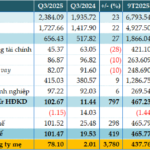

Masan MEATLife Joint Stock Company (UPCoM: MML) has released its consolidated financial report for Q3/2025, revealing a net revenue of VND 2,384 billion, marking a 23.2% increase compared to the same period last year. This growth is attributed to both the livestock segment (up 30.1%) and the meat segment, including fresh and processed meat (up 21.5%).

Gross profit also saw a 26.8% rise, reaching VND 656 billion. Notably, MML demonstrated improved operational efficiency with operating profit (EBIT) recorded at VND 144 billion, a remarkable 13.2-fold increase year-over-year, pushing the EBIT margin up to 6.0%.

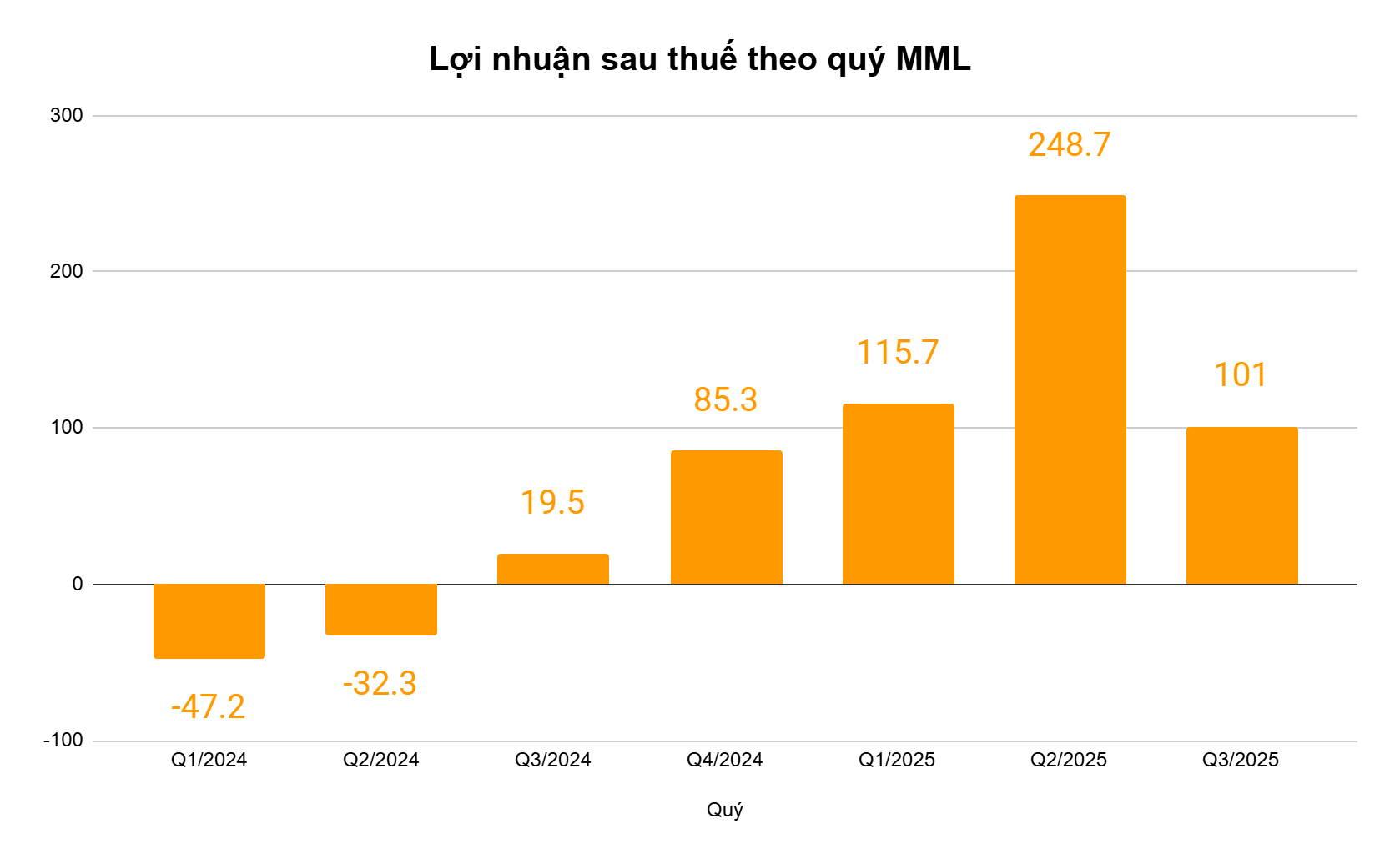

During the period, financial expenses were reduced by 10% year-over-year to nearly VND 87 billion, primarily due to lower interest costs. Conversely, selling expenses rose slightly by 9% to VND 415 billion, and administrative expenses increased by 5% to VND 97 billion, reflecting intensified investment in sales alongside revenue growth. As a result, MML’s after-tax profit reached VND 101 billion, a 5.2-fold increase compared to Q3/2024.

