The comparative context is notable, as the same period in 2024 marked a low point for the entire industry due to rising raw material costs, declining selling prices, and intense competition in cassava procurement.

|

Apfco’s Q3 net profit surges by nearly 1,500%

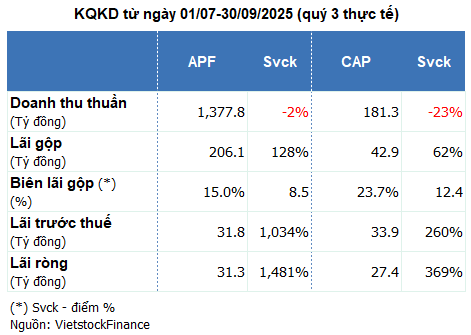

According to the Q3/2025 financial report, Apfco (APF) recorded a net profit of over 31 billion VND, a staggering 1,481% increase year-over-year, despite a slight 2% decline in revenue to nearly 1.379 billion VND. Gross margin significantly improved to nearly 15%, up from 6.4% in the same period last year, driven by a substantial reduction in the cost of goods sold. The company attributed this to a more favorable market for cassava starch, with stable and gradually increasing selling prices, and a 40% rise in sales volume compared to the previous year.

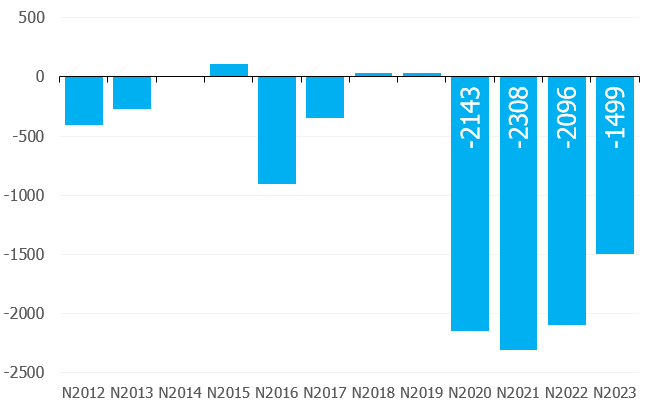

| Apfco’s Quarterly Business Results for 2023-2025 |

In the first nine months of 2025, Apfco’s revenue reached over 4.424 billion VND, an 18% decrease year-over-year, while net profit stood at nearly 117 billion VND, down 12%. Nevertheless, the company exceeded its annual profit plan by 18%, thanks to a conservative initial target.

Core profit margins were maintained, but a sharp decline in financial income was the primary reason for the nine-month setback. Financial revenue amounted to just over 36 billion VND, a 70% drop, due to a 72% decrease in foreign exchange gains to 33.5 billion VND.

Simultaneously, financial expenses rose by 19% to over 119 billion VND, with interest expenses accounting for 92%. Selling expenses surged by 39% to over 413 billion VND, putting pressure on net profit.

As of September 2025, Apfco held nearly 103 billion VND in bank deposits, a 27% increase from the beginning of the year, while total debt decreased by over 500 billion VND (27%) to 1.461 billion VND, primarily short-term debt. The three largest creditors—Vietinbank, Vietcombank, and BIDV, all in Quang Ngai—accounted for over 1.100 billion VND in short-term loans.

Yfatuf achieves highest profit in nine quarters

Within the cassava starch sector, Yfatuf (CAP) concluded its 2024-2025 fiscal year with positive results. In the fourth quarter of the fiscal year (equivalent to Q3/2025), the company reported a net profit of over 27.4 billion VND, a 369% increase year-over-year, despite a 23% decline in revenue to over 181 billion VND. Gross margin surged to 23.7%, up 12 percentage points, driven by cost reductions and the liquidation of inventory carried over from the previous fiscal year.

| Yfatuf’s Quarterly Business Results Over the Past Three Fiscal Years |

For the entire 2024-2025 fiscal year, CAP achieved revenue of nearly 657 billion VND, an 11% increase, and a net profit of 50.4 billion VND, up 63% from the previous year. Both metrics exceeded targets, by 6% and 26%, respectively. This marks CAP’s return to peak revenue levels seen three years prior, although profits remain lower than that period.

Exports remained CAP’s core segment, generating nearly 359 billion VND, or 55% of total revenue. Cassava starch contributed 275.5 billion VND (78% of exports), a slight 9% decrease year-over-year. In contrast, golden paper products saw robust growth, with export revenue reaching nearly 51 billion VND, up 19%, while paperboard exports totaled nearly 33 billion VND, a 10% increase.

By the end of September 2025, CAP’s bank deposits reached 138.5 billion VND, a 47% increase from the start of the fiscal year (October 2024), boosting deposit interest income by 48% to 2.7 billion VND. Additionally, foreign exchange gains quadrupled to 7.2 billion VND, driving financial revenue for the fiscal year to nearly triple, reaching 10.5 billion VND. CAP currently has no outstanding debt.

Stocks react positively

Following the release of financial results, both CAP and APF stocks rose. On October 29, CAP closed at 43,000 VND/share, while APF reached 40,000 VND/share. However, over the past year, CAP’s stock price dipped slightly by 1%, whereas APF lost 17%, reflecting the varying recovery rates of these two industry peers.

– 16:19 29/10/2025

HAG’s Sudden Ceiling Surge on October 29th Afternoon: What Just Happened?

In the afternoon session of October 29th, shares of Hoang Anh Gia Lai Joint Stock Company (HOSE: HAG) surged unexpectedly, hitting the upper limit of 16,950 VND per share. The stock closed the session in a strong uptrend, with minimal sell orders remaining.

Stock Market Update: October 28th – Will Selling Pressure Persist?

The trading session on October 27th saw widespread selling pressure across multiple sectors. Will this trend persist and dominate the market on October 28th?