Illustrative image

Dien Quang Corporation (Stock Code: DQC) has submitted a report to the Ho Chi Minh City Stock Exchange (HoSE) detailing its efforts to address the warning and periodic control status of its stocks in Q3/2025.

According to the consolidated financial statements for Q3/2025, Dien Quang recorded an accumulated after-tax profit of nearly VND 8.3 billion, significantly reducing the company’s existing accumulated losses.

The company will continue implementing corrective measures, including synchronized solutions to enhance business efficiency, negotiating lower raw material costs, streamlining operations, and cutting expenses. Focus will also be placed on securing new clients, partners, and projects to drive annual revenue growth.

Priority will be given to high-margin business segments to boost profits and offset losses. The company will reassess the effectiveness of past investments and consider divesting from underperforming assets.

Enhanced monitoring and control of subsidiaries and affiliates will ensure accurate bookkeeping, debt reconciliation, and compliance with regulations.

In Q3/2025, the company’s consolidated net revenue reached nearly VND 241 billion, an increase of VND 26 billion compared to the same period last year. After-tax profit stood at over VND 11 million, a significant improvement from the VND 4.9 billion loss reported in the same quarter of the previous year. The parent company’s after-tax profit was nearly VND 5.1 billion.

For the first nine months of 2025, Dien Quang’s cumulative net revenue exceeded VND 598 billion, a slight increase of VND 7 billion year-on-year. Notably, the company reported a net profit of over VND 836 million, compared to a loss of nearly VND 6.4 billion in the same period last year.

Dien Quang Group attributed the rise in consolidated profits primarily to its streamlined operations, reduced management costs, lower interest expenses, and asset liquidations.

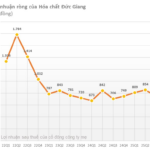

Duc Giang Chemicals Holds Over VND 12,700 Billion in Bank Deposits, Q3/2025 Net Profit Reaches VND 804 Billion

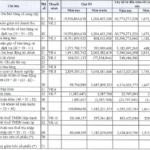

Duc Giang Chemicals reported a net profit of over 804 billion VND in Q3/2025, a 9% increase year-over-year. As of September 30, 2025, the company holds nearly 12,762 billion VND in bank deposits.