A significant surge followed HAG‘s announcement of its board resolution, approving the listing of subsidiaries and launching major agricultural investment projects.

HAG plans to list Hưng Thắng Lợi LLC in 2026 and Gia Súc Lơ Pang JSC in 2027. The subsidiaries are currently selecting advisors for valuation, issuance strategies, and exchange selection to finalize listing plans.

Alongside listings, HAG is expanding its agricultural footprint, focusing on coffee and durian cultivation. In 2025, the company will plant 2,000 hectares of Arabica coffee, followed by an additional 1,000 hectares, totaling 3,000 hectares by year-end. From 2026-2027, annual new plantings are expected to reach 3,500 hectares, bringing the total to 10,000 hectares by 2027, with 70% Arabica and 30% Robusta.

Durian cultivation currently spans 2,000 hectares, with plans to add 1,000 hectares in 2026-2027, reaching 3,000 hectares by the end of the period.

HAG is also investing in two large-scale coffee processing plants in Laos and Vietnam, along with a 20,000m² cold storage system and three durian processing plants in both countries. These projects aim to achieve a profit target of VND 5 trillion by 2028.

|

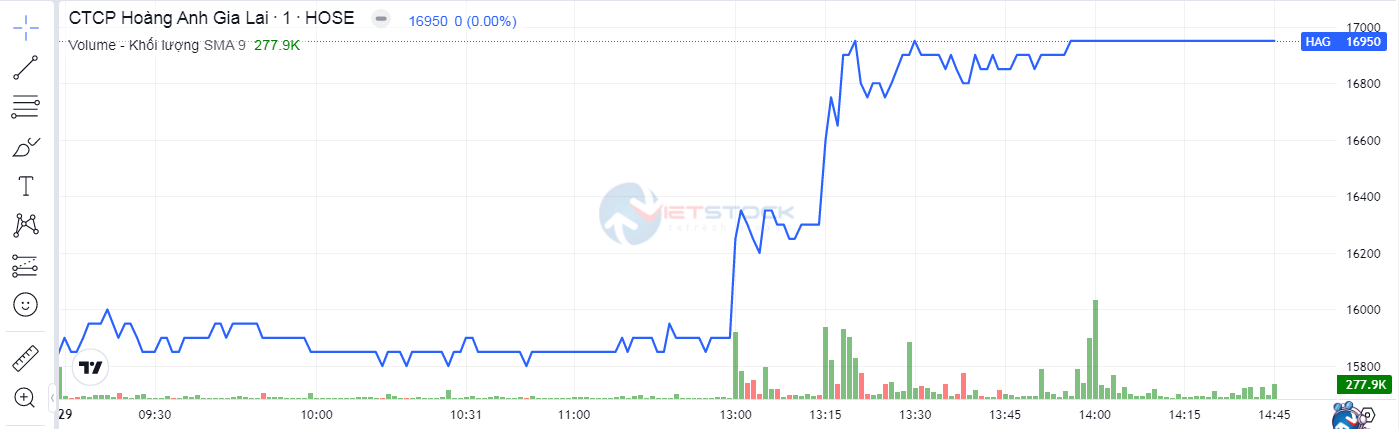

HAG Stock Performance on October 29

Source: VietstockFinance

|

On the stock market, HAG shares opened weakly on October 29, trading near the reference price. However, strong buying pressure in the afternoon session pushed the stock to its ceiling from 1:30 PM, maintaining its upper limit until the close. Over the past three sessions (October 27-29), HAG shares have risen approximately 10%.

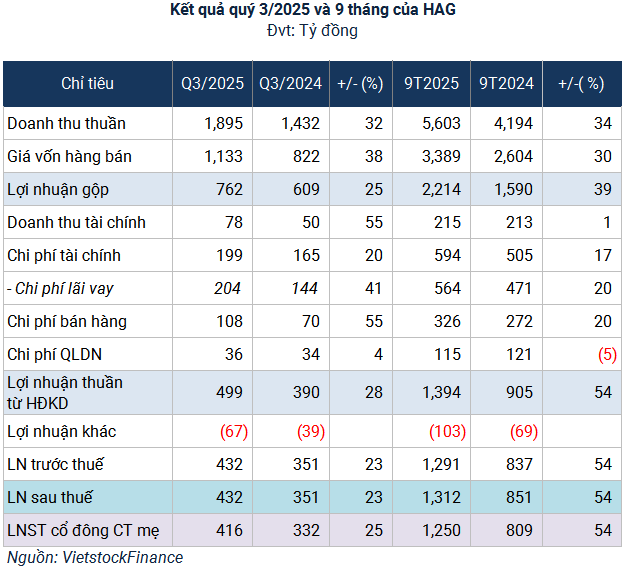

In Q3 2025, HAG reported net revenue of VND 1,895 billion, up 32% year-on-year, driven by a 57% increase in fruit sales to over VND 1,400 billion, offsetting declines in hog sales. Despite higher costs and financial expenses, net profit rose 25% to VND 416 billion.

For the first nine months, net revenue exceeded VND 5.6 trillion, with net profit nearing VND 1.2 trillion, up 34% and 54% respectively. The company has surpassed its annual profit target by 18% and turned cumulative losses of VND 423 billion into a profit of VND 825 billion by Q3 2025.

– 16:28 October 29, 2025

Intense Selling Pressure in Investment Fund Transactions

Last week (October 20–24, 2025), investment funds recorded no new transactions, instead solely disclosing the results of the previous week’s trades, which were overwhelmingly dominated by sell-side activity.

Market Pulse 23/10: Vingroup Once Again “Rescues” the Market

The afternoon session on October 23rd saw the VN-Index continue its volatile trend. At one point, it seemed poised to reclaim the 1,700-point mark, but mounting pressures forced the index to retreat, closing at 1,687 points. Despite the gains, the rally was largely driven by the influence of the Vingroup conglomerate.

How Do Investors Fare After a Memorable Stock Market Session?

Today (October 22nd), shares purchased at the market bottom during the VN-Index’s record 94-point plunge on October 20th have been credited to investor accounts and are now eligible for trading. However, hopes of quick profits through short-term trading have largely been unfulfilled for the majority.