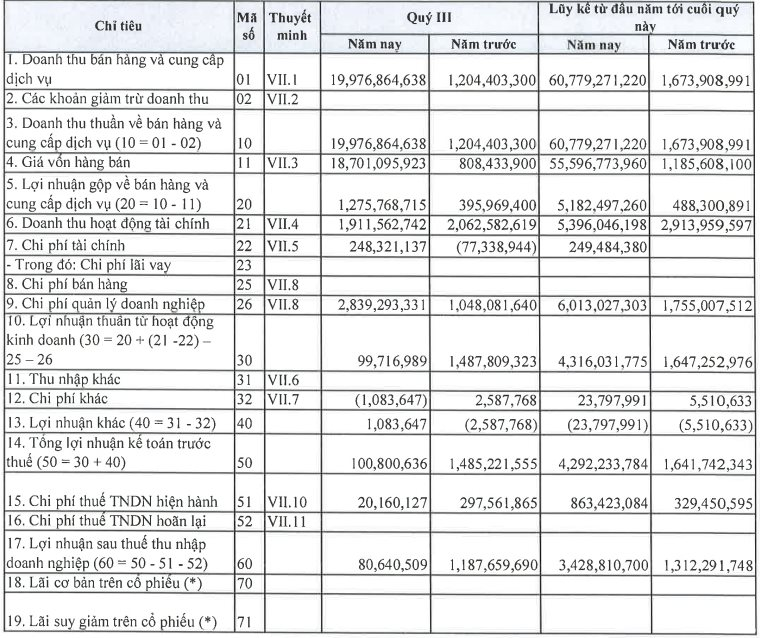

HVA Investment Corporation (HVA Group, stock code: HVA) recently released its Q3/2025 financial report, revealing a net revenue of nearly VND 20 billion, a staggering 17-fold increase compared to the VND 1.2 billion recorded in the same period last year. After deducting the cost of goods sold, HVA Group’s gross profit reached over VND 1 billion, triple the amount from Q3/2024.

Additionally, HVA recorded a financial revenue of VND 1.9 billion, primarily from business cooperation contract profits. Meanwhile, administrative expenses surged to VND 2.8 billion, an 180% increase year-over-year.

Source: HVA Q3/2025 Financial Report, unit: VND.

After accounting for other expenses, HVA Group’s pre-tax profit stood at a mere VND 100 million, a 93% decline from the VND 1.5 billion reported in Q3/2024.

For the first nine months of 2025, the company reported a cumulative net revenue of nearly VND 61 billion and a pre-tax profit of over VND 4 billion, 36 times and nearly 3 times higher than the same period last year, respectively.

As of September 30, 2025, HVA’s equity reached VND 151 billion, with total assets nearing VND 190 billion. The company has invested over VND 10 billion in securities, with significant holdings in stocks such as TLG (29%), CLX (33%), DTB (14%), and TCL (16%). HVA also holds smaller positions in MSB, TPB, OCB, and SHB. As of Q3, the company’s trading securities portfolio is down nearly 5%.

According to the company’s website, HVA operates in several key sectors: (1) Banking and Investment Services; (2) Innovation Investment; (3) M&A Consulting and Trusteeship; (4) Financial Support Services; (5) Wholesale of Precious Metals and Raw Gold; (6) Franchise Investment; (7) Industrial Real Estate Investment; and Technology Products for Investment Support.

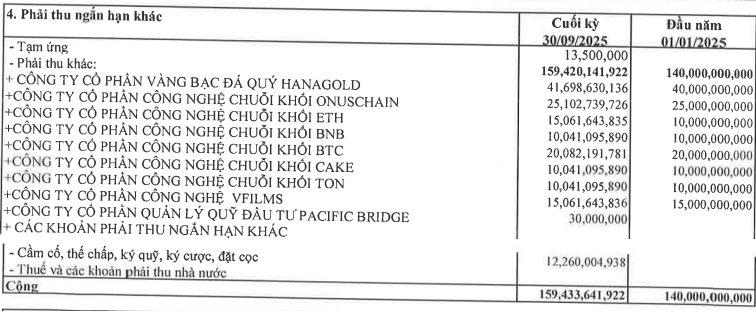

Notably, HVA’s detailed investment portfolio, as disclosed on its website, includes BCC contracts on assets like gold, cash, and notably, digital assets. HVA’s partners include ETH Blockchain Technology JSC, BTC Blockchain Technology JSC, and BNB Blockchain Technology JSC, names that evoke popular digital assets such as Bitcoin, Ethereum, and Binance.

As of the end of Q3, these BCC contracts were recorded under other short-term receivables, valued at VND 159 billion, a 14% increase from the beginning of the year.

Source: HVA Group Website

Plans for a VND 10,000 Billion Digital Asset Trading Platform

In related news, HVA Group is gearing up to establish a digital asset trading platform with a capital scale of VND 10,000 billion.

During the 2025 Extraordinary Shareholders’ Meeting in September, HVA approved the plan to launch the DNEX Digital Asset Trading Platform in Da Nang, with a cooperative capital of VND 10,000 billion. This move follows the government’s issuance of Resolution 05/2025/NQ-CP on the pilot implementation of the digital asset market, effective from September 9.

According to business registration information, DNEX Digital Asset Trading JSC was established on September 9, with its headquarters at MISA Building, Da Nang. Mr. Nguyen Chi Cong, born in 1984, serves as the General Director.

The company has a charter capital of VND 2 billion, with three founding shareholders: Fundgo Fund Management JSC (30%), Trustpay JSC (30%), and Digital Asset Management Technology JSC (40%).

Mr. Vuong Le Vinh Nhan is the Chairman of HVA Group’s Board of Directors, while Mr. Nguyen Chi Cong is a board member.

The DNEX platform is expected to be based in Da Nang, aligning with the city’s vision to become an international financial hub. The project’s cooperative capital is approximately VND 10,000 billion, to be raised from strategic investors in phases.

As the lead entity, HVA Group will be responsible for planning, coordination, and partner networking. Announced strategic partners include Onus Finance UAB, Alpha Securities JSC (APSC), Pacific Bridge Capital, SFVN Investment JSC, and Vemanti Group.

The implementation roadmap consists of three phases: legal and technological infrastructure preparation; sandbox testing; and commercial operation from 2025–2026, with a gradual expansion of product scope and customer base.

Additionally, shareholders approved the establishment of the ETH Treasury on the ETHCapital.vn platform, with a maximum cooperative capital of VND 1,000 billion. HVA Group will collaborate with Onus Finance UAB, Parker Rusell, and ETHCapital.vn to execute this project.

“From Joy to Despair: Hanoi Vodka Company Plunges Back into Losses”

In the first nine months of 2025, net revenue reached VND 87.9 billion, a 10% increase compared to the same period last year. However, the company still reported a post-tax loss of VND 3.8 billion.

Duc Giang Chemicals Holds Over VND 12,700 Billion in Bank Deposits, Q3/2025 Net Profit Reaches VND 804 Billion

Duc Giang Chemicals reported a net profit of over 804 billion VND in Q3/2025, a 9% increase year-over-year. As of September 30, 2025, the company holds nearly 12,762 billion VND in bank deposits.