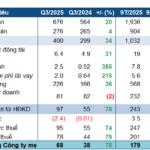

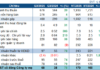

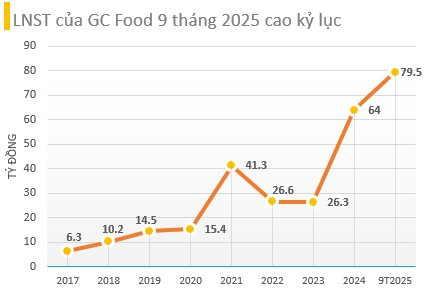

GC Food Joint Stock Company (GC Food, stock code: GCF) has released its Q3/2025 financial report, revealing a net revenue of VND 192 billion, a 12% increase compared to the same period last year. Post-tax profit reached VND 32 billion, marking a 38% growth compared to Q3/2024. The gross profit margin for the quarter stood at 36%.

Selling and administrative expenses rose by 13% to VND 26 billion, accounting for approximately 14% of the revenue. Financial costs decreased by 11% to VND 3 billion, attributed to reduced loan balances and lower interest rates.

In the first nine months of 2025, the company’s cumulative net revenue reached VND 526 billion, a 22% increase year-over-year. Consolidated post-tax profit hit a record high of VND 79.5 billion, up 45% compared to the same period last year, achieving over 88% of the annual target.

As of September 30, the company’s total assets stood at VND 827 billion, a 24% increase since the beginning of the year. Inventory was valued at VND 101 billion, and fixed assets at VND 241 billion.

In August, AIG (Asia Ingredients Corporation) became a strategic shareholder of GC Food after acquiring over 7.1 million newly issued GCF shares, increasing its ownership from 34.73% to 52.87%.

GC Food raised approximately VND 214 billion from this transaction, with plans to allocate VND 80 billion to increase the charter capital of its subsidiary, Coco Vietnam Food JSC, and VND 50 billion to Canh Dong Viet Food JSC. VND 40 billion will be used to repay bank loans, and over VND 44 billion will be added to working capital.

AIG is a leading supplier of food ingredients, including non-dairy cream powder, cassava starch, coconut water, and coconut milk.

Founded in 2011 in Ninh Thuan, GC Food began with aloe vera cultivation, later establishing a processing plant and developing a closed value chain. The company now leads the domestic market in aloe vera and coconut jelly products, exporting to 27 countries.

The partnership between AIG and GC Food is expected to create a closed value chain, ensuring stable raw material inputs and expanding market reach for both parties.

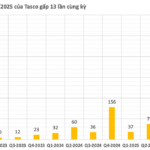

Tasco Shatters Profit Records: Q3 2025 Earnings Surge 13x Year-Over-Year, Exceeding Annual Targets

Tasco has achieved an unprecedented milestone, reporting an after-tax profit of VND 487 billion, a remarkable 13-fold increase compared to the same period last year. This outstanding result marks the highest profit in the company’s history, showcasing its exceptional performance and growth.

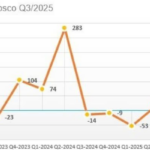

“Former ‘Steel Fist’ Reports Nearly 100 Billion VND Loss in Q3/2025 Due to Prolonged Shutdowns, Accumulated Losses Exceed 2.1 Trillion VND”

Over the first nine months, net revenue reached VND 2.996 trillion, a slight increase of 0.1% compared to the same period last year. The post-tax loss was VND 38 billion, an improvement from the VND 61 billion loss recorded in the same period last year.