After a steep decline, the Vietnamese stock market continued to witness significant volatility. The VN-Index plummeted by approximately 30 points before staging a remarkable rebound, closing the session on November 27th with a 28-point gain, reaching 1,680 points. Liquidity remained robust, with trading values on HOSE nearing 30 trillion VND.

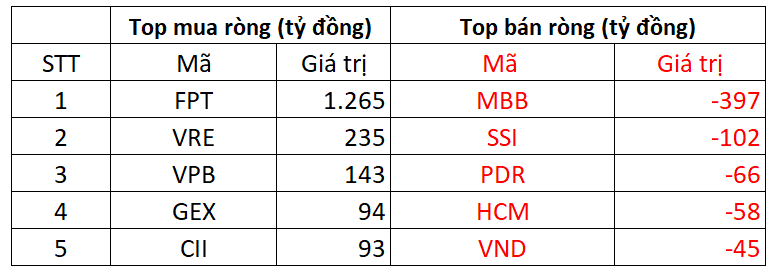

Foreign investors turned bullish, net buying 1.475 trillion VND across the market.

On HOSE, foreign investors net bought 1.537 trillion VND.

On the buying side, FPT was the most heavily purchased stock by foreign investors on HOSE, with a value exceeding 1.265 trillion VND. VRE and VPB followed, with net buys of 235 billion VND and 143 billion VND, respectively. Additionally, GEX and CII were bought for 94 billion VND and 93 billion VND, respectively.

Conversely, MBB and SSI faced the strongest selling pressure from foreign investors, with nearly 397 billion VND and 102 billion VND, respectively. PDR and HCM were also offloaded, with 66 billion VND and 58 billion VND, respectively.

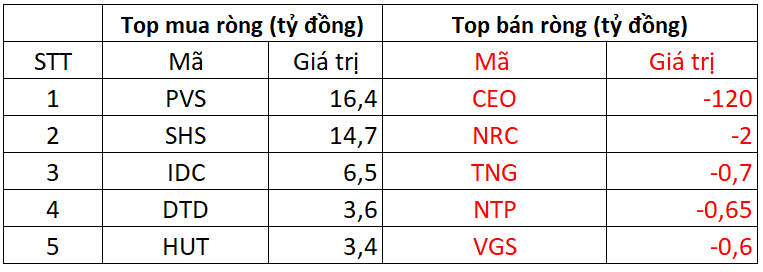

On HNX, foreign investors net sold 73 billion VND

On the buying side, PVS was the most net-bought stock on HNX, with a value of 16 billion VND. SHS followed closely, with net buys of 14 billion VND. Foreign investors also allocated a few billion VND to net buy IDC, DTD, and HUT.

On the selling side, CEO faced the strongest net selling pressure from foreign investors, with a value of nearly 120 billion VND. NRC, TNG, and NTP followed, with a few billion VND sold.

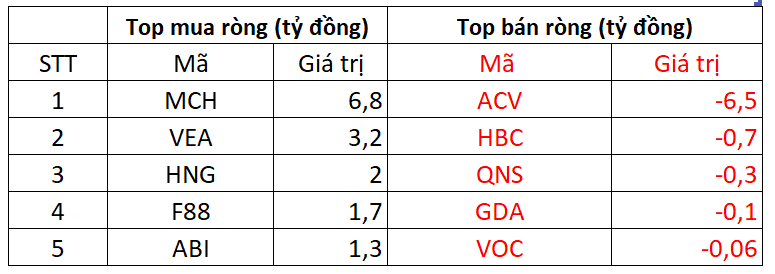

On UPCOM, foreign investors net bought 11 billion VND

On the buying side, MCH was purchased by foreign investors for 7 billion VND. VEA and HNG also saw net buys of a few billion VND each.

Conversely, ACV was net sold by foreign investors for 6.5 billion VND. Foreign investors also net sold HBC, QNS, GDA, and others.

Securities Firm Aims to Quadruple 2025 Profit Plan, Targeting Capital Raise of Over 24 Trillion VND

The company anticipates raising over 11,000 billion VND through its upcoming share offering. This capital will be allocated to fund the development of the VIX Cryptocurrency Exchange and bolster resources for proprietary trading and margin lending activities.

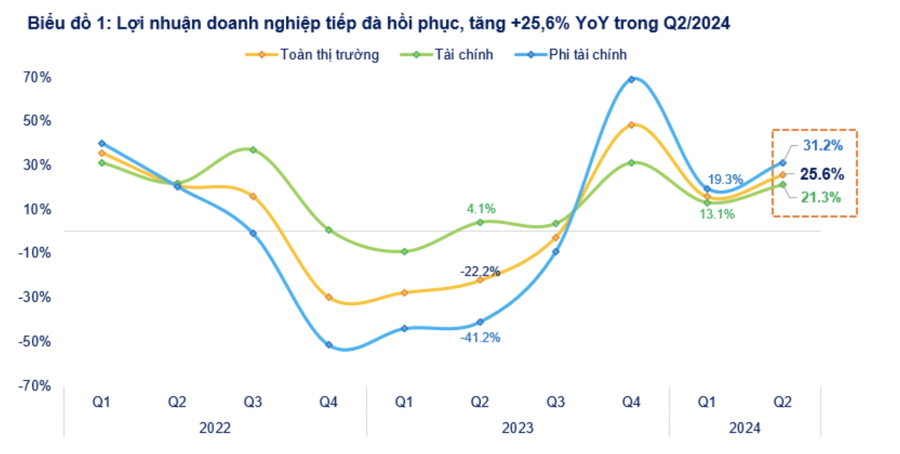

Market Boom Halts, Squeezing Equity Fund Performance

In recent months, amidst the sideways trend of the stock market and the decline in traditionally favored sectors like banking and securities, the profitability of equity investment funds has significantly diminished compared to previous periods.