Equity Fund Performance Under Pressure

As of October 22, the VN-Index stood at 1,678.5, marking a remarkable 32.5% year-to-date surge, positioning Vietnam among the world’s top-performing markets. However, recent trends indicate challenges in sustaining this momentum. This is reflected in the weakened performance of equity funds.

Across various timeframes since the year’s start, the last six months (from late April) have shown the highest NAV/ccq returns for equity funds, excluding the early April tariff-induced slump. Notably, the Dynamic Securities Investment Fund DC (DCDS), Bao Viet Dynamic Equity Fund (BVFED), and Mirae Asset Vietnam Growth Equity Fund (MAGEF) all saw gains exceeding 40%.

In the last three months, returns have significantly narrowed due to a sideways market trend since mid-August.

Most strikingly, over the past month, despite a near-1,800-point rally driven by “mega-cap” stocks, a sudden broad decline occurred, culminating in a historic 95-point drop on October 20, severely impacting equity fund performance.

Only four funds—United ESG Vietnam Equity Fund (UVEEF), DCDS, MAGEF, and BVFED—posted positive returns, all below 1%. The rest of the equity fund sector was in the red.

Balanced funds, with diversified allocations across stocks, bonds, and deposits, recorded no positive growth.

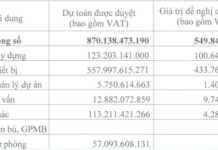

|

Performance Ranking by Fund Type as of October 22, 2025

Source: VietstockFinance

|

These results highlight the challenges in equity trading during this period, particularly with the financial sector showing signs of weakness after a stellar run.

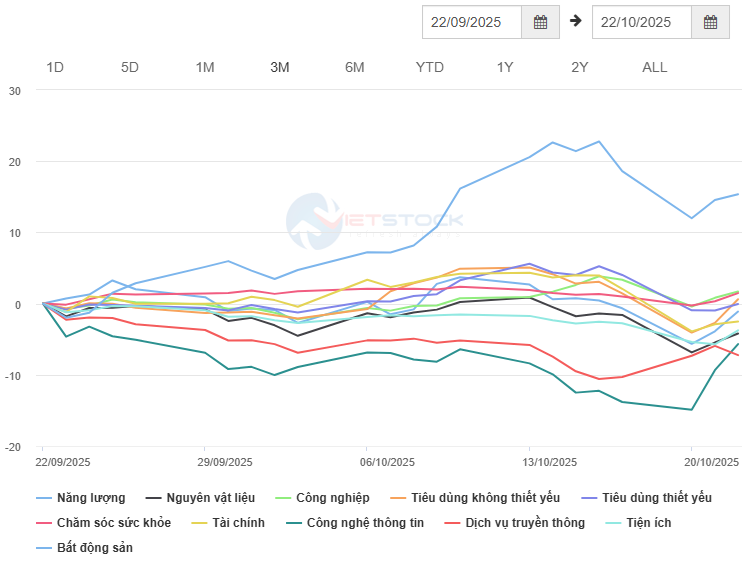

VietstockFinance data for the past month reveals significant sectoral disparities. Positive performers included non-essential consumer goods (+0.62%), healthcare (+1.48%), industrials (+1.7%), and notably, real estate (+15.37%), driven by Vingroup’s surge.

Conversely, several sectors saw declines: essential consumer goods (-0.06%), energy (-1.12%), financials (-2.52%), utilities (-3.75%), materials (-4.2%), IT (-5.68%), and telecom services (-7.24%). The financial sector, heavily weighted in many funds, was particularly affected.

|

Financial Sector Weakens While Real Estate Thrives

Source: VietstockFinance

|

BVFED, a top performer year-to-date with a 37% return, saw minimal gains in the last month. Its portfolio, nearly 50% allocated to banks and 5% to securities, with only 10% in real estate, explains this outcome.

Similarly, DCDS, up 32% year-to-date, saw slight gains recently. Its portfolio includes 28% in banks, 9% in securities, and over 24% in real estate.

Recently, Vietcombank Securities Investment Fund Management (VCBF) reported Q3 2025 results, showing slower growth than benchmark indices.

According to Pham Le Duy Nhan, VCBF’s Portfolio Manager, funds like VCBF-BCF, VCBF-MGF, VCBF-TBF, and VCBF-AIF underperformed due to low or no holdings in VIC, VHM, VIX, SHB, LPB, and GEX, which performed well. Instead, holdings in PNJ, BWE, ACV, FPT, CTR, TLG, and LHG lagged the market.

“The market’s strong performance in the first nine months was driven by select stocks, making VCBF’s underperformance understandable,” Nhan noted.

Unlike equity and balanced funds, bond funds maintained stable returns. In the past month, the Ban Viet Bond Fund (VCAMFI) led with a 1.4% gain, followed by the PVCOM Bond Fund (PVBF) at approximately 1%.

After a restructuring phase post-2022 shocks, the corporate bond market has shown positive growth in scale and quality. Bonds offer attractive yields compared to deposits and less volatility than equities.

Is the Equity Market Still Attractive?

While the stock market remains promising, a correction after a strong rally is necessary. The VN-Index’s sideways trend since mid-August has impacted fund and individual investor returns, raising questions about future market potential.

This correction was anticipated due to the market’s P/E ratio no longer being historically low. Recent foreign net selling has added pressure.

At KAFI’s “360 Investment – Optimizing Assets, Seizing Opportunities” event on October 18, Trinh Duy Viet, KAFI’s Strategy Director, noted that while a P/E of 15-16 is average for 2012-2025, investor confidence in stable growth and upgrade prospects could justify higher valuations, potentially 1-2 standard deviations above average, opening doors for new highs.

Additionally, 2025-2026 corporate earnings are projected to grow 20-25%, sustaining high growth and supporting valuations.

Regarding foreign outflows, KAFI experts view this as a rational response to global volatility. Capital is expected to return once global conditions improve.

Asset allocation trends may shift as Vietnam moves from Frontier to Secondary Emerging Market status, attracting more investment.

Risks like exchange rates and inflation have subsided, while domestic factors like investment and consumption remain key drivers of corporate profit growth, a focus for investors.

Recent market volatility, including a historic 95-point drop on October 20, has been linked to bond market scrutiny.

– 10:27 28/10/2025

Vietstock Daily 29/10/2025: Surging Powerfully from Previous Lows

The VN-Index staged an impressive rebound after successfully testing its August 2025 lows. Short-term prospects have improved as the index broke above its 50-day SMA, while the Stochastic Oscillator also signaled a buy. If trading volume surpasses its 20-day average in upcoming sessions, the upward momentum will be confirmed.