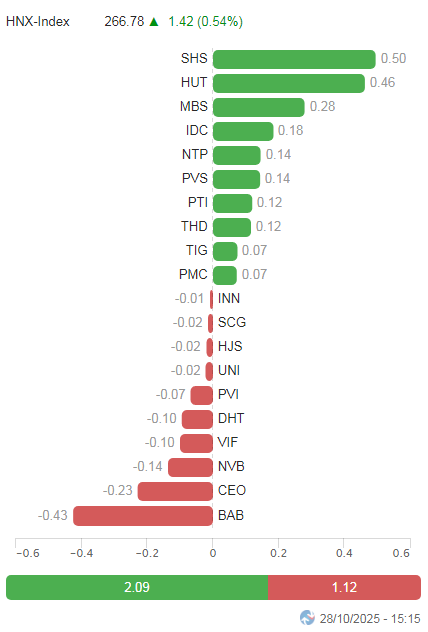

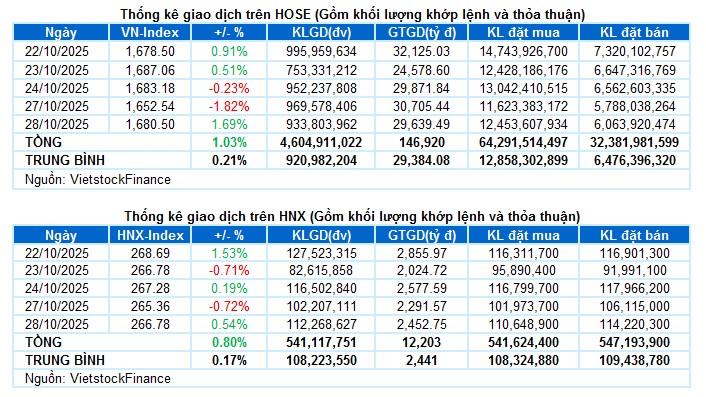

– Key indices rebounded during the October 28 trading session. Specifically, the VN-Index surged by 1.69%, reaching 1,680.5 points, while the HNX-Index also rose by 0.54%, closing at 266.78 points.

– Trading volume on the HOSE continued to decline slightly by 3%, totaling nearly 877 million units. In contrast, the HNX recorded approximately 101 million units, a 10.6% increase compared to the previous session.

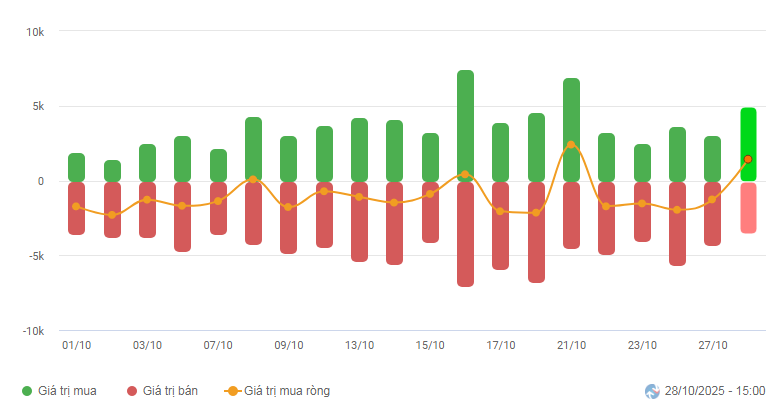

– Foreign investors returned to net buying on the HOSE, with a value of nearly 1.5 trillion VND, but remained net sellers on the HNX with a value of approximately 77 billion VND.

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

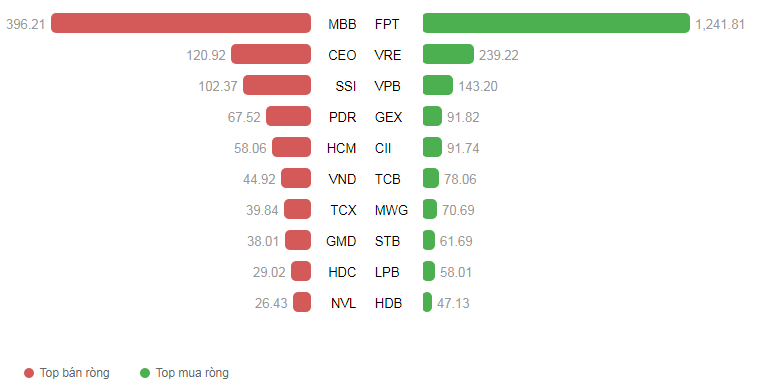

Net Trading Value by Stock Code. Unit: Billion VND

– Vietnam’s stock market experienced another volatile session on October 28. Starting with fluctuations below the reference level, weakness in large-cap stocks led to widespread negative sentiment. The VN-Index plummeted, losing over 30 points at one stage. However, a dramatic reversal occurred as the index retreated to 1,622 points. Strong bottom-fishing demand, particularly in large-cap stocks, helped the VN-Index erase all losses and surge by nearly 28 points. At the close, the index stood at 1,680.5 points, up 1.69% from the previous session.

