TCL CSOT’s journey from LCD manufacturing to high-tech innovation.

From LCD Manufacturer to High-Tech Innovator

Over a decade since its inception, TCL China Star Optoelectronics Technology (CSOT) has evolved from a producer of affordable LCD panels to a bona fide technology leader in the display industry. The company now operates a range of factories, from Gen 5.5 to Gen 11, supplying screens for smartphones, TVs, laptops, and industrial devices.

A pivotal moment came with the announcement of the T8 project—an 8.6G inkjet OLED factory in Guangzhou, with an investment of 29.5 billion RMB (approximately $4.1 billion) and a designed capacity of 22,500 substrates per month, each measuring 2,290 × 2,620 mm. This marks the world’s first large-scale inkjet OLED factory, signaling China’s ambition to not only manufacture using legacy technologies but also to shape the next generation of display technology.

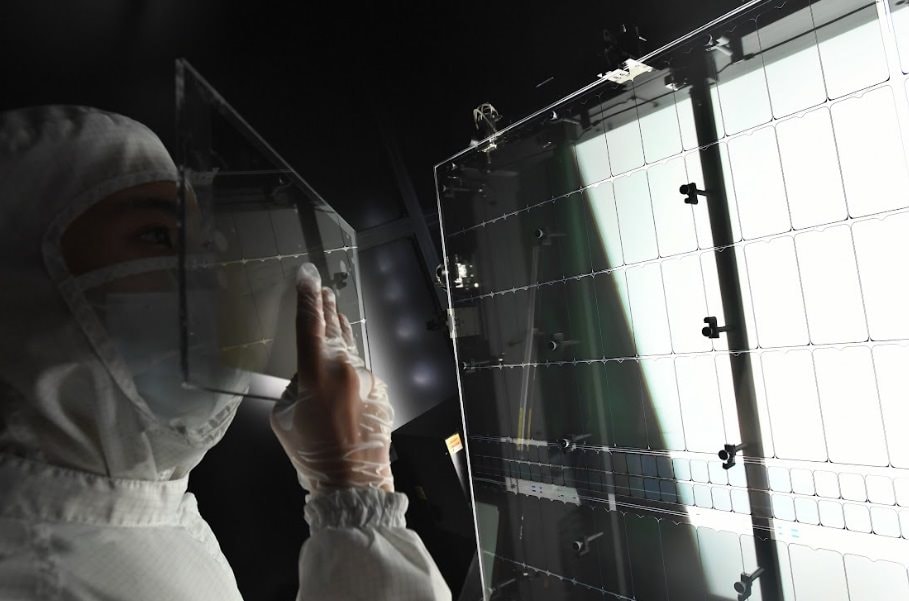

CSOT’s advanced manufacturing facility.

