DNSE Securities Corporation (stock code: DSE, listed on HoSE) has released a report on the public offering of bonds under the Public Bond Offering Certificate No. 340/GCN-UBCK, issued by the Chairman of the State Securities Commission on October 2, 2025.

By the end of the offering period on October 27, 2025, DNSE successfully distributed 10 million bonds with the code DSE125018 to 298 investors.

Of these, 91,792 bonds were allocated to 287 domestic individual investors, while 9.9 million bonds were distributed to 11 domestic institutions.

The bonds are non-convertible, unsecured, and do not include warrants, establishing a direct debt obligation for the issuer.

With a face value of 100 million VND per bond, DNSE raised 1,000 billion VND from this offering. The funds will be utilized for advance payment activities and margin trading.

The bonds have a 24-month term, with the first interest period offering a fixed rate of 8.3% per annum. Subsequent interest periods will have a floating rate, with interest paid semi-annually.

Following this offering, DNSE’s total liabilities as of October 27, 2025, increased to 10,716.3 billion VND. Bond debt accounts for nearly 1,300 billion VND of this total.

In terms of business performance, DNSE Securities recorded an operating revenue of nearly 1,023.1 billion VND in the first nine months of 2025, a 78% increase year-on-year. After-tax profit reached 263 billion VND, up 77%.

For 2025, DNSE Securities set a business target of 849 billion VND in total revenue and an estimated after-tax profit of 262 billion VND.

By the end of the first three quarters, the company achieved 120.5% of its total revenue target and 100.5% of its after-tax profit goal.

As of September 30, 2025, DNSE’s total assets increased by 31.7% compared to the beginning of the year, reaching nearly 14,009 billion VND.

This includes loans of nearly 5,750.1 billion VND, up 48%. Financial assets measured at fair value through profit or loss (FVTPL) exceeded 1,009 billion VND, six times higher than at the start of the year. Held-to-maturity (HTM) investments totaled nearly 3,497 billion VND.

DNSE Surpasses Full-Year 2025 Profit Target by Q3 End

DNSE Securities achieved record-breaking Q3 results, with revenue soaring 2.5 times and profits tripling year-over-year, surpassing its full-year 2025 profit target ahead of schedule.

Derivatives Market: VPS Securities Loses Ground as DNSE Surges Ahead

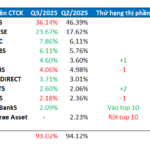

The Hanoi Stock Exchange has unveiled the top 10 brokerage market shares for derivatives in Q3/2025. The data highlights a notable shift in market share, with VPS Securities relinquishing its dominance to other brokerage firms.