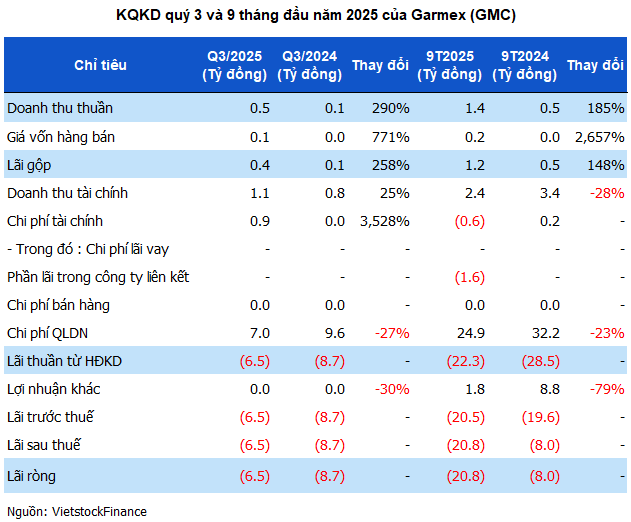

| During 2022-2025, Garmex reported profits only in Q2/2022 and Q1/2024, with the remaining quarters showing losses. |

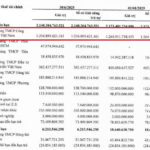

Garmex incurred a net loss of 6.5 billion VND in Q3/2025, although this was a reduction from the nearly 9 billion VND loss in the same period last year. This marks the largest loss of the year. Accumulated losses for the first nine months reached nearly 21 billion VND, bringing the total accumulated losses by the end of September 2025 to 125 billion VND. Shareholders’ equity now stands at just over 345 billion VND.

The primary reason for Garmex’s continued losses remains high fixed costs, predominantly management expenses. In Q3, these costs amounted to 7 billion VND, bringing the total management expenses for the first nine months to nearly 25 billion VND, despite a 23% reduction compared to the same period last year. Over half of these management expenses are attributed to depreciation of fixed assets.

|

In contrast to its expenses, Garmex’s net revenue for the first nine months was only 1.4 billion VND, lower than its financial income of 2.4 billion VND, primarily from interest on deposits. As of the end of September, the company held approximately 72 billion VND in bank deposits, a slight 9% decrease from the beginning of the year, with no outstanding loans.

Having ceased production in May 2023 due to a lack of orders, Garmex’s current revenue sources are primarily from service operations and property rentals. Within its revenue structure, the service segment generated 290 million VND, while pharmaceutical and medical supplies sales contributed 258 million VND. The majority of revenue comes from leasing premises.

Since late February 2025, Garmex has signed a contract with VinaPrint JSC (UPCoM: VPR) to lease 3,000 square meters of land for the development of pickleball courts and other sports activities. This arrangement has brought Garmex approximately 795 million VND in revenue, equivalent to nearly 3 million VND per day in pickleball court rental income for the first nine months of this year.

Pickleball, a rapidly growing sport in Vietnam. Illustrative image from the Vietstock Pickleball 2025 tournament.

|

“Legacy” inventory and the burden of the past

As of the end of September 2025, Garmex still holds nearly 109 billion VND in inventory, including over 21 billion VND in finished goods transferred to consignment sales, and approximately 86 billion VND in remaining finished goods inventory (with nearly 15 billion VND in provisions). A significant portion of this inventory is linked to its main outsourcing partner, Gilimex, which is embroiled in a legal dispute with Amazon, severely impacting Garmex’s operations.

Once a company with five factories and over 4,000 employees, Garmex now employs only 29 staff members. The company is focused on capital recovery, reducing investments, and liquidating unused assets. Recently, Garmex announced plans to transfer land and associated assets in Ba Ria – Vung Tau for 313 billion VND, after several other assets failed to sell at auction.

After being delisted from HOSE and moving to UPCoM, Garmex’s stock (GMC) is subject to trading restrictions. The stock currently trades at 5,400 VND per share, up 23% in the last three months but still down 35% over the past year and more than 75% from its peak of 22,000 VND per share in September 2022.

| GMC stock price performance since relisting on UPCoM |

– 15:10 29/10/2025

South Korean Conglomerate Builds Billion-Dollar Plant in Ho Chi Minh City: Reports $188M Loss in H1 2025, Accumulated Losses Reach $850M, PwC Auditors Raise Concerns

PwC’s audit reveals that Hyosung Vina Chemicals’ accumulated losses and short-term liabilities have surpassed its current assets, raising concerns about the company’s ability to continue as a going concern.

Garmex Offloads 50,000m² of Land for $313 Billion to Offset Ongoing Losses

Garmex Saigon JSC (UPCoM: GMC) is offering its land and associated assets in Ba Ria – Vung Tau for sale at VND 313 billion, following unsuccessful auctions of other properties. This move underscores the company’s urgent need to recover capital and scale back investments as it continues to grapple with ongoing losses.

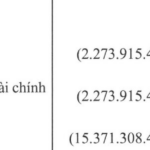

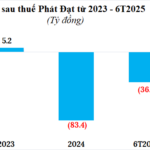

Phat Dat Corporation Reports Continued Losses in H1 2025, Debt Surpasses 11 Trillion VND

Real estate businesses continued to report losses in the first half of 2025, pushing accumulated deficits close to 115 billion VND. Meanwhile, their debt burden has ballooned, surpassing 11 trillion VND.