AI-generated illustrative image

According to the Tax Department of 7 provinces in Dak Lak, based on the Tax Administration Law No. 38/2019/QH14, Decree No. 126/2020/NĐ-CP, and Circular No. 40/2021/TT-BTC issued by the Ministry of Finance, to ensure compliance with tax obligations, the Tax Authority guides households and individuals engaged in business to file taxes using the declaration method.

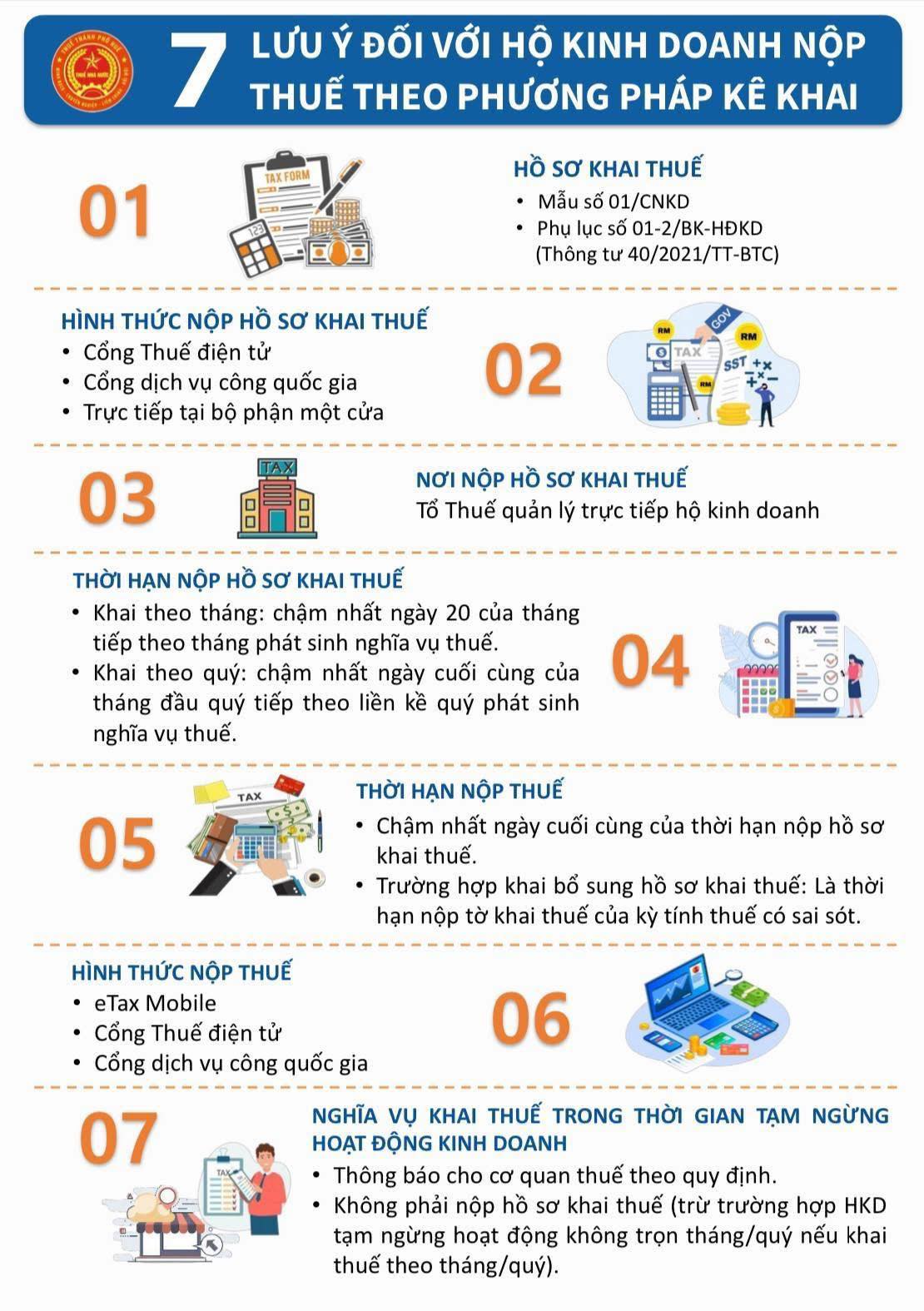

As per the Tax Authority’s guidance, households and individuals in business should take note of the following 7 points to ensure a smooth tax declaration process:

1. Tax Declaration Documents:

Tax declaration form No. 01/CNKD

Appendix No. 01-2/BK-HĐKD

2. Methods of Submitting Tax Declaration Documents:

– Via the Electronic Tax Portal: https://thuedientu.gdt.gov.vn;

– Via the National Public Service Portal: https://dichvucong.gov.vn;

– In person at the “One-Stop Shop” of the Tax Authority.

3. Location for Submitting Tax Declaration Documents:

– The Tax Office directly managing the business household.

4. Deadline for Submitting Tax Declaration Documents:

– Monthly declaration: no later than the 20th day of the following month of tax liability;

– Quarterly declaration: no later than the last day of the first month of the following quarter of tax liability.

5. Tax Payment Deadline:

– No later than the last day of the tax declaration document submission deadline.

– In case of supplementary tax declaration: the deadline is the submission deadline for the tax period with errors.

6. Methods of Tax Payment:

– Via the eTax Mobile application;

– Via the Electronic Tax Portal;

– Via the National Public Service Portal.

7. Tax Declaration Obligations During Temporary Business Suspension:

– Notification of temporary suspension must be sent to the Tax Authority no later than 1 working day before the suspension.

– No tax declaration documents need to be submitted during the suspension period, except in cases where the suspension does not cover a full month or quarter (if declaring taxes monthly/quarterly).

Data from the Tax Department (Ministry of Finance) shows that in the first 9 months of 2025, over 18,500 business households switched from presumptive tax to the declaration method, and nearly 2,530 business households transitioned to enterprise models.

Notably, 98% of business households declaring taxes have utilized electronic tax filing and payment; over 133,000 business households have registered to use electronic invoices generated from cash registers.

The Ministry of Finance is also leading the drafting of the Tax Administration Law and proposing amendments to the Personal Income Tax Law (expected to be submitted to the National Assembly at the 10th session in October 2025).

The Ministry further stated that Circulars and Decrees will be reviewed and amended comprehensively to establish a clear and transparent legal framework, facilitating the transition of business households from presumptive tax to the declaration method. The Tax Authority aims to simplify procedures, enhance smart electronic tax services, and strengthen direct support and communication to make tax compliance easier for taxpayers.

Tax Authority Responds to Criticism Over Confusing Rental Property Tax Regulations

Residents highlight that the current tax regulations for individuals leasing property lack clarity, making it challenging to distinguish between property rental activities and residential services.

Automated Late Tax Payment Reminders and Penalty Review Needed

At the seminar “Promoting Voluntary Compliance, Full Tax Contribution – Building a Prosperous Era” organized by Lao Dong Newspaper on October 23, experts emphasized that tax authorities should shift from a “management and imposition” mindset to one of “accompaniment and support” to enhance taxpayers’ voluntary compliance.

Former Deputy Director of the General Department of Taxation: It’s Highly Unreasonable for Someone to Face an 8 Million VND Fine for a Mere 300,000 VND Delay in Personal Income Tax Declaration

At the seminar titled “Promoting Voluntary Compliance, Full Tax Contribution – Building a Prosperous Era,” organized by Lao Dong Newspaper on October 23, experts emphasized that tax authorities should shift from a mindset of “management and imposition” to one of “partnership and support” to enhance taxpayers’ voluntary compliance.