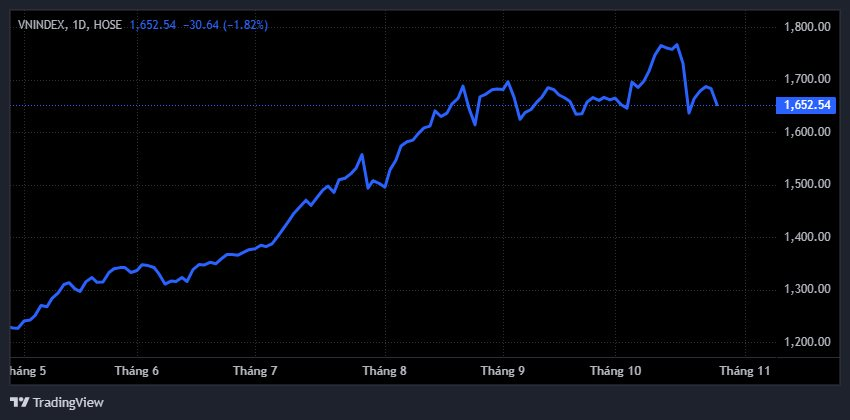

The VN-Index concluded a forgettable trading session, plummeting over 30 points by the close to settle at 1,652. Despite the sharp decline, trading volume remained subdued, indicating investor caution following recent heavy losses. From its recent peak, the VN-Index has shed approximately 130 points.

Prioritize Defensive Strategies in the Short Term

Mr. Nguyễn Tuấn Anh, Chairman of Finpeace, noted that the recent market downturn was unexpected given the overall positive global backdrop, with major international indices maintaining their upward momentum. He attributed domestic investor anxiety primarily to an “information vacuum,” where the market declines without a clear, identifiable cause.

According to Mr. Tuấn Anh, the VN-Index’s recent rally was largely driven by blue-chip stocks, while the majority of other equities failed to keep pace. As these blue chips entered a correction phase, the broader market faced significant downward pressure.

“From a macroeconomic perspective, exchange rates and interest rates show some unfavorable signals, but not to the extent that would justify such a steep market decline. In an economy targeting growth, it’s normal for certain macro indicators to lag,” he explained, emphasizing that current macro factors alone cannot account for the recent sell-off.

The expert suggested that the market’s late-session plunge reflected heightened caution and concern among investors. While the VN-Index remains above the critical 1,600 support level and has not confirmed a clear downtrend, many stocks have breached their short-term support levels, triggering stop-loss orders and widespread selling pressure.

In the near term, Mr. Tuấn Anh advises investors to adopt a defensive stance, avoiding overconfidence based on index movements, as the divergence between stock groups becomes increasingly pronounced.

Long-Term Outlook Remains Positive

Despite potential short-term volatility, Vietnam’s equity market retains substantial long-term growth potential. In a recent investor letter, Dragon Capital highlighted that the market is entering a phase of sustainable growth, albeit with intermittent short-term corrections.

Dragon Capital’s data reveals that from 2020 to early Q4 2025, the VN-Index experienced over 20 instances of 4%+ declines, yet consistently resumed its upward trajectory—including three 5%+ drops this year alone, followed by a 32% year-to-date gain. This underscores that short-term shocks do not alter the market’s long-term bullish trend.

Even after surpassing 1,700 points, valuations remain attractive, with projected P/E ratios of 12.5–13x for 2025 and 11x for 2026—significantly lower than regional peers. Coupled with robust corporate earnings growth forecasts and a double-digit economic growth target, Dragon Capital believes Vietnam’s market has the potential to “double up” like other frontier economies.

The fund recommends investors maintain a long-term strategy, leveraging corrections to accumulate quality stocks while minimizing short-term trading to optimize returns and costs.

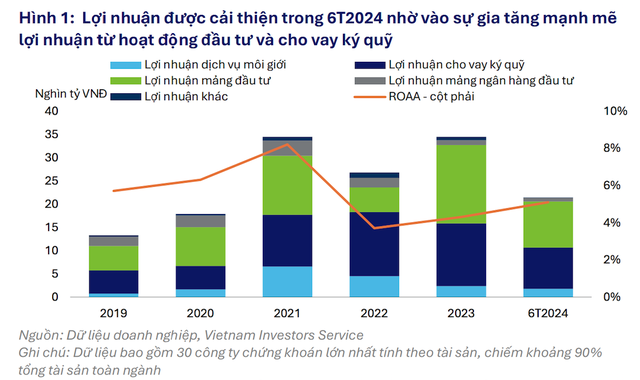

Market Boom Halts, Squeezing Equity Fund Performance

In recent months, amidst the sideways trend of the stock market and the decline in traditionally favored sectors like banking and securities, the profitability of equity investment funds has significantly diminished compared to previous periods.

Vietstock Daily 29/10/2025: Surging Powerfully from Previous Lows

The VN-Index staged an impressive rebound after successfully testing its August 2025 lows. Short-term prospects have improved as the index broke above its 50-day SMA, while the Stochastic Oscillator also signaled a buy. If trading volume surpasses its 20-day average in upcoming sessions, the upward momentum will be confirmed.

Mastering Stock Market Adjustments: A Comprehensive Guide to Navigating 100% Equity Shifts

Although the VN-Index has yet to breach the correction threshold, a notable divergence has emerged across the entire securities sector. This phenomenon highlights a disconnect between the broader index and the sentiment within this industry, traditionally regarded as a barometer of market dynamics.