Amidst the volatile VN-Index, shares of Saigon General Service Corporation (Savico, stock code: SVC) have demonstrated a remarkable upward trend. From the morning session on October 27th, SVC surged to its upper limit, reaching a price of 34,100 VND per share, marking an impressive eight consecutive sessions of hitting the ceiling.

Since the beginning of October, the stock has soared by over 70% in value, climbing to its highest point in nearly three years (since February 2023). The company’s market capitalization has surged to nearly 3.2 trillion VND.

In a statement addressing the five consecutive ceiling sessions from October 16th to October 22nd, 2025, SVC attributed the surge to objective market dynamics and supply-demand factors. The company emphasized that investors’ decisions regarding SVC shares are beyond its control.

Additionally, the company’s robust Q3 2025 performance may have influenced investors’ assessments and investment considerations.

Savico further clarified that it has not exerted any influence on stock transactions and remains compliant with all applicable legal regulations for public companies.

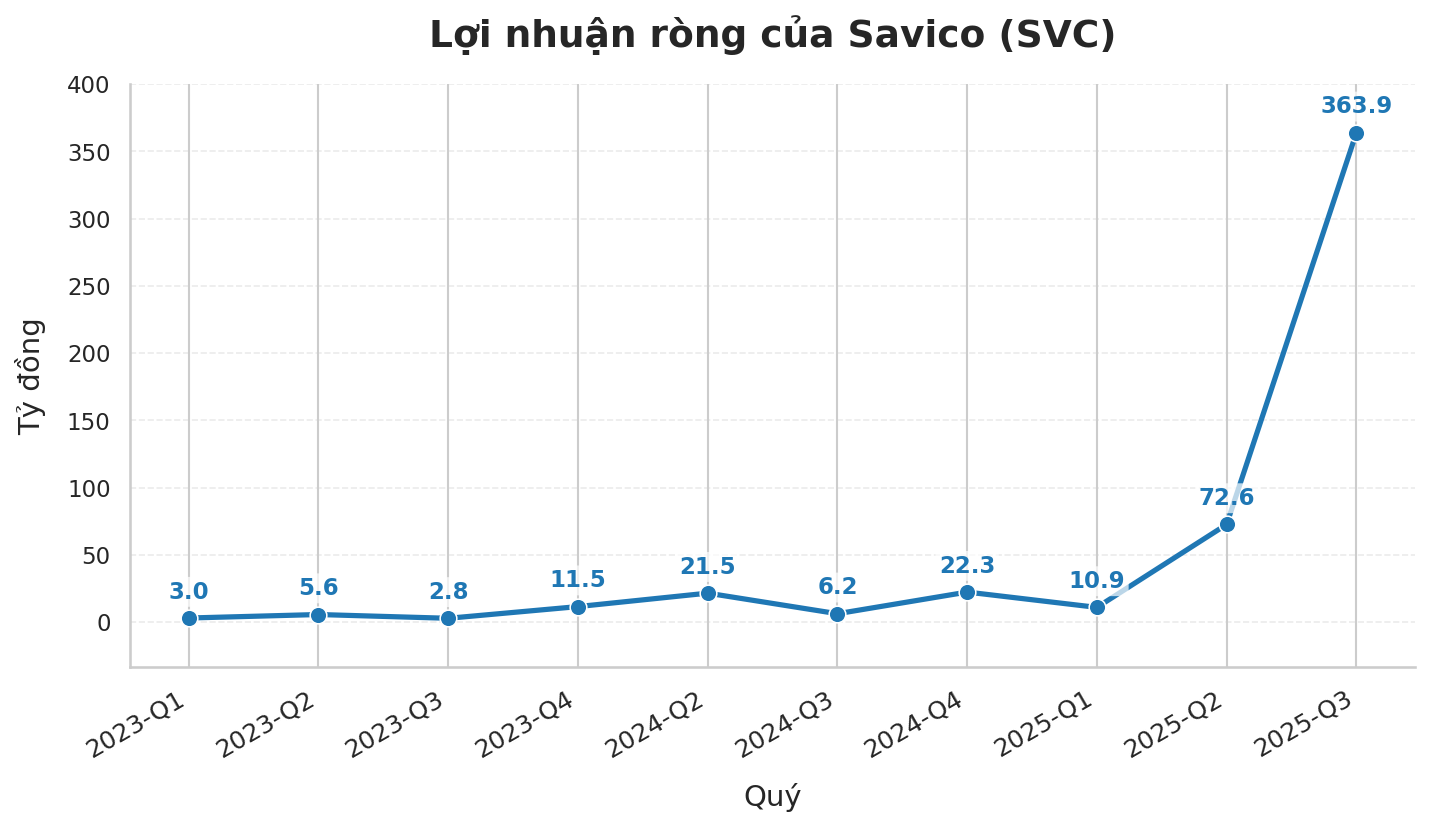

Q3 Profit Surges 5,800%, Setting a New Record

The stock’s remarkable rally followed Savico’s release of its Q3 2025 consolidated financial report, revealing a post-tax profit of 364 billion VND, a staggering 5,800% increase from the same period last year, which stood at just over 6 billion VND.

This marks the highest quarterly profit in the company’s history, surpassing the 2022 record of 333 billion VND and nearly quadrupling the 2024 annual profit of 100 billion VND.

According to Savico, the significant increase in Q3 2025 consolidated revenue was driven by the recovery of the automobile market and the expansion of its subsidiary network. The growth in the number of affiliated units substantially boosted sales revenue.

However, the primary driver of the profit surge was the financial segment, with financial revenue reaching 669 billion VND in the quarter, a 33-fold increase from the 20 billion VND recorded in Q3 2024. Over 537 billion VND of this was generated from the sale of investments.

For the first nine months of 2025, Savico reported revenue of more than 20,547 billion VND, a 27% year-on-year increase, and a post-tax profit of nearly 450 billion VND, a 767% surge and 4.5 times the 2024 annual profit. With these results, the company has already exceeded its annual profit target by 120%, despite achieving only 69% of its revenue goal.

As of September 30th, 2025, the company’s total assets stood at 12,067 billion VND, a 35% increase from the beginning of the year. Notably, short-term other receivables rose sharply from 1,087 billion VND to 2,597 billion VND, with receivables from investment cooperation contracts increasing from 284 billion VND to 1,611 billion VND.

On the liabilities side, total debt at the end of Q3 was 9,055 billion VND, a 37% increase year-to-date, with the company’s total debt amounting to 5,609 billion VND.

Savico primarily operates in the distribution of automobiles, real estate, and financial services. According to its website, Savico is Vietnam’s leading automobile distributor and service provider, with a network of 106 showrooms nationwide. In 2024, Savico held a 13.6% market share, as reported by VAMA.

Foreign Block Continues Net Selling Spree of VND 1,200 Billion Amid VN-Index’s Sharp Decline, Focusing on Heavy Selling of “Bank, Securities” Stock Duo

In the afternoon trading session, FPT shares were the most heavily accumulated by foreign investors across the market, with a total value of 306 billion VND. Similarly, VPB also saw significant net buying activity, exceeding hundreds of billions of VND.

Will Financial Reports and Stock Market News Signal a Market Recovery?

After a “forgettable” trading week marked by a record plunge of over 94 points, the VN-Index staged a modest recovery but still closed the week below the 1,700 threshold. Next week, analysts anticipate the VN-Index may experience volatility as it tests demand levels, while capital is expected to shift toward fundamentally strong stocks with positive Q3 earnings results.