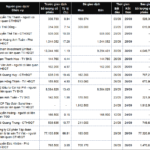

In this round, KSF issued 600 million new shares to swap all shares of SSH at a ratio of 1 SSH share for 1.6 KSF shares. The transaction, executed on October 22, granted Mr. Tuan 390 million KSF shares, increasing his ownership to 61.4%.

Simultaneously, Mr. Tuan’s family members conducted similar transactions. Mr. Do Van Truong (Mr. Tuan’s brother) acquired 36 million KSF shares, raising his stake to 4.03%. Mrs. Do Thi Hong Nhung (Mr. Tuan’s sister) secured over 6.2 million shares, equivalent to 0.69%. Collectively, the group associated with Mr. Do Anh Tuan holds over 595.4 million shares, representing 66.2% of KSF’s charter capital.

SSH’s report indicates the company no longer qualifies as a public entity, with one major shareholder holding 99.96% and the remaining 121 shareholders collectively owning just 0.04%. As previously announced, SSH plans to transition to a single-member LLC and delist from UPCoM.

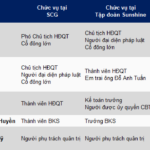

Mr. Do Anh Tuan – Founder and Chairman of KSF

|

Established in 2015, SSH originated as Sunshine Vietnam Construction JSC, operating in construction and real estate. Prior to the merger, Mr. Do Anh Tuan owned 65% of SSH, while his relatives, Mr. Do Van Truong and Mrs. Do Thi Hong Nhung, held 6% and 1%, respectively.

Meanwhile, KSF, also founded in 2015, underwent multiple name changes before adopting its current identity. Beyond real estate, the conglomerate is expanding into retail, healthcare, finance, technology, and education. In 2025, KSF initiated a large-scale restructuring, including the SSH swap and plans to become the parent company of SCG Group JSC (HNX: SCG).

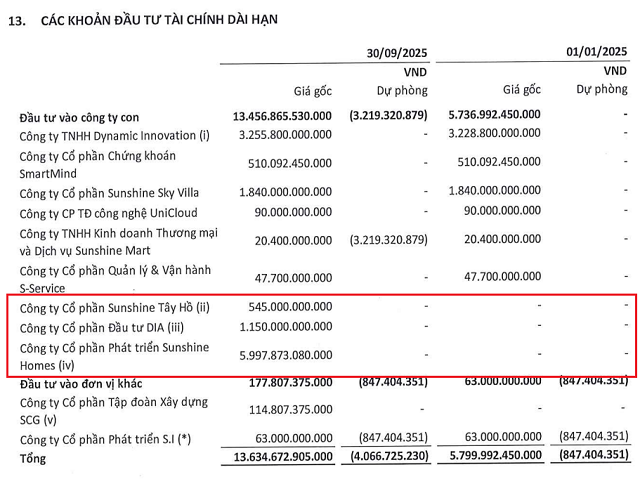

With SSH as a subsidiary, KSF gains indirect control over several entities within SSH’s former ecosystem. Additionally, in the first nine months, KSF directly expanded its holdings in companies like Sunshine Tay Ho JSC and DIA Investment JSC, with total acquisitions nearing VND 1.7 trillion.

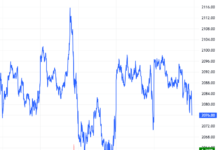

By the end of Q3, KSF’s total assets surged to nearly VND 79 trillion, almost quadrupling since the year’s start. Short-term receivables exceeded VND 54 trillion, liabilities reached nearly VND 65 trillion, and outstanding loans surpassed VND 21 trillion. Post-swap, charter capital increased from VND 3 trillion to nearly VND 9 trillion.

Despite rapid expansion, KSF’s consolidated performance remains modest compared to its 2025 targets. The company aims for VND 50-60 trillion in revenue and VND 8-12 trillion in pre-tax profit but has recorded approximately VND 5.4 trillion in revenue and VND 2 trillion in pre-tax profit after nine months.

KSF consolidated three subsidiaries since early 2025. Source: Q3/2025 Consolidated Financial Report of KSF

|

| KSF’s asset scale skyrocketed post-acquisition, including SSH |

– 09:11 29/10/2025

Top Executives and Insiders at GEX, ING, TT6 Aggressively Accumulate Shares

The stock market week of September 29–October 3, 2025, witnessed several notable share purchase transactions registered by executives and their relatives at GEX, ING, and TT6.

Sunshine Group Initiates Plan to Transform SCG into a Subsidiary

The Hanoi Stock Exchange (HNX)-listed Sunshine Group Joint Stock Company (KSF) has set its sights on acquiring over 1.9 million shares of the Construction Group Joint Stock Company (SCG), equating to 2.25% of the company’s capital. This strategic move is in line with KSF’s previously announced plans to solidify its position as a majority shareholder and transform SCG into a subsidiary.