I. FUTURES CONTRACTS OF THE STOCK MARKET INDEX

I.1. Market Trends

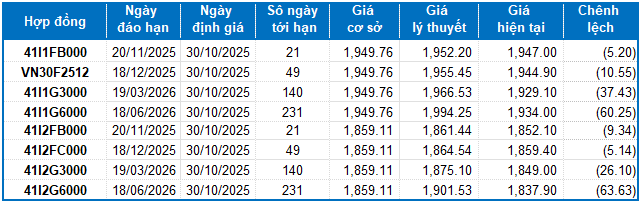

VN30 futures contracts showed mixed movements during the trading session on October 29, 2025. Specifically, 41I1FB000 (I1FB000) rose by 0.31%, reaching 1,947 points; VN30F2512 (F2512) increased by 0.54%, hitting 1,944.9 points; contract 41I1G3000 (G3000) declined by 0.05%, to 1,929.1 points; and contract 41I1G6000 (I1G6000) dropped by 0.05%, to 1,934 points. The underlying index, VN30-Index, closed at 1,949.76 points.

Additionally, all VN100 futures contracts gained during the October 29, 2025 session. Notably, 41I2FB000 (I2FB000) climbed 0.29%, to 1,852.1 points; 41I2FC000 (I2FC000) surged 1.58%, to 1,859.4 points; contract 41I2G3000 (I2G3000) jumped 3.05%, to 1,849 points; and contract 41I2G6000 (I2G6000) rose 0.51%, to 1,837.9 points. The underlying VN100-Index closed at 1,859.11 points.

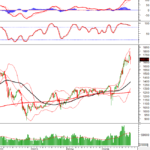

During the October 29, 2025 session, 41I1FB000 opened with sideways movement around the reference point in the first half but gradually shifted in favor of the Long side, pushing the contract higher for the remainder of the morning session. In the afternoon, selling pressure re-emerged, causing the contract to trade sideways within a narrow range. By the end of the session, selling pressure intensified, erasing most of the buyers’ efforts, and 41I1FB000 closed at 1,947 points, up 6.1 points.

Intraday Chart of 41I1FB000

Source: https://stockchart.vietstock.vn/

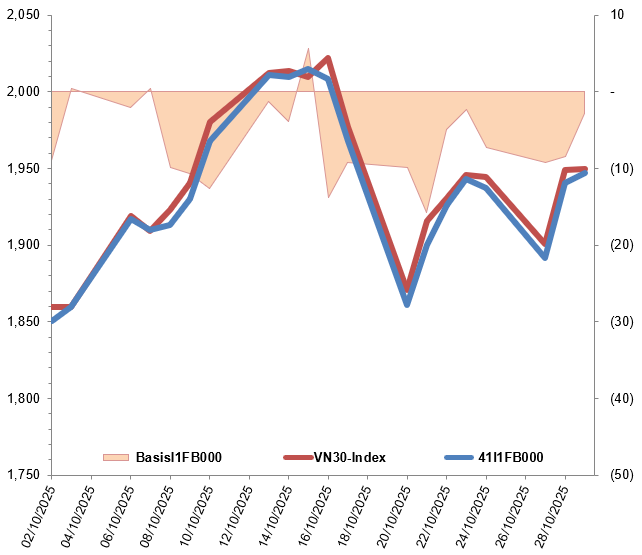

At the close, the basis of the 41I1FB000 contract narrowed compared to the previous session, reaching -2.76 points. This indicates a less pessimistic sentiment among investors.

Movements of 41I1FB000 and VN30-Index

Source: VietstockFinance

Note: Basis is calculated as follows: Basis = Futures Contract Price – VN30-Index

