The Hanoi Department of Agriculture and Rural Development is currently seeking public input on a draft proposal for the city’s first land price list, set to be implemented from January 1, 2026.

This new land price list divides Hanoi into 17 zones based on administrative rearrangements. It is expected to increase land prices by 2-26% compared to the current list.

However, many believe the proposed prices still don’t reflect the actual market value. Mr. Nguyen Van Chung, an employee at a Hanoi real estate company, points out that the proposed price for prime locations like Hang Ngang, Hang Dao, and Hang Khay streets is 702 million VND/m², while the actual market price is 3-4 billion VND/m². Similarly, the highest price in Zone 3, Nguyen Trai Street, is proposed at 241 million VND/m², but the real market price ranges from 600-700 million VND/m², with apartments in the area exceeding 100 million VND/m².

In outlying areas, the highest proposed increase is 26% for Zone 9, with other zones seeing 15-16% increases. However, these prices are still less than 40% of the market value. For example, the proposed price for National Highway 32, from Xuan Phuong Ward to the Kim Chung Di Trach urban area entrance, is 64.7 million VND/m², while the actual transaction price is 200-300 million VND/m².

Mr. Tran Van Son, an expert from the Economic-Infrastructure Division of O Dien Commune (Hanoi), agrees. He notes that Zone 9’s average price is 11-30 million VND/m², but this doesn’t match local market prices. In Tan Lap (O Dien Commune), ongoing large-scale projects have driven land prices up daily. In his neighborhood, land prices range from 120 million VND/m² for motorcycle-accessible alleys to over 200 million VND/m² for car-accessible alleys. Main road locations average 250-350 million VND/m².

The new land price list is considered not to reflect the market value accurately.

A Neutral Land Price is Needed

The Hanoi Department of Agriculture and Rural Development believes the proposed increases won’t significantly impact businesses or economic development. They argue it will ensure fair compensation for land clearance and expedite project progress.

However, the department acknowledges that higher land prices mean increased financial obligations related to land. This could burden low-income groups during transactions like land transfers, inheritances, or gifts.

Lawyer and land law expert Nguyen Van Dinh argues that higher prices can turn land into a development resource. The state budget would benefit, and citizens would receive fairer compensation for land acquisition. However, it also increases financial burdens for citizens paying land use fees, income tax on land transfers, and registration fees.

Specifically, higher land prices indirectly push up specific land prices (as specific prices are calculated using comparison, income, and surplus methods, which cannot be lower than the listed price, making the list a “floor price”). This means companies acquiring land for projects will pay more, and citizens will receive market-rate compensation for land acquisition, reducing land disputes.

Conversely, higher land prices increase land-related costs for citizens. This includes first-time land registration, land use purpose changes, annual land rent, land use tax, registration fees, and especially income tax on land transfers. If land prices double, these fees and taxes will also double, impacting a large portion of the population. The new land price list will have a widespread and comprehensive effect.

Expert Nguyen Van Dinh notes that citizens receiving compensation for land acquisition want high prices, but when registering land for the first time, changing land use, or paying land rent, they prefer lower prices to reduce financial burdens.

Therefore, setting a “neutral” land price that balances the interests of all parties is challenging. Lawyer Nguyen Van Dinh suggests that adjusting tax, fee, and charge regulations related to land use will help mitigate the negative effects of rising land prices, protect citizens (especially vulnerable groups), maintain social stability, and turn land into a development resource.

Projected Hanoi Land Prices to Peak at 702 Million VND/m² by 2026

The Hanoi Department of Agriculture and Rural Development has recently drafted a proposal for the establishment of a land price list, set to be announced and implemented starting January 1, 2026.

Proposed Implementation of Land Price Tables by Land Type

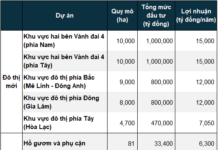

The government proposes implementing a standardized land price table, categorized by land type, area, and location, to calculate financial obligations and compensation when the state reclaim land, replacing the current method of determining specific land prices.