The anticipated transaction is expected to be executed via an order-matching mechanism on the exchange, aimed at managing personal finances.

During the morning session on October 29th, HNA shares traded around 23,400 VND per share. It is estimated that if the entire volume of shares is successfully sold, Mr. Giap could generate approximately 6 billion VND and would no longer be a shareholder of the company.

| HNA Stock Performance from Early 2024 to October 29, 2025 |

In the stock market, HNA reached its highest price in a year at 25,500 VND per share on August 26th, a 23% increase compared to the low of 20,800 VND per share in April, during a period when the market was impacted by tariff shocks. Currently, the stock price has declined by approximately 8% from its peak.

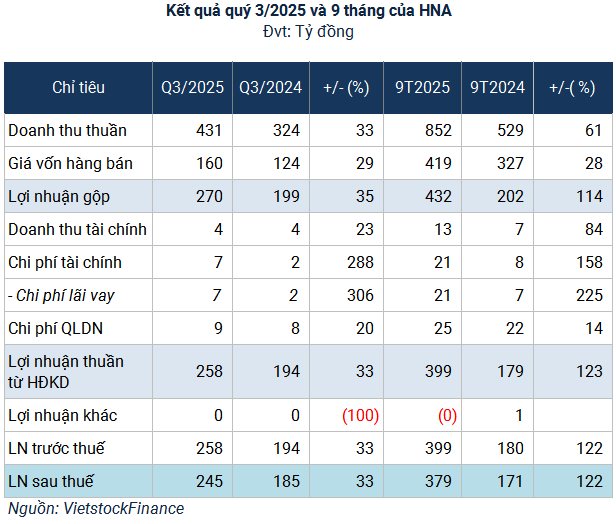

The capital reduction move by a relative of the Chairman of the Board of Supervisors comes after HNA announced positive Q3 2025 business results.

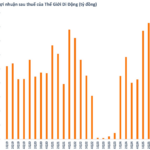

Specifically, electricity output in Q3 2025 reached 403.77 million kWh, an increase of 138.17 million kWh compared to the same period last year (265.6 million kWh), driving a 33% rise in net revenue to 431 billion VND. This led to a significant surge in net profit to 245 billion VND, the second-highest quarterly profit in the company’s history, just behind the peak of 267 billion VND in Q3 2022.

| HNA’s Net Profit Over Quarters |

In the first nine months of the year, HNA recorded net revenue of 852 billion VND and net profit of 379 billion VND, 2.1 times and 2.2 times higher than the same period last year, respectively.

According to the 2025 plan, HNA set a target of total revenue exceeding 744 billion VND (an 11% increase compared to the 2024 plan) and net profit of approximately 185 billion VND (a slight 3% increase). Thus, after just nine months, the company has far exceeded its profit plan, achieving more than double the annual target.

– 13:00 29/10/2025

Unveiling the Astonishing Cash Reserves of Businesses

Some businesses are sitting on massive cash reserves, either parked in bank deposits or invested in bonds. Notably, FPT’s bank deposits have reached nearly 37 trillion VND, equivalent to approximately $1.4 billion.

iDepo VIB: Safeguarding Your Cash Flow During Market Volatility

As the financial markets enter a phase of adjustment, investors are increasingly turning to safer channels. Amid this shift, iDepo by International Bank (VIB) stands out as a balanced solution, offering both security and profitability with an attractive interest rate of up to 6.3% per annum. Additionally, its flexible transfer capabilities on the MyVIB platform make it a standout choice for savvy investors.

PVI Surpasses Annual Profit Plan, Short-Term Debt Soars to Over 1.6 Trillion VND

PVI Holdings (HNX: PVI) reported a significant acceleration in business performance during Q3 2025, propelling its nine-month profit well beyond the annual target.