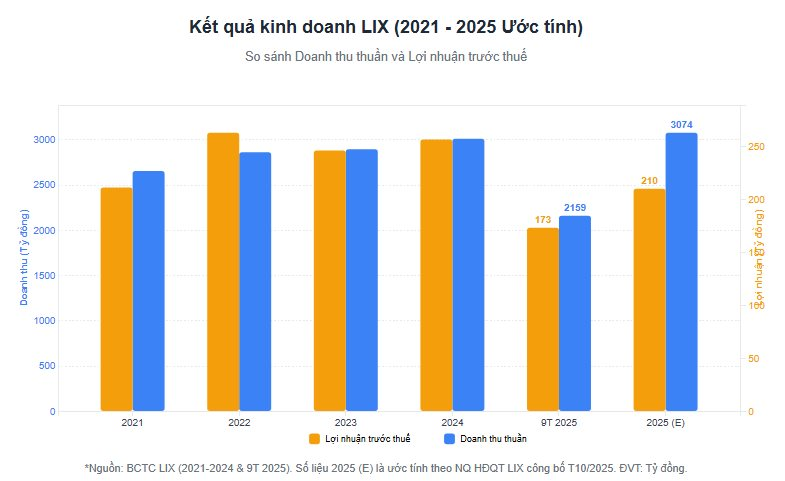

In Q3 2025, LIX reported net revenue of VND 780.6 billion, marking an 8.8% increase compared to the same period in 2024. However, rising costs have eroded profitability. The cost of goods sold surged by 10% to VND 613.4 billion, while selling expenses spiked by 26% year-over-year, reaching nearly VND 74 billion.

As a result, LIX’s after-tax profit for Q3 2025 stood at VND 45.5 billion, reflecting an 8.3% decline from the VND 49.6 billion recorded in Q3 2024.

For the first nine months of 2025, LIX’s net revenue reached VND 2,158.7 billion, a slight 0.7% decrease compared to the same period in 2024. Despite this, gross profit increased by 1.25% to VND 485.2 billion, driven by a faster decline in the cost of goods sold relative to revenue.

Nevertheless, a 6.4% rise in selling expenses and an 11.3% increase in administrative expenses have kept the nine-month after-tax profit nearly flat at VND 140.5 billion, a marginal improvement from the VND 139.5 billion recorded in the same period last year.

With these nine-month results, LIX has achieved 71.5% of its full-year pre-tax profit target of VND 242 billion.

Following the release of the nine-month results, the LIX Board of Directors set a Q4 2025 target of VND 915 billion in revenue, a 30% increase from Q4 2024. However, pre-tax profit is projected to drop sharply by 54% to VND 37 billion compared to the same quarter last year.

Based on the Q4 plan, LIX estimates full-year 2025 revenue at VND 3,074 billion, exceeding the annual target by 1%. However, full-year pre-tax profit is expected to reach only VND 210 billion, equivalent to 87% of the target approved by the Annual General Meeting.

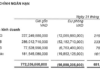

Financially, as of September 30, 2025, LIX’s total assets stood at nearly VND 1,482.4 billion, a 6% increase from the beginning of the year. Cash and cash equivalents rose by 14% to VND 427.2 billion, while inventory increased by 19% to VND 274.8 billion.

Total liabilities grew by 9% to VND 503.1 billion. Notably, LIX’s debt structure remains secure, with short-term loans holding steady at VND 55 billion. The company’s current cash reserves are 7.7 times higher than its total debt.

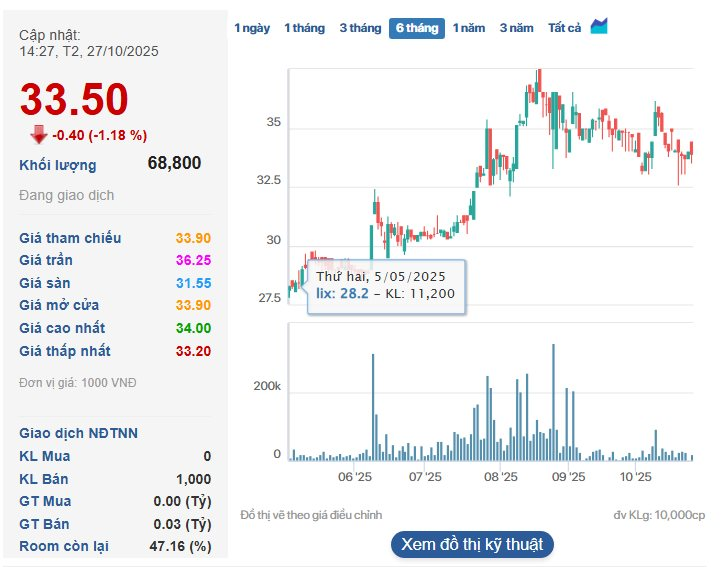

On the stock market, LIX shares experienced a significant rally from July 2025, peaking at VND 36,500 per share in mid-August. Since then, the stock price has corrected downward. As of October 27, 2025, LIX shares were trading between VND 33,000 and VND 34,000 per share, a 9% decline from the August peak.

Masan Group Q3 Net Profit Surges to Nearly VND 1.9 Trillion, 1.4x YoY Growth, Driven by Wincommerce and Masan MeatLife

In Q3, revenue surged to VND 21,164 billion, marking a 9.7% year-on-year increase. Post-tax profit reached VND 1,866 billion, a remarkable 1.4-fold growth compared to the same period last year.

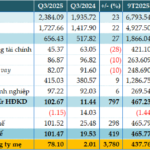

MML Sustains Strong Profitability in Q3, Fueled by Masan Ecosystem Momentum

Masan MeatLife (UPCoM: MML) has reported impressive results in its Q3/2025 consolidated financial statements, with net revenue reaching VND 2,384 billion and post-tax profit exceeding VND 101 billion. This represents a 23% increase in revenue and a remarkable 5.2-fold growth in profit compared to the same period last year.