BBB Rating with Stable Outlook: A Gateway to Affordable Capital

On October 10, 2025, FiinRatings upgraded F88‘s credit rating from “BBB-” to “BBB” with a “Stable” outlook. This significant milestone for the non-banking financial institution opens doors to accessing mid to long-term capital at more reasonable costs, particularly from international institutional investors who prioritize transparency and robust risk management standards.

The impact of this rating upgrade extends beyond mere perception. A higher rating typically enables companies to secure financing at lower costs, longer tenors, and more flexible terms, ultimately reducing the cost of funds (COF) in future periods and stabilizing profit margins. For F88, this advantage, coupled with its strong Q3 performance, could create a “double effect”: robust financial results leading to higher creditworthiness, which in turn lowers funding costs and sustains profitability.

According to the report, “FiinRatings upgraded F88‘s rating to ‘BBB’ with a ‘Stable’ outlook, reflecting significant improvements in capital sources and liquidity through diversified funding channels, the upcoming 2026 public bond issuance, and a substantial reduction in average funding costs. The upgrade also acknowledges F88‘s leading position in the alternative lending segment, along with its strong profitability and asset quality.”

Additionally, asset quality is supported by the internal A/B/C credit rating system and machine learning models that detect anomalies early. The financial leverage ratio (debt-to-equity) has decreased to around 1.5 times, significantly lower than the domestic consumer finance industry median of 3.0 times. From a rating agency’s perspective, these factors not only demonstrate the company’s profitability but, more importantly, highlight that profits stem from a well-controlled risk model and a healthy capital structure.

Financial Performance Reflects the Strength of the Secured Lending Model

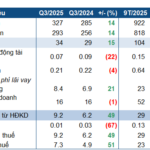

In the first nine months of the year, F88‘s pre-tax profit doubled year-on-year to VND 603 billion, equivalent to 90% of the annual target (VND 673 billion). Key efficiency metrics also improved significantly: ROE of 34%, ROA of 12%, and CIR of 52%. The highlight lies not only in profit scale but also in portfolio quality: the net write-off ratio decreased from 2.6% in Q1/2025 to 2.4% in Q3/2025, while the average on-time repayment rate for the first nine months of 2025 reached 85.4%. The increase in outstanding loans alongside a decrease in overdue ratios indicates that F88‘s credit control system is operating effectively, with early detection and swift response mechanisms.

The Risk Control System (Decision Engine) provides real-time internal scoring and alerts, enabling dynamic adjustments to underwriting standards based on customer segments, collateral types, and geographic regions. When a segment shows signs of abnormality (increased delinquency rates or behavioral deviations), the risk management team immediately tightens application requirements or requests additional verification. Conversely, stable segments maintain seamless processing to optimize asset turnover.

In terms of customer structure, the repeat customer rate reached 68% (a 4 percentage point increase from Q2), reflecting improvements in core customer quality and brand trust. This allows F88 to sustain growth without aggressively expanding its branch network—a critical message for investors: growth is always accompanied by risk control, without compromising profit margins.

Broadly examining the “drivers of efficiency,” Q3 results reveal three harmoniously functioning pillars: first, reasonable funding costs due to diversified capital sources; second, improved asset quality through close data monitoring and risk-based policy segmentation; and third, enhanced productivity at branch level (processing time, asset turnover, and recovery rates). This combination stabilizes F88‘s profit margins even as the company scales up its disbursements.

Two significant developments in October 2025—the outstanding Q3 results and the “BBB, Stable” rating—tell a cohesive story: a secured lending model driven by data, rigorous risk management, and growing capital market confidence. Building on this foundation, F88 aims to maintain stable profit margins, further reduce funding costs, selectively expand into high-creditworthy customer segments, and enter a new growth phase where efficiency, not scale, is the primary metric.

– 10:43 28/10/2025

Hanosimex Returns to Profitability After Two Years of Losses, Stock Surges to Upper Limit

Following the announcement of a return to profitability, shares of Hanoi Textile and Garment Corporation (Hanosimex, UPCoM: HSM) surged to their highest level in 19 months. However, the recovery faces significant challenges as the company still grapples with accumulated losses of nearly VND 153 billion.

Masan Group’s Workforce Turbulence: Unraveling the Shifts in Personnel Dynamics

Mount Phào Minerals, a subsidiary of the Masan Group, has recently announced significant changes to its personnel and capital representation. This development marks a pivotal shift in the company’s leadership and investment structure, signaling new directions for the enterprise.

Massive Profits Reported by Leading Electricity Companies

In the first nine months of the year, Nhon Trach 2 PetroPower recorded a net profit of VND 577.4 billion.