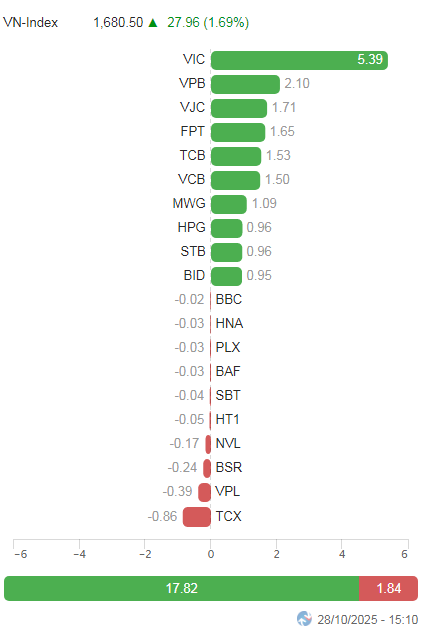

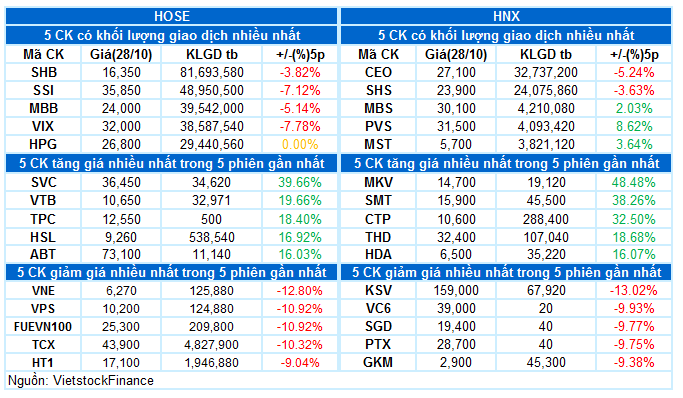

– In terms of impact, the top 10 stocks contributed nearly 18 points to the VN-Index, with VIC leading the charge at 5.4 points. Conversely, TCX was the sole significant drag, subtracting 0.86 points from the index.

Top Stocks Influencing the Index. Unit: Points

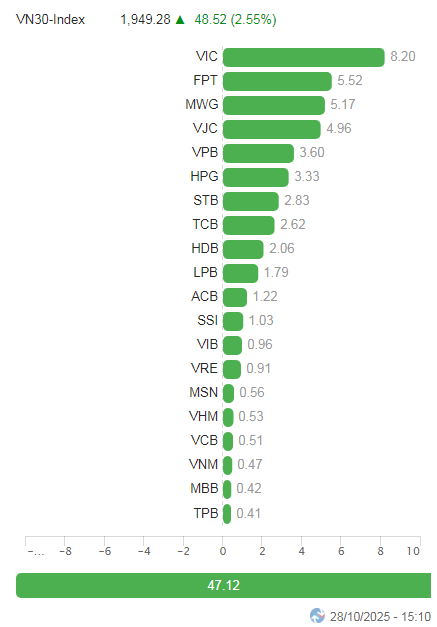

– The VN30-Index closed with a gain of 48.52 points, reaching 1,949.28 points. Buyers dominated with 28 advancing stocks, 1 declining stock, and 1 unchanged stock. Notably, VJC stood out with a strong performance. Other top performers included FPT, VIB, VPB, and STB, all surging over 4%. In contrast, PLX was the only stock in the basket to decline, falling by 0.3%, while SAB remained flat.

Green returned to most sectors. Information technology led the gains with a 4.1% increase, driven by strong demand for FPT (+4.29%), ELC (+1.64%), DLG (+1.58%), POT (+1.45%), and VEC, which hit its upper limit.

The industrial sector also made a strong impression, with notable performances from VJC, CTD, and HAH, all reaching their upper limits. Other gainers included ACV (+2.81%), GEE (+1.18%), GEX (+6.25%), VGC (+1.18%), VCG (+2.36%), BMP (+1.68%), and VSC (+5.73%).

Two major sectors, real estate and finance, rebounded by over 1.5%, with several notable reversals toward the end of the session, including VIC, KDH, PDR, DXG, DIG, TCH, VPI, IDC, HDC, SCR; TCB, VPB, HDB, STB, VIX, TPB, SSI, VIB, and VND.

Conversely, the communication services sector struggled, declining by 1.13%, weighed down by VGI (-1.67%), VNZ (-0.89%), CTR (-0.55%), and TTN (-1.08%). Despite this, FOX (+0.62%), YEG (+0.81%), FOC (+0.93%), SGT (+1.76%), and ICT attracted strong buying interest. Similarly, the energy sector was under pressure, with BSR (-1.33%), OIL (-0.94%), PLX (-0.29%), and PVC (-0.95%) leading the declines.

