Net Loss from Business Operations

According to the Consolidated Financial Report for the first six months of 2025 (audited) of CMH Vietnam Group Joint Stock Company (CMH Group, Stock Code: CMS), the company’s net revenue from sales and services during this period reached nearly VND 137 billion, more than double compared to the same period last year.

However, the high cost of goods sold (nearly VND 128 billion) resulted in a gross profit of only VND 9 billion, a slight increase of VND 1.3 billion compared to the VND 7.7 billion recorded in the first half of 2024.

Increased financial expenses and management costs, reaching nearly VND 1.5 billion and VND 8.1 billion respectively, led to a net loss from business operations of VND 209 million for CMH Group. In contrast, the company had a profit of nearly VND 518 million during the same period last year.

Illustrative image

Thanks to other income of over VND 5.1 billion, the company reported a pre-tax profit of more than VND 5.1 billion and a post-tax profit of nearly VND 3.8 billion, an increase of VND 1.3 billion compared to the VND 2.5 billion recorded in the same period of 2024.

As of June 30, 2025, the company’s total capital stood at VND 643 billion, a nearly 15% increase from the beginning of the year. This primarily consists of short-term assets totaling over VND 590 billion, mostly in short-term receivables of more than VND 471 billion. CMH Group has provisioned nearly VND 44 billion (100% of the original value) for hard-to-recover short-term receivables related to debts from Cavico Electric Power and Resources JSC, Cavico Vietnam LLC, Cavico Vietnam Mining and Construction JSC, and others.

A highlight in CMH Group’s balance sheet is the significant reduction in inventory from nearly VND 120 billion at the beginning of the year to over VND 74 billion.

Regarding liabilities, as of the end of Q2/2025, the company recorded short-term and long-term loans and financial lease liabilities totaling more than VND 268 billion, mostly from loans at VietinBank Thanh An Branch. These loans were used to cover construction costs, machinery and equipment investment for production and business, and land use fee payments on behalf of Tuan Huy Phu Tho JSC.

Bank Loans for Land Use Fee Payments on Behalf of Tuan Huy Phu Tho

Regarding the land use fee payment for Tuan Huy Phu Tho, the audited Consolidated Financial Report for the first six months of 2025 by CMH Group states that, according to the Investment Cooperation Contract No. 16/2024/HĐHTĐT/CMH-THPT dated June 1, 2024, both parties will jointly invest in, construct, and operate the Cam Khe Central Park Urban Housing and Cultural-Sports Complex project in Cam Khe town, Cam Khe district (formerly), Phu Tho province. The first phase covers an area of over 13.8 hectares with a total investment of more than VND 527.9 billion. Tuan Huy Phu Tho contributes VND 97 billion (18.38%), while CMH Group contributes VND 430.9 billion (81.62%).

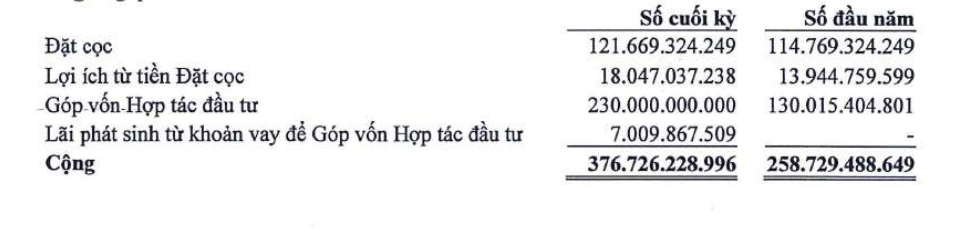

CMH Group’s financial report records other short-term receivables of nearly VND 377 billion from Tuan Huy Phu Tho. According to the Framework Contract No. 19/2022 and its appendices, the company will make a deposit to secure the signing and execution of contracts and transactions related to the Cam Khe Central Park project. Throughout the contract period, the company will earn an interest of 7% per annum on the deposit amount, calculated from the disbursement date to the deposit refund date. The entire deposit will be converted into investment capital according to the Investment Cooperation Contract No. 16/2024. Additionally, the company will earn interest on loans taken from credit institutions to contribute to the investment cooperation with Tuan Huy Phu Tho under the Investment Cooperation Contract.

CMH Group borrowed VND 230 billion from the bank to pay the land use fee for the 138,496 m² plot, as notified by the Phu Tho Provincial Tax Department on December 31, 2024, on behalf of Tuan Huy Phu Tho. This loan is considered part of the investment capital under the Investment Cooperation Contract No. 16/2024. The entire investment value serves as collateral for the bank loan.

Details of deposits, deposit benefits, capital contributions, and interest receivables related to the bank loan for capital contribution are as follows:

Source: Audited Consolidated Financial Report for the first six months of 2025 by CMH Group

Additionally, CMH Group recorded nearly VND 41 billion in work-in-progress production and business costs for the Cam Khe Central Park project, where the company acts as the general contractor under the EPC Contract No. 1102-1/2022 with Tuan Huy Phu Tho and its appendices. The contract value is provisionally estimated at over VND 450 billion. The value of work completed and accepted is nearly VND 165 billion, with expected completion in Q4/2026.

Cam Khe Central Park is a closed all-in-one urban development featuring 22 modern amenities, catering to all living needs of future residents.

Perspective of Cam Khe Central Park. Photo: CMH Group

The project includes 72 villas, 323 shophouses, and adjacent houses, with a total investment of VND 1,026 billion. Cam Khe Central Park is designed to become the economic, cultural, and sports center of the district, as well as a model urban area contributing to the development of the Cam Khe real estate market in the future.

According to documents, in September 2024, Tuan Huy Phu Tho used all its property rights and those of CMH Group arising from the Investment Cooperation Contract and its amendments (if any) for the Cam Khe Central Park – Phase 1 project as collateral at VietinBank Thanh An.

Not only Tuan Huy Phu Tho, but CMH Group also engaged in secured transactions at VietinBank Thanh An related to the Cam Khe Central Park project.

Specifically, in late July 2025, CMH Group pledged its property rights arising from the EPC General Contractor Contract No. 1102-1/2022/HĐTT dated February 11, 2022, for the implementation of the Cam Khe Central Park project between the company and Tuan Huy Phu Tho at VietinBank Thanh An.

VietinBank Thanh An is a familiar credit partner for CMH Group, as the company frequently engages in secured transactions at this branch.

Most recently, in September 2025, CMH Group pledged its property rights arising from the Construction Contract No. 04/2025/HĐ-TCXD signed on August 29, 2025, between Cam Khe Commune People’s Committee and the Cam Khe Project Joint Venture (including CMH Group and TDT Group JSC), along with any amendments to this contract, at the same VietinBank branch.

Additionally, CMH Group has repeatedly pledged construction contracts, machinery, CMS shares, and more at VietinBank Thanh An.

Real Estate Firms Reap Massive Profits Through Strategic Stock Market Investments

Despite a slowdown in its core business, Da Nang Housing Development Investment Corporation (HDIC) reported a remarkable post-tax profit of over VND 145 billion in the first nine months, a 3.5-fold increase compared to the same period last year. This impressive performance was largely driven by gains from its stock portfolio, which includes 23 stocks with investments ranging from a few hundred million to under VND 100 billion, such as HPG, VHM, DGC, FPT, VPB, VCG, EIB, and CTG.