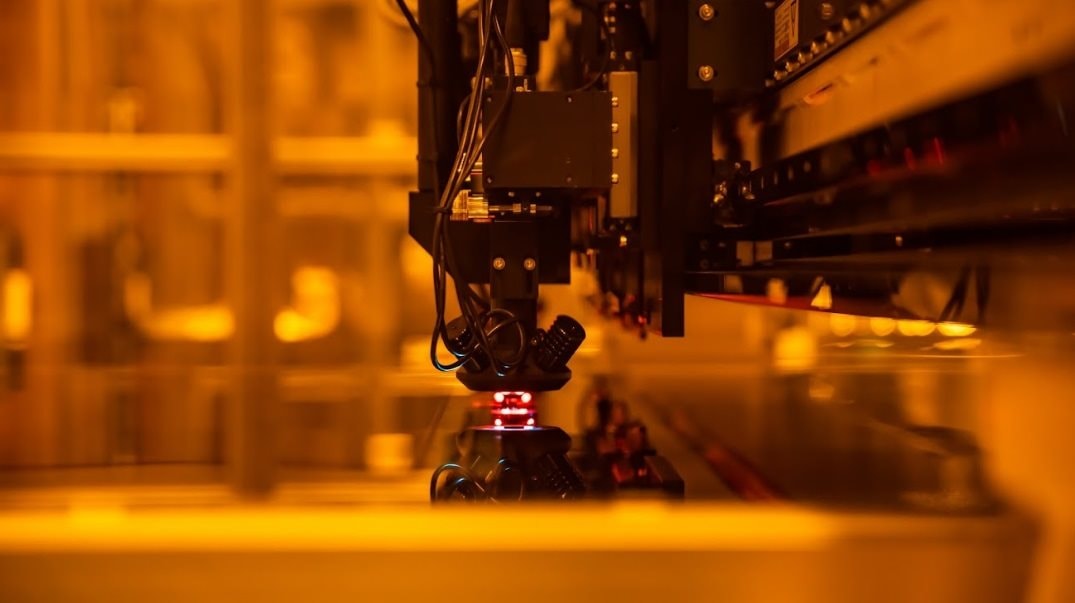

Cutting-edge technology in action at CSOT.

With T8, TCL CSOT is not merely increasing production volume. They are reshaping the entire value chain, from materials and direct RGB OLED inkjet printing processes to AI-driven manufacturing oversight. In essence, T8 is a declaration that China aims to move beyond being a mere display assembler to becoming a hub for core technology development.

AI and Automation: The Backbone of Modern Display Manufacturing

Unlike traditional OLED vacuum evaporation methods, inkjet technology allows for the direct printing of organic RGB ink onto glass substrates, saving materials and reducing production costs by 15–20% compared to evaporation, according to TrendForce.

Inkjet OLED technology in use.

Precision in every detail.

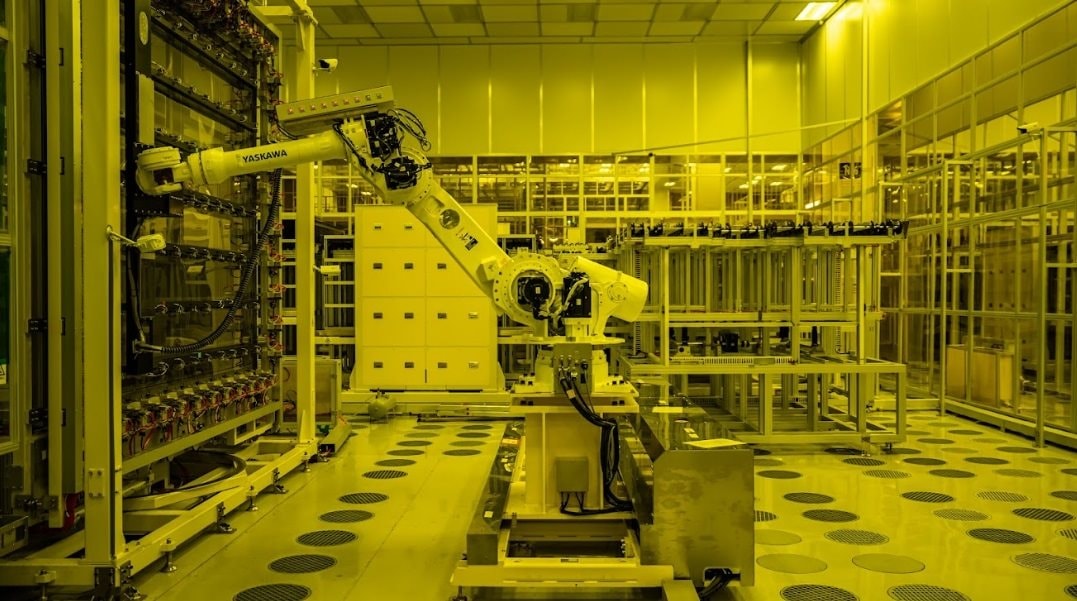

Advanced machinery at CSOT’s facility.

Applying this technique to 8.6G glass substrates—significantly larger than those used in smartphones—represents a technological leap that few companies, including CSOT, have dared to pursue.

To achieve this, CSOT has heavily invested in automation and AI. Its new-generation factories, including T8 and the Wuhan facility, are designed as “smart factories,” where industrial robots, real-time sensors, and machine learning algorithms operate seamlessly from material application to quality control.