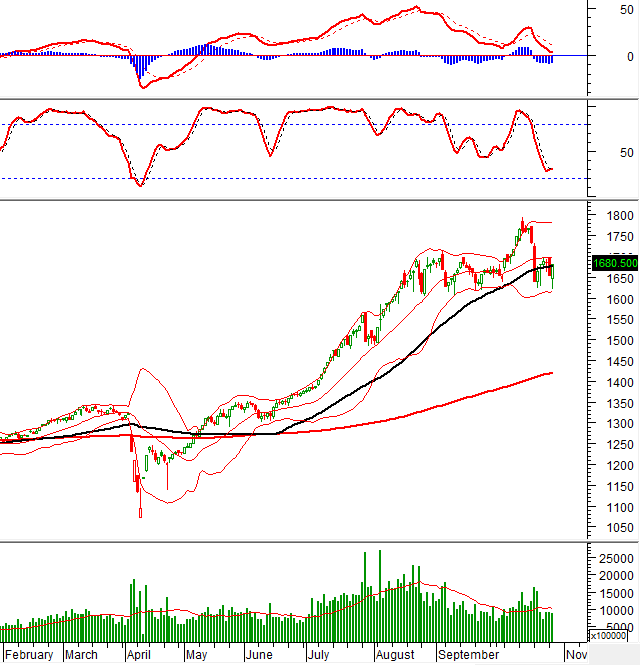

The VN-Index staged an impressive comeback after successfully testing the August 2025 low. The short-term outlook improved as the index crossed above the 50-day SMA, and the Stochastic Oscillator also signaled a buy. If trading volume exceeds the 20-day average in upcoming sessions, the uptrend will be confirmed.

II. PRICE TREND AND VOLATILITY ANALYSIS

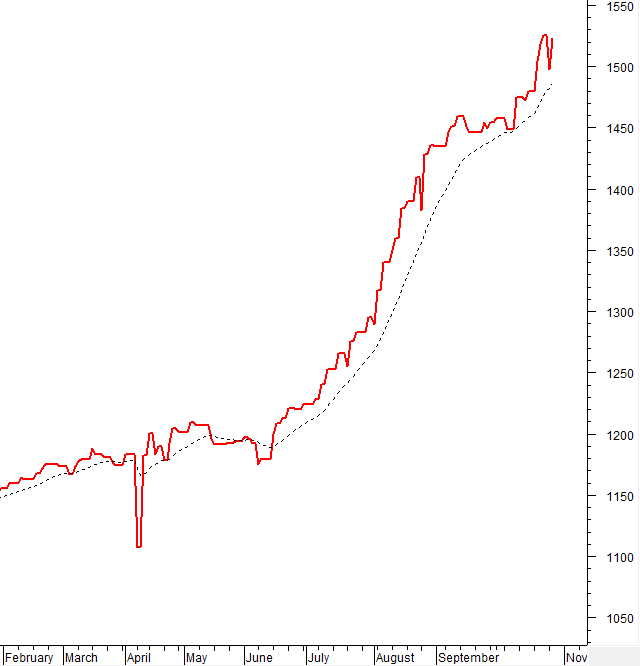

VN-Index – Strong Support at August 2025 Low

The VN-Index staged an impressive comeback after successfully testing the August 2025 low.

The short-term outlook improved as the index crossed above the 50-day SMA, and the Stochastic Oscillator also signaled a buy. If trading volume exceeds the 20-day average in upcoming sessions, the uptrend will be confirmed.

HNX-Index – Stochastic Oscillator Signals Buy

The HNX-Index recovered well toward the end of the session but remains below the Middle Band of the Bollinger Bands. The index needs to break above this level to exit its short-term consolidation phase.

Currently, the Stochastic Oscillator has signaled a buy. If the MACD continues to narrow its gap with the Signal line and provides a similar signal in upcoming sessions, the index’s outlook will turn more positive.

Capital Flow Analysis

Smart Money Flow: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Flow: Foreign investors were net buyers in the October 28, 2025 session. If foreign investors maintain this trend in upcoming sessions, the outlook will become more positive.

III. MARKET STATISTICS FOR OCTOBER 28, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:15, October 28, 2025

Real Estate Firms Reap Massive Profits Through Strategic Stock Market Investments

Despite a slowdown in its core business, Da Nang Housing Development Investment Corporation (HDIC) reported a remarkable post-tax profit of over VND 145 billion in the first nine months, a 3.5-fold increase compared to the same period last year. This impressive performance was largely driven by gains from its stock portfolio, which includes 23 stocks with investments ranging from a few hundred million to under VND 100 billion, such as HPG, VHM, DGC, FPT, VPB, VCG, EIB, and CTG.