Trade Surpasses Expectations

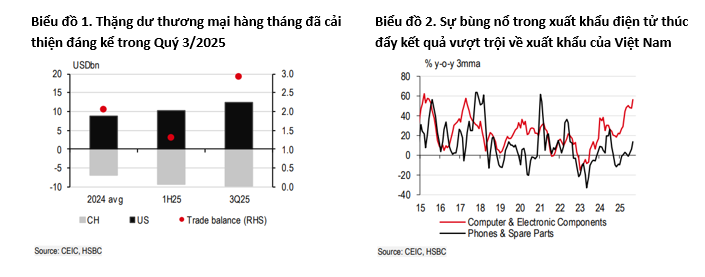

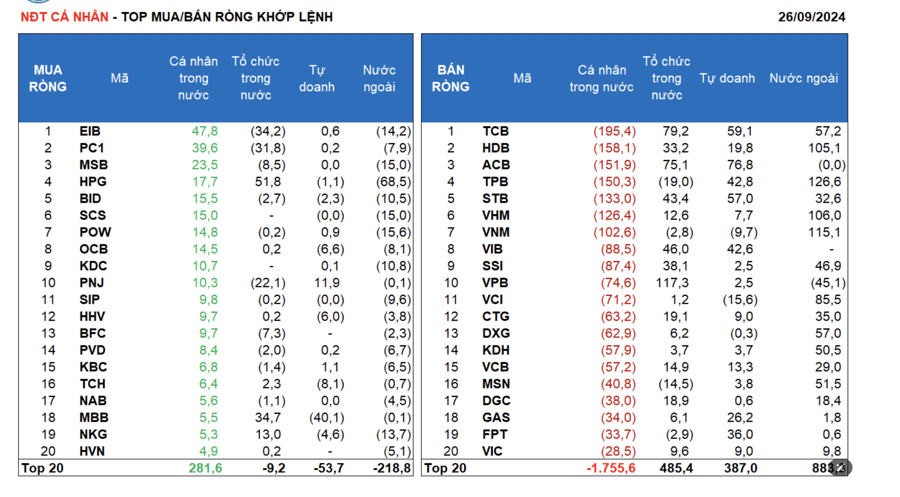

For the second consecutive quarter, Vietnam’s economic growth has exceeded 8% year-on-year, effortlessly surpassing market expectations. While exports from other ASEAN countries to the US witnessed a slight decline as frontloading activities subsided, Vietnam’s trade performance remained robust with double-digit growth. Encouragingly, the third-quarter trade surplus doubled that of the first half, driven by increased surpluses with non-US trading partners. This success is partly attributed to the surging demand for AI-related technology, benefiting tech-centric economies.

Domestic Sector Resilience

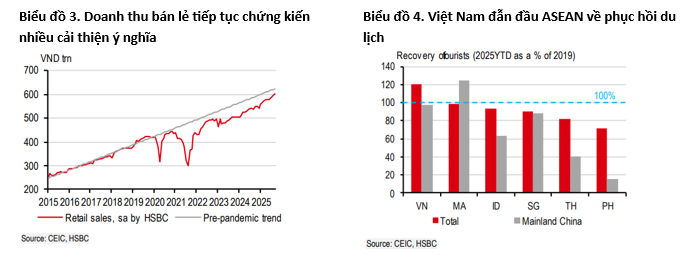

Beyond trade, the domestic sector’s resilience is equally vital. Despite challenges in goods trade, the services sector contributed significantly to growth. Retail sales showed notable improvements, and tourism continued to thrive, with Vietnam leading ASEAN in tourism recovery. Additionally, government-driven infrastructure megaprojects boosted construction activities. Further growth potential exists if public investment disbursement accelerates, currently at 50% of the annual plan as of Q3.

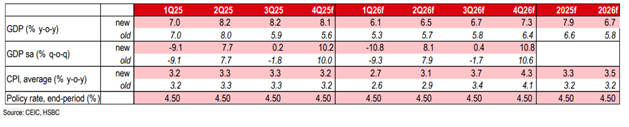

Updated GDP Growth Forecast

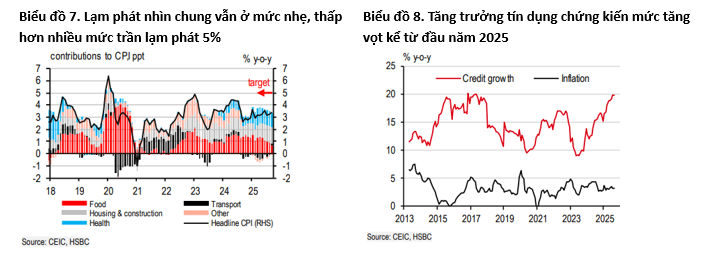

Following the unexpected Q3 growth, HSBC revised its GDP growth forecast to 7.9% for 2025 (from 6.6%) and 6.7% for 2026 (from 5.8%). However, trade volatility remains the most significant risk to growth. HSBC also slightly raised its inflation forecast to 3.3% for 2025 (from 3.2%) and 3.5% for 2026 (from 3.2%).

