Profits Decline Amid Rising Costs

|

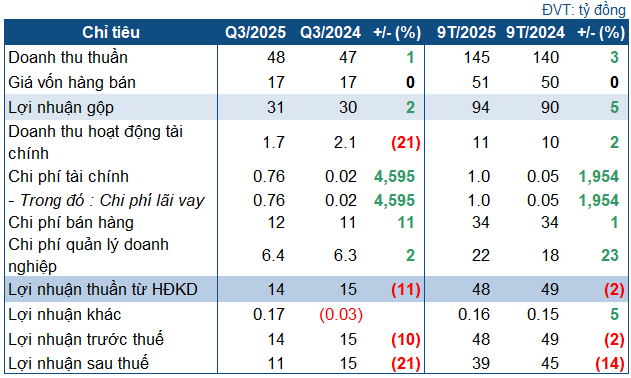

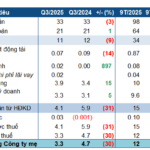

VLW’s Q3/2025 Business Metrics

Source: VietstockFinance

|

In Q3, VLW recorded a net revenue of VND 48 billion, a slight increase compared to the same period last year. Cost of goods sold remained relatively stable, resulting in a modest rise in gross profit to VND 31 billion.

Notably, expenses fluctuated significantly. Financial revenue decreased by 21% to VND 1.7 billion due to lower interest income from deposits, while financial expenses surged to VND 764 million, nearly 47 times higher than the previous year, primarily from loan interest. Additionally, selling and administrative expenses saw slight increases. Consequently, the company reported an after-tax profit of nearly VND 11 billion, a 21% decline.

VLW attributed the profit contraction to declining bank interest rates, rising input costs (electricity, alum, and liquid chlorine), and the implementation of a new wage policy, which increased labor costs. Furthermore, the interest expenses for the Vung Liem water plant construction project, which had reached the end of its capitalization period, were recognized as expenses in the quarter, further reducing profits.

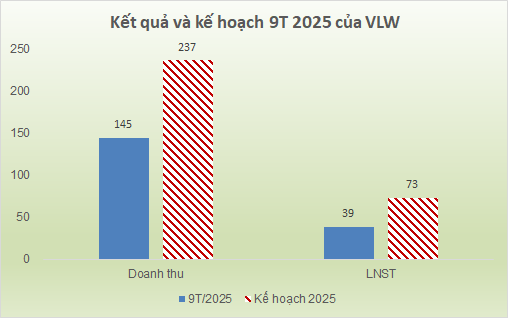

For the first nine months of the year, VLW achieved nearly VND 145 billion in net revenue, a 3% increase year-over-year; after-tax profit decreased by 14% to VND 39 billion. The company has fulfilled 61% of its annual revenue target and nearly 53% of its after-tax profit target set by the shareholders’ meeting.

Source: VietstockFinance

|

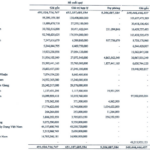

As of the end of Q3, VLW’s total assets reached VND 649 billion, a 5.8% increase from the beginning of the year, with nearly VND 345 billion in current assets, up 9%. Cash and cash equivalents accounted for the majority, rising nearly 10% to nearly VND 320 billion. Cash equivalents increased significantly from VND 15.3 billion to VND 49.1 billion.

Construction in progress rose by 22% to VND 55 billion, primarily due to continued investment in the Vung Liem water plant project.

On the liabilities side, total debt decreased slightly by 2.1% to VND 133 billion. Of this, loans (short-term and long-term) amounted to VND 56 billion, a 2.5% decrease from the beginning of the year.

Major Shareholder Seeks to Increase Ownership

Despite the decline in performance, VLW’s major shareholder, Binh Duong Water and Environment Joint Stock Company (HOSE: BWE), registered to purchase nearly 2.63 million shares via a negotiated transaction to increase its ownership stake. The transaction is expected to take place from October 28 to November 26.

Currently, BWE holds 7.1 million shares in VLW, equivalent to 24.57% of the charter capital. If the transaction is successful, its stake will increase to nearly 33.7%, or over 9.7 million shares. At the market price of VND 28,000 per share on the morning of October 27, the transaction value is estimated at approximately VND 74 billion.

BWE also indirectly owns another portion of VLW shares through its 52%-owned subsidiary, Biwase Construction and Installation Joint Stock Company. This subsidiary holds the same number of shares as BWE’s registered transaction (9.08%), suggesting that this is likely an internal transfer of shares among major shareholders.

In fact, BWE recently acquired 7.1 million VLW shares from its subsidiary in late May 2025 through a negotiated transaction.

– 10:22 27/10/2025

“Currency Shockwave Slashes Textile Firm’s Q3 Profits by 87%”

Over the first nine months, cumulative net revenue reached 1.029 trillion VND, marking a 38% increase compared to the same period in 2024. After-tax profit surged by 47%, exceeding 39 billion VND.

Phuong Phu Pharmaceutical’s Q3 Performance: A Step Back

Amidst declining revenues and rising production costs, Phong Phu Pharmaceutical JSC (HNX: PPP) experienced a downturn in profits during Q3 2025.