At the press conference titled “Macroeconomic Outlook and Investment Strategies in the Era of Innovation 2.0”, Ms. Vu Ngoc Linh, Director of Market Analysis and Research at VinaCapital, forecasted that 2026 will be a year of more balanced growth, still reaching 8%. This growth will be driven by a strong recovery in domestic consumption and, notably, 2026 will be the “golden moment” to feel the ripple effects of public investment disbursement.

Ms. Vu Ngoc Linh – Director of Market Analysis and Research, VinaCapital

|

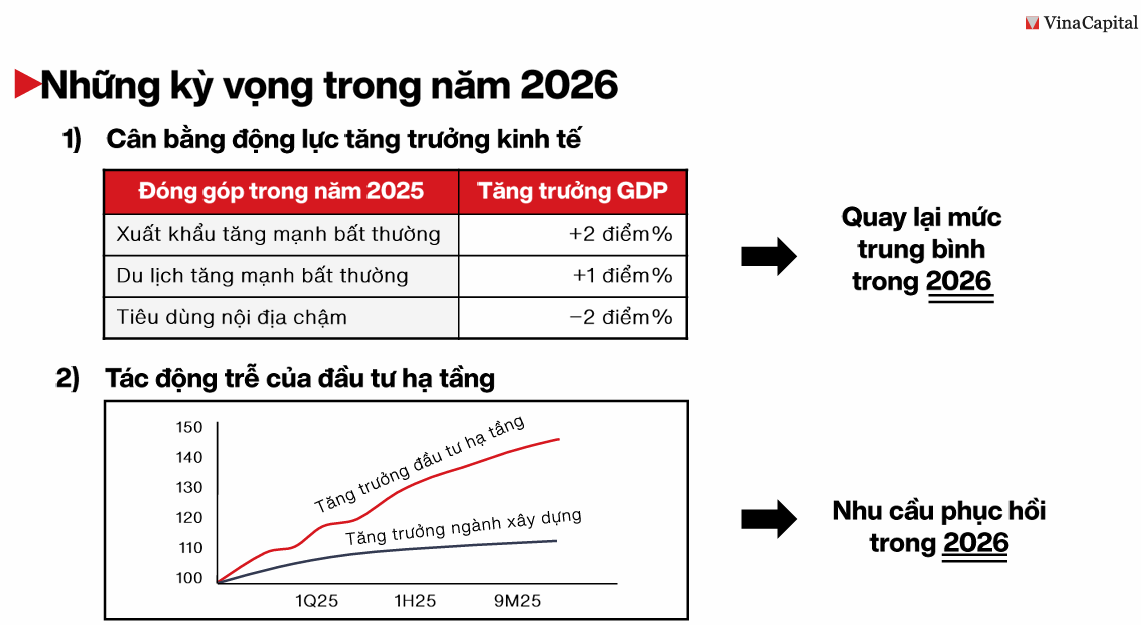

According to Ms. Vu Ngoc Linh, Vietnam’s GDP growth rate from the beginning of 2025 has been impressive, primarily due to two main factors. First, strong export growth, reaching 28% in the first nine months (projected to grow by 22% for the entire year), particularly to the U.S. market despite tariff concerns. Second, the growth of tourism, with Chinese visitor numbers increasing by 20% year-on-year, significantly contributing to retail growth.

However, Ms. Linh emphasized that excluding these two factors, overall domestic consumption remains relatively weak. Actual retail growth (excluding international tourism) is only around 5-6%, significantly lower than the 8-9% pre-COVID-19 levels.

Moving into 2026, VinaCapital expects the economy to grow more balanced, targeting an 8% GDP growth rate. This balance is reflected in: export growth to the U.S. normalizing to 8% (still positive on a high 2025 base), and more importantly, real retail growth (adjusted for inflation) recovering to 8%. This figure reflects Vietnam’s intrinsic potential, no longer reliant on the explosive growth of tourism as seen in 2025.