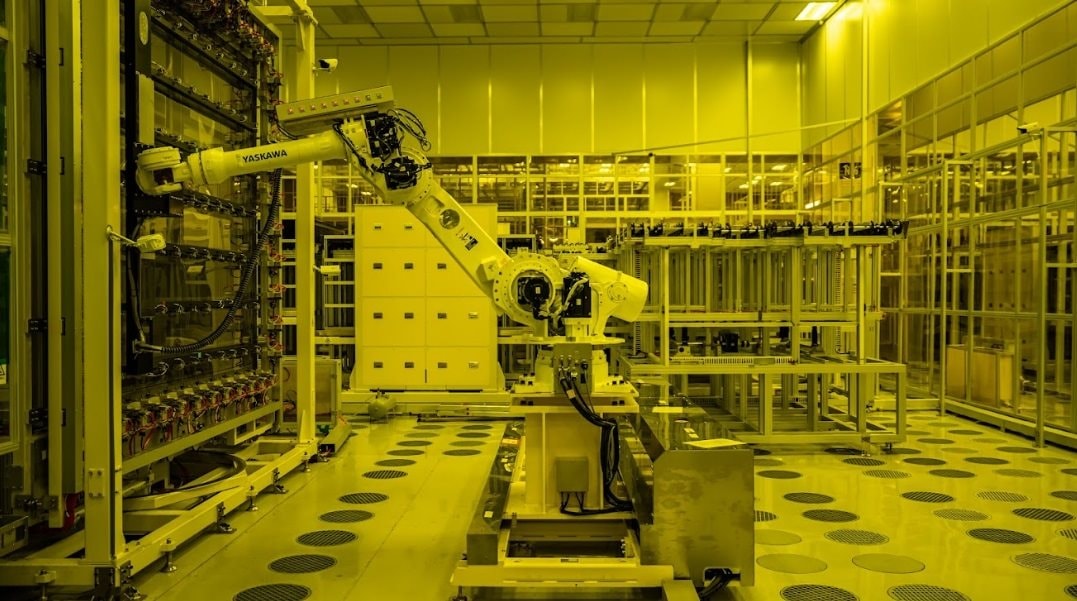

According to official reports, this AI system can halve product R&D time and significantly reduce defect rates—a critical factor in RGB OLED manufacturing.

AI-driven quality control.

Another notable feature is CSOT’s use of digital twins to simulate and optimize production lines, alongside big data analytics platforms that monitor millions of parameters per minute within the factory.

At T8’s scale, even a 0.1% improvement in yield can save millions of dollars annually. Thus, AI is not just a technical component but a genuine financial lever for efficiency.

A Strategic Move in the Global Race

In the broader industry landscape, South Korean giants like Samsung and LG Display still dominate high-end OLED production. However, there is a growing gap in the IT panel market—laptops, tablets, and specialized monitors—where high quality at affordable prices is in demand. This is where CSOT is focusing: on mid-sized panels, leveraging the cost advantages of inkjet OLED technology.

In addition to the T8 project, CSOT operates a G5.5 inkjet OLED factory in Wuhan, which began mass production in late 2024. The synergy between these two facilities allows the company to quickly dominate the mid-sized display segment, an area where South Korean competitors remain focused on high-end TVs and smartphones.

Mid-sized panel production line.

Precision engineering at its finest.

Simultaneously, CSOT’s acquisition of LG Display’s LCD factory in China (in 2024) underscores a dual strategy: maintaining stable LCD capabilities to sustain cash flow while investing heavily in OLED—the technology of the future.

According to TCL Technology’s reports, the display segment (including CSOT) contributes over 60% of consolidated revenue, amounting to hundreds of billions of RMB annually. This financial foundation is robust enough to support multi-billion-dollar investments in T8 and subsequent production lines.

Analysts predict that if T8 meets expectations, CSOT could become the world’s first large-scale inkjet OLED panel manufacturer, establishing a new technological axis to compete directly with South Korea and Japan.

The “8.6G Leap” and Its Broader Implications

T8 is more than just a factory; it is a strategic statement about China’s ambition for self-reliance in display technology. By choosing the risky yet promising path of inkjet OLED, TCL CSOT exemplifies the shift in Asia’s display industry from imitation to innovation.

Innovation at the core of T8.

The future of display technology.

With an investment of $4.1 billion, a capacity of 22,500 substrates per month, and comprehensive AI integration, CSOT is laying the groundwork for a new generation of displays, where technology and production efficiency are optimized simultaneously.

If T8’s promises materialize, the global display market will witness not just a new competitor, but a new technological hub—where substrates are defined not by size, but by the intelligence of the algorithms that operate them.