Revenue growth this quarter was driven by increased sales volume, deeper integration with the WinCommerce (WCM) chain, and the success of new products. Average daily revenue per WCM store reached VND 2.3 million (up 17.9%), with MML capturing 65% market share in the protein product category within this retail chain.

The processed meat segment grew by 14.2%, with new products contributing 33% of revenue (a 1.6-fold increase year-over-year). Notably, the snack segment saw a 55% growth. Operationally, the average value of pork increased by 6% due to production optimization, partially offsetting the 5% decline in average live pig prices during the quarter (to approximately VND 63,000/kg).

For the first nine months of 2025, MML’s net revenue reached VND 6,794 billion, a 24.7% increase year-over-year. The company reported an after-tax profit of VND 466 billion, a significant improvement from the VND 526 billion loss in the same period in 2024. This strong performance has substantially reduced MML’s accumulated losses. As of September 30, 2025, accumulated losses stood at VND 604 billion, down significantly from VND 1,041 billion at the beginning of the year.

Financially, MML’s total assets as of Q3 ended at VND 11,348 billion, a slight 1% increase from the beginning of the year. Cash and cash equivalents rose by 48% to VND 282 billion. Inventory recorded over VND 801 billion (at cost), a 13% increase, primarily in raw materials and work-in-progress. Total liabilities decreased slightly to VND 6,300 billion, with short-term loans rising sharply to VND 3,715 billion while long-term loans decreased significantly.

For 2025, MML aims to achieve revenue between VND 8,250 billion and VND 8,749 billion (an 8-14% increase). The company plans to further strengthen its processed meat segment, targeting to increase the value of processed products per pig to VND 10 million and launch the “Meat Corner” model within the WCM chain, aiming for a 20% market share in processed meat within this chain by 2025.

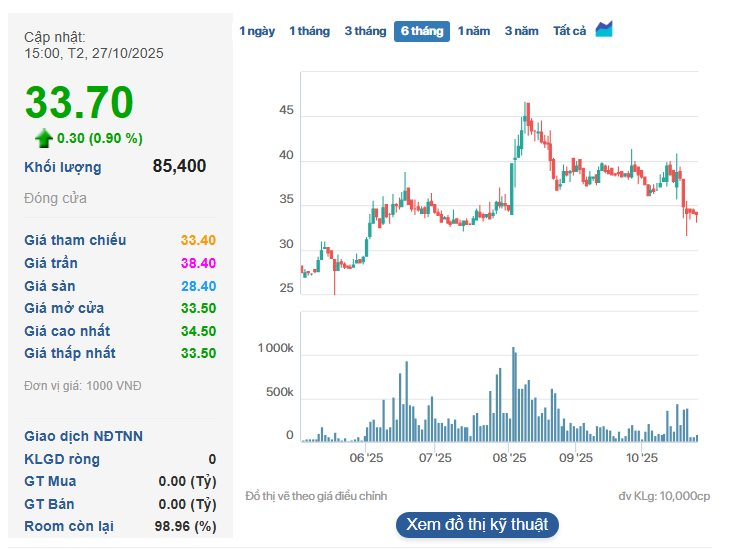

On the stock market, MML shares experienced strong growth from May to August 2025, peaking at around VND 45,000 per share. However, the stock has corrected in recent months. As of the close of trading on October 27, 2025, MML shares were priced at VND 33,700 per share.

Viconship Reports 456 Billion VND Profit in First 9 Months, Up Nearly 50% Year-on-Year

According to the latest announcement, Vietnam Container Corporation (Viconship, HOSE: VSC) has reported consolidated revenue of VND 844 billion and pre-tax profit of VND 144 billion, marking a 19% and 39% increase, respectively, compared to the same period last year.

Real Estate Firms Reap Massive Profits Through Strategic Stock Market Investments

Despite a slowdown in its core business, Da Nang Housing Development Investment Corporation (HDIC) reported a remarkable post-tax profit of over VND 145 billion in the first nine months, a 3.5-fold increase compared to the same period last year. This impressive performance was largely driven by gains from its stock portfolio, which includes 23 stocks with investments ranging from a few hundred million to under VND 100 billion, such as HPG, VHM, DGC, FPT, VPB, VCG, EIB, and CTG.

Binh Minh Plastics to Distribute Over VND 532 Billion in Interim Dividends for 2025’s First Phase

Binh Minh Plastics is set to distribute over VND 532 billion in interim dividends for the first tranche of 2025, offering a payout ratio of 65%. The final registration date for eligibility is November 18, 2025, with payments expected to commence on December 8, 2025.

MML Sustains Strong Profitability in Q3, Fueled by Masan Ecosystem Momentum

Masan MeatLife (UPCoM: MML) has reported impressive results in its Q3/2025 consolidated financial statements, with net revenue reaching VND 2,384 billion and post-tax profit exceeding VND 101 billion. This represents a 23% increase in revenue and a remarkable 5.2-fold growth in profit compared to the same period last year.