|

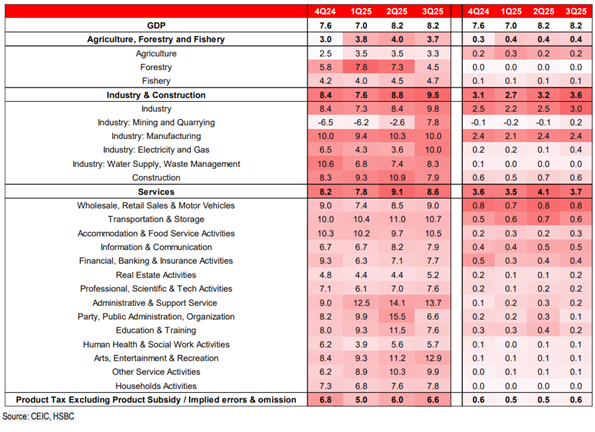

Vietnam’s GDP Structure

|

Unwavering Momentum

Following ASEAN’s surprising Q2 growth, the momentum continued in Q3, particularly in trade-dependent economies like Singapore and Malaysia. Vietnam’s 8.2% year-on-year growth in Q3, surpassing market expectations of 7.2%, solidified its position as Southeast Asia’s fastest-growing economy.

The resilience of externally traded sectors, notably manufacturing and trade, was remarkable. Despite a volatile trade environment, Q3 industrial production rose 10% year-on-year. Trade flourished, with exports and imports growing nearly 20% year-on-year. Vietnam’s trade surplus doubled to $3 billion in Q3 compared to the first half of 2025, reflecting increased surpluses with non-US partners, though the US remains the largest export market, accounting for one-third of total exports.

Electronics, both consumer and components, drove trade growth, significantly boosting exports to the US, which nearly reached 30% year-on-year growth in Q3. Despite frontloading peaking across ASEAN, Vietnam’s continued export growth to the US highlights a trend observed across Asia: tech-related economies are benefiting from rising AI technology demand, providing robust trade support.

The services sector also thrived, with retail sales linked to final consumption showing significant improvement. Q3 retail sales grew 12% year-on-year, narrowing the gap to pre-pandemic levels to just 3%, compared to 10% at the start of 2025.

Tourism-related sectors, including transportation and accommodation, experienced a boom. Vietnam has become a new favorite destination for Chinese tourists, despite the absence of visa-free policies. Leading ASEAN in tourism recovery, Vietnam welcomed 15 million tourists by Q3, reaching 120% of 2019 levels. While less tourism-dependent than Thailand, Vietnam’s growing tourism competitiveness offers some protection against goods trade challenges.

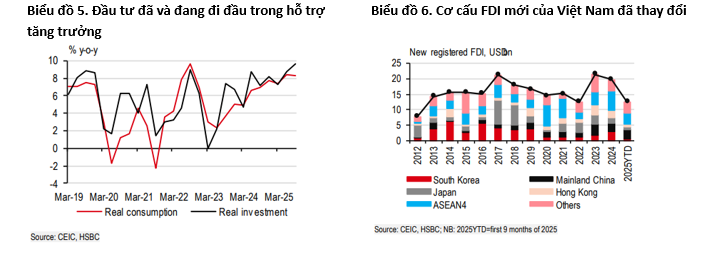

On the demand side, Q3 consumption grew over 8% year-on-year, and investment nearly 10%. Accelerated progress on infrastructure megaprojects highlights further growth potential, with public investment disbursement at 50% of the annual plan as of Q3.

FDI remains a key growth driver. Since the “liberation day” in April, concerns arose about FDI stability. While Q3 total FDI rose 15% year-on-year, new FDI registrations fell 9%. Notably, Vietnam’s FDI composition shifted in 2024, with Singapore and mainland China each accounting for a quarter of new FDI, replacing South Korea. Despite trade tensions, the world’s two largest economies continue investing in Vietnam. As ASEAN’s emerging markets face similar tariffs, countries benefiting from trade tensions, like Malaysia and Vietnam, will maintain their advantage.

Inflation remains manageable, with September’s 3.4% year-on-year increase aligning with market expectations. Core inflation stabilized at 3.2%, well below the central bank’s 4.5-5% ceiling. With inflation under control, the central bank aims for higher credit growth to support economic expansion, reaching 20% year-on-year in August, exceeding the initial 16% target.

|

HSBC’s Updated Macroeconomic Forecasts for Vietnam

|

– 11:31 28/10/2025

Vietnam-Singapore Trade Flourishes, Total Turnover Reaches Nearly $2.47 Billion

Singapore’s Enterprise Management Agency statistics reveal that, considering only goods originating from Singapore and Vietnam, Vietnam recorded a trade surplus of nearly SGD 3.1 billion in the first nine months.

Surplus Balance of Payments, Yet Exchange Rates Remain in Turbulent Waters

The balance of payments has shown cyclical improvements, yet pressures on the exchange rate persist due to heightened demand for the US dollar—particularly for debt servicing and capital outflows. The currency outlook for late 2025 will hinge significantly on trade surpluses, remittance inflows, and the global trade environment.