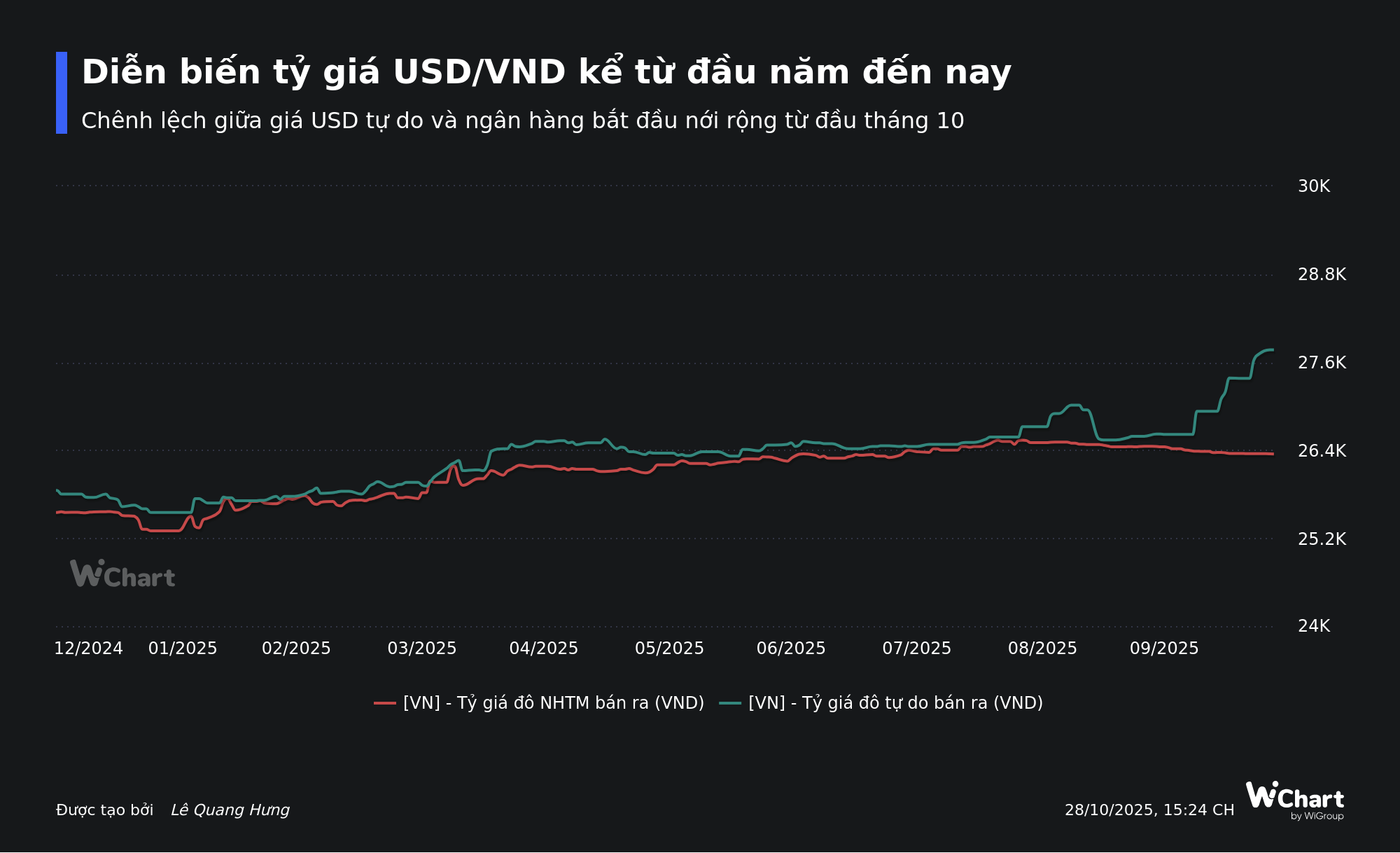

Recent trading sessions have highlighted a significant disparity between the USD/VND exchange rates at banks and the unofficial (free) market. On October 28th, the free market USD was trading at around 27,550 – 27,650 VND/USD, while banks were selling USD at nearly 26,350 VND/USD, a difference of 1,200 – 1,300 VND/USD (approximately 5%).

