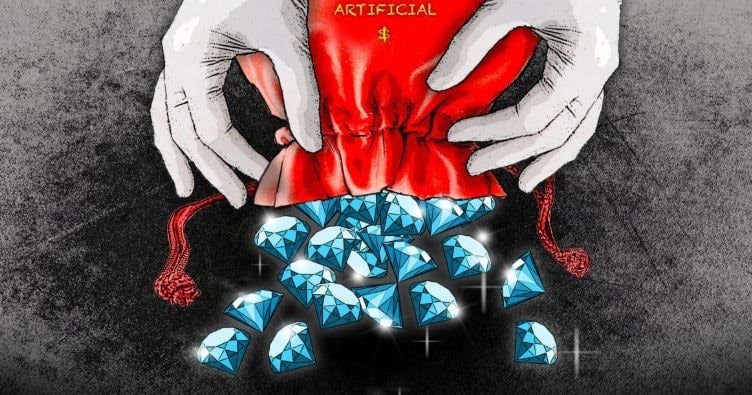

Lab-Grown Diamonds: Revolutionizing an Age-Old Industry

For centuries, diamonds have symbolized eternity, undying love, and social status. However, this narrative is shifting as China—the world’s largest producer of lab-grown diamonds—transforms what was once nature’s miracle into an industrially replicable product, crafted in mere hours. As Wired observes, advancements in lab synthesis have reached a point where even experts struggle to distinguish between diamonds born deep within the earth and those created through modern technology.

In cities like Suzhou, Hefei, and Changchun, plasma reactors operate 24/7, producing flawless diamonds in just 150 minutes—a pace Fortune describes as “rendering diamond scarcity a relic of the past.” China now dominates over 80% of global lab-grown diamond production, far outpacing India and the U.S. This surge has slashed prices dramatically; The Guardian reports a 74% drop in lab-grown diamond prices over five years, while natural diamond prices have plummeted nearly 30% as buyers perceive diminishing differences between the two.

This shift extends beyond technology to a redefinition of value. Younger generations, particularly Gen Z and Millennials, no longer view diamonds as obligatory symbols of love or success. Many opt for lab-grown alternatives for ethical reasons: they bypass mining, avoid “blood diamond” conflicts, and offer a more sustainable footprint. As one Chinese consumer told the Financial Times, “I don’t need a diamond to prove love. I just want it to be beautiful, durable, and eco-friendly.” This mindset is gaining global traction, especially as economies falter and luxury is redefined through sustainability and innovation.

The Crossroads of Tradition and Innovation

Yet, the rapid rise of lab-grown diamonds has sparked paradoxes. As supply surges and prices free-fall, brands once touting “green technology” now face credibility crises. Feriel Zerouki, President of the World Diamond Council, warned Reuters: “Lab-grown diamond prices are collapsing, leaving buyers uncertain. The bubble has burst, and some are returning to natural diamonds.”

The issue lies in lab-grown diamonds’ ubiquity and affordability eroding their exclusivity. If a diamond can be mass-produced, it loses its symbolic “eternity”—at least in perception. Conversely, natural diamond miners are rebranding their products. African nations like Botswana, Namibia, and Angola are uniting under initiatives like the Luanda Accord to promote natural diamonds as “witnesses of time and earth,” emphasizing cultural and emotional value over commerce. However, experts argue that relying solely on tradition may fall short in an era prioritizing practicality and technology.

Meanwhile, China views lab-grown diamonds as a strategic sector. Reuters reports new export controls on synthetic diamonds, signaling their role in high-tech supply chains. Firms like Sino Crystal and Henan Huanghe Whirlwind are pioneering diamonds for semiconductors, energy, and optics—far beyond traditional jewelry. This positions lab-grown diamonds not just as luxury disruptors but as 21st-century strategic materials.

The ripple effects are profound: De Beers, once synonymous with natural diamonds, is slashing production and overhauling marketing strategies, emphasizing individual narratives and origins. Yet, the question remains: Will modern consumers still value such stories? As SCMP and The Guardian highlight, the diamond industry stands at a crossroads, where technology, ethics, and tradition collide—reshaping not just markets, but the very meaning of luxury.

Sources: SCMP, The Guardian