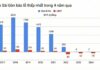

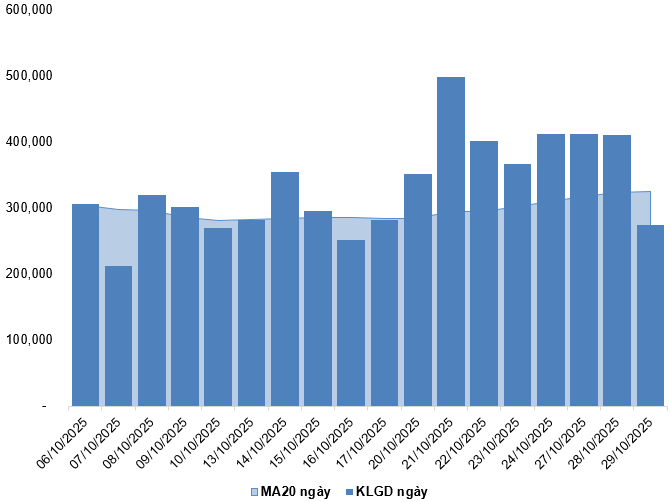

Trading volume and value in the derivatives market decreased by 33.24% and 31.37%, respectively, compared to the October 28, 2025 session. Specifically, the trading volume of I1FB000 fell by 33.15%, with 273,188 contracts matched. The trading volume of I2FB000 dropped by 39.71%, to 82 contracts.

Foreign investors returned to net buying, with a total net purchase volume of 957 contracts during the October 29, 2025 session.

Daily Trading Volume Trends in the Derivatives Market. Unit: Contracts

Source: VietstockFinance

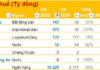

I.2. Futures Contract Valuation

Based on the fair pricing method as of October 30, 2025, the reasonable price range for futures contracts currently trading in the market is as follows:

Summary Table of Derivatives Valuation for VN30-Index and VN100-Index

Source: VietstockFinance

Note: Opportunity costs in the pricing model have been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments appropriate for each futures contract.

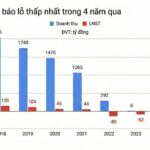

I.3. Technical Analysis of VN30-Index

During the October 29, 2025 session, the VN30-Index saw a slight increase, accompanied by a near-Doji candlestick pattern and trading volume remaining below the 20-session average, indicating investor hesitation.

Additionally, the Bollinger Bands are narrowing (Bollinger Band Squeeze), while the ADX indicator continues to decline and remains below the gray zone (20 < ADX < 25).

Technical Analysis Chart of VN30-Index

Source: VietstockUpdater

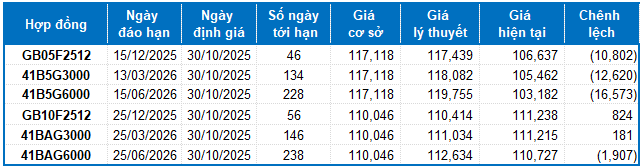

II. FUTURES CONTRACTS OF THE BOND MARKET

Based on the fair pricing method as of October 30, 2025, the reasonable price range for futures contracts currently trading in the market is as follows:

Summary Table of Government Bond Futures Valuation

Source: VietstockFinance

Note: Opportunity costs in the pricing model have been adjusted to suit the Vietnamese market. Specifically, the risk-free treasury bill rate (government treasury bill) is replaced by the average deposit rate of major banks, with term adjustments appropriate for each futures contract.

According to the above valuation, contracts GB05F2512, 41B5G3000, 41B5G6000, and 41BAG6000 are currently attractively priced. Investors may focus on and consider buying these futures contracts in the near term, as they present a favorable opportunity in the market.

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 18:28 29/10/2025

Derivatives Market Update: October 29, 2025 – Sentiment Turns Less Pessimistic

On October 28, 2025, most VN30 and VN100 futures contracts closed higher. The VN30-Index rebounded after retesting its 50-day SMA, signaling a shift in investor sentiment from pessimism to cautious optimism.

Vietstock Weekly 27-31/10/2025: Will Market Volatility Persist?

The VN-Index extended its correction into the second consecutive week, accompanied by trading volumes dipping below the 20-session average. While the decline has somewhat narrowed, a cautious sentiment persists, with demand largely exploratory and lacking the breadth required for a sustained rebound. Against a backdrop where the Stochastic Oscillator has signaled a sell and the MACD is gradually converging with the Signal Line, continued volatility is likely in the near term.

Derivatives Market on October 24, 2025: Uncertainty Takes Hold

On October 23, 2025, both the VN30 and VN100 futures contracts rallied during the trading session. The VN30-Index edged higher, forming a Spinning Top candlestick pattern, while trading volume continued to decline, remaining below the 20-session average. This suggests a sense of investor hesitation in the market.