Since the beginning of October, bank USD rates have consistently decreased in line with the ceiling rate set by the State Bank of Vietnam (SBV), which is the central rate plus 5%. Conversely, the free market USD rate has been on a steady rise. Bank USD selling rates dropped by nearly 100 VND in October, whereas the free market USD rate increased by approximately 1,100 VND.

The appreciation of the USD at banks is not only constrained by the ceiling rate but also by the SBV’s intervention activities. Most recently, on October 22nd, the SBV announced a plan to sell foreign currency through 180-day cancellable forward contracts—the third such intervention in nearly two months. These transactions are conducted with credit institutions holding a negative foreign currency position, at a selling price of 26,550 VND/USD. The maximum amount of foreign currency sold to each bank in each transaction is equivalent to the amount needed to balance the bank’s foreign currency position.

According to ACB’s Financial Market Research Department, the volume of foreign currency sold through forward contracts on October 22nd was estimated at around 1.5 billion USD.

Previously, on October 1st, the SBV also announced the sale of 180-day cancellable forward foreign currency at the same rate of 26,550 VND/USD. Similar actions were taken on August 25th and 26th.

The SBV’s forward sale of USD shifts the banking system’s foreign currency demand to the following year, effectively delaying short-term exchange rate pressures.

In a newly released monetary market report, Dragon Capital Securities (VDSC) noted that the exchange rate gap between the free and official markets has reached an all-time high.

According to VDSC, this unprecedented gap indicates a limited USD supply both within and outside the banking system, as evidenced by the SBV’s commitment to sell forward foreign currency to commercial banks totaling approximately 4.4 billion USD since August.

Additionally, the surge in USD demand on the free market may reflect the interconnection between the free USD market and the gold market, as the price gap between domestic and international gold widened in October.

In the short term, VDSC believes that the SBV’s assurance of future foreign currency supply serves as a stabilizing factor for the official market exchange rate. VDSC anticipates that the unusual gap between the two markets will not persist for long. Furthermore, while difficult to measure, the demand for foreign currency on the free market may foreshadow expectations of VND depreciation pressures in 2026.

In response to these developments, on October 24th, 2025, the State Bank of Vietnam issued a document to the Ministry of Public Security, the Ministry of Industry and Trade, and the Government Inspectorate regarding coordinated management of foreign exchange market activities.

The SBV noted that, given the complex global economic situation, the exchange rate between the Vietnamese Dong and the US Dollar in the unofficial market has shown signs of volatility and divergence from bank trading rates.

To proactively stabilize the foreign exchange market and minimize risks to the banking system, the SBV has regularly directed credit institutions to strictly adhere to legal regulations on foreign exchange management in their foreign exchange service provision.

To enhance state management coordination, the State Bank of Vietnam requested that the Ministry of Public Security, the Ministry of Industry and Trade, and the Government Inspectorate direct their functional units to inspect, monitor, and manage the foreign exchange activities of organizations and individuals in the economy. This includes promptly identifying violations of foreign exchange regulations, particularly illegal foreign currency buying and selling, and activities in the unofficial foreign exchange market. Appropriate measures should be taken to strictly address any legal violations, if found.

Furthermore, the SBV requested cooperation in providing information on cases and instances of foreign exchange regulation violations, enabling the State Bank of Vietnam to implement effective foreign exchange market management measures and ensure the safety of the banking system’s operations.

Where is Ho Chi Minh City’s Nearly 5 Quadrillion VND Heading?

As of the end of October, Ho Chi Minh City’s total credit outstanding balance reached nearly 5,000 trillion VND, marking a 9.79% increase compared to the end of 2024. The majority of credit capital has been allocated to the production and business sectors, with small and medium-sized enterprises accounting for a significant portion.

Eurowindow Sport Garden Launches with a Bang, Captivating Nghe An Investors

On October 19, 2025, Eurowindow Sport Garden officially launched in Vinh City, the capital of Nghe An province. The event attracted over 1,000 distinguished guests, marking a significant milestone in the real estate market of North Central Vietnam. This unveiling introduces a pioneering urban development to Vinh City, embodying a lifestyle centered around green living, wellness, and happiness.

Peer-to-Peer Lending in Vietnam: A Legal Turning Point Reshaping the Market

The new legal framework for peer-to-peer lending (P2P Lending) in Vietnam is reshaping the industry landscape, presenting both opportunities and challenges for businesses within the sector. These regulations establish a clear legal corridor, significantly influencing operational strategies, risk management, and the overall growth potential of the market.