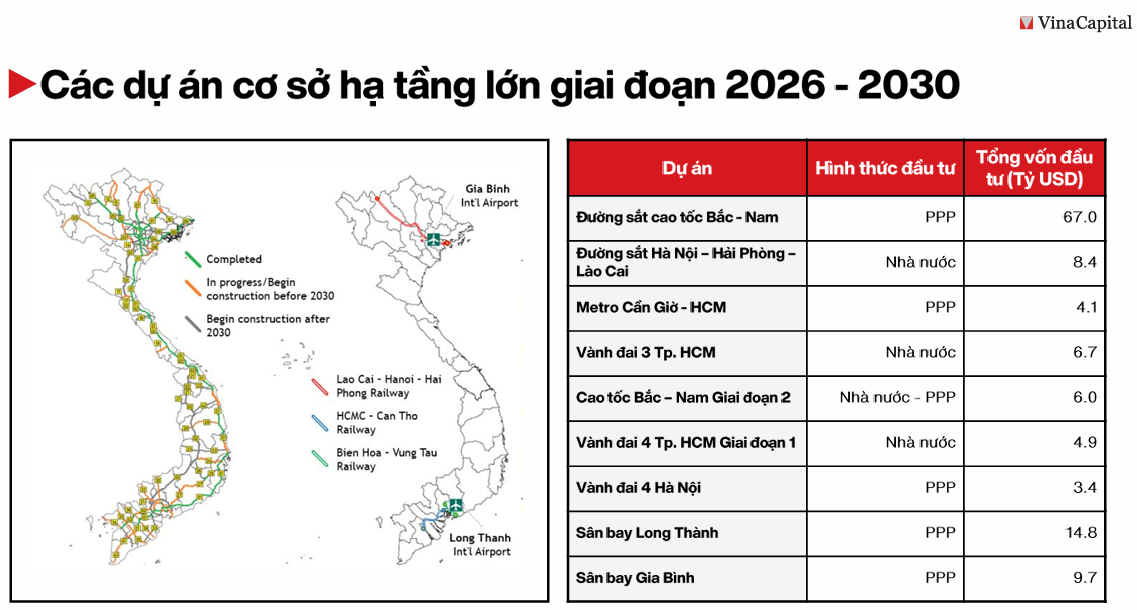

Notably, 2026 is considered the “golden moment” to experience the widespread impact of public investment disbursement, with infrastructure investment projected to increase by 30-40%.

Explaining the recovery of domestic consumption in 2026, Ms. Linh identified three key drivers. First, the wealth effect, as a segment of the population becomes wealthier due to the stock market (up 35% since the beginning of the year), gold, and the recovery of real estate. Second, the middle class is saving faster by 10% compared to pre-pandemic levels, boosting their confidence in spending. Third, the government’s administrative restructuring has injected approximately 5 billion USD into restructuring and social welfare, increasing disposable income.

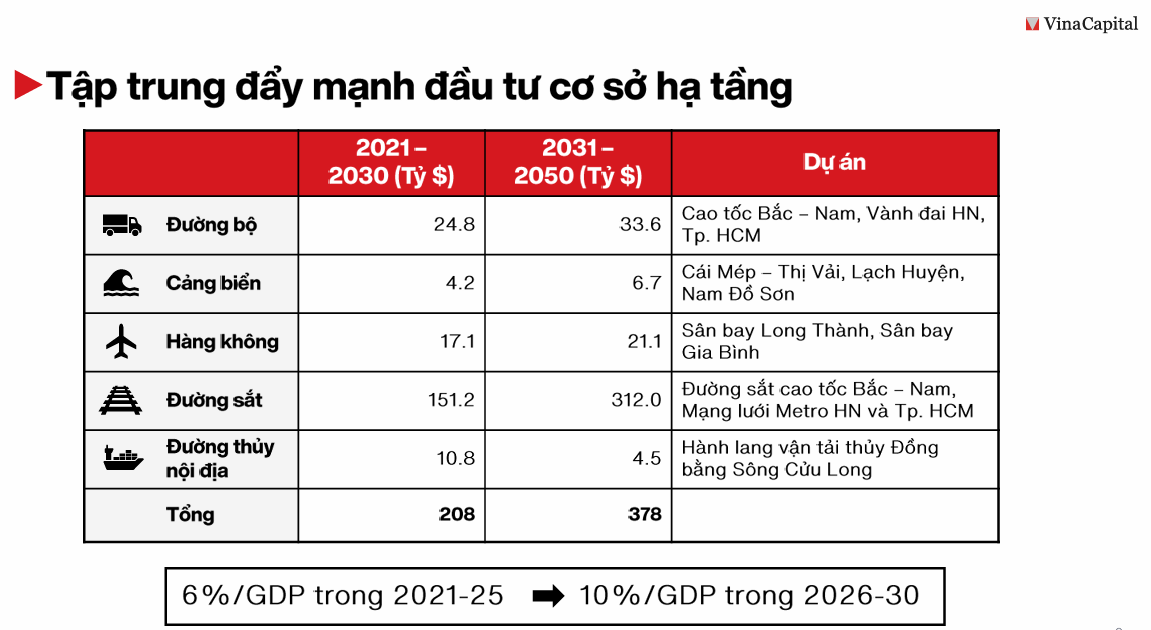

In the long term, infrastructure investment is identified as the key factor for Vietnam to escape the middle-income trap. The goal is to raise the infrastructure investment ratio from the current 6% of GDP to 10% (comparable to the golden era of China and Japan), requiring foreign capital mobilization for major projects like the North-South high-speed railway and Long Thanh airport.

In summary, Ms. Linh believes that the 2025-2026 figures are positive, with the only concern being Vietnam’s low foreign exchange reserves (approximately 2.5 months of imports), which could put pressure on the exchange rate in the near future.

– 20:06 28/10/2025

Hanoi Intensifies Tax Collection from Business and Land Sectors

Hanoi mandates that all relevant units aggressively pursue state budget collection efforts, striving to achieve a minimum 25% increase in the 2025 state budget compared to the projected estimate. This includes a strong focus on bolstering revenue streams from business operations and land-related sources.

“Excess Funds: The Surprising Reason Behind Low Public Investment Disbursement”

Can Tho’s public investment disbursement rate lags behind the national average, falling short of targets. Investors attribute this partly to excessive allocated funds, making it impossible to execute and disburse the entire amount within the year. Even the threat of disciplinary action against project directors fails to resolve the issue.

Can Tho City: Public Investment Disbursement Falls Below National Average

The Chairman of Can Tho City has urged all departments, agencies, and local authorities to accelerate their efforts in the fourth quarter of 2025 to ensure the timely completion of assigned tasks.