| May 10’s Quarterly Business Results for 2022-2025 |

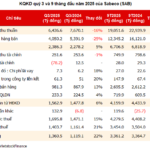

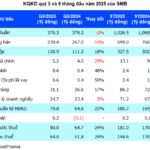

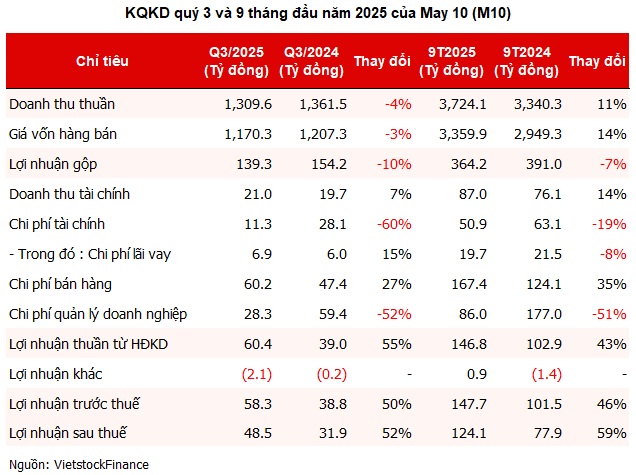

May 10 reported a robust Q3 2025 performance, with net profits reaching VND 48.5 billion, a 52% increase year-over-year. This profit level nearly matches the peak of Q4 2022, despite a 4% dip in revenue to under VND 1,310 billion and a slight gross margin contraction from 11.3% to 10.6%.

The positive outcome stems from significant cost-cutting measures. Specifically, financial expenses dropped by 60%, management costs by 52%, offsetting a 27% rise in selling expenses. Additionally, a 7% uptick in financial income to VND 21 billion further bolstered profitability.

|

Record-High 9-Month Profits, Surpassing Previous Two Years

For the first nine months of the year, May 10 achieved revenues exceeding VND 3,724 billion, an 11% year-over-year increase, fulfilling 76% of the annual plan. Net profits surpassed VND 124 billion, a 59% surge, equivalent to 87% of the yearly target. This marks the highest 9-month profit since the company’s inception, outperforming both 2024 and 2023 results and matching the 2022 record.

| May 10’s Business Results from 2016 to 9M2025 |

Beyond substantial cost reductions, financial income played a pivotal role in the overall results. Over the nine months, May 10 recorded total financial income of VND 87 billion, a 14% year-over-year increase. Of this, 83% derived from exchange rate gains, and 17% from deposit interest.

As of September, the company held over VND 143 billion in bank deposits, a 38% decrease from the beginning of the year. Inventory levels fell by 16% to over VND 670 billion, primarily comprising raw materials and finished goods, each accounting for more than 35% of the total value.

In the investment segment, the “long-term work-in-progress assets” category saw a sharp decline, with construction costs at the Thai Ha Garment Factory (Thai Binh) project dropping from over VND 72 billion at the start of the year to VND 2.2 billion by the end of September 2025.

On the liabilities side, May 10’s total debt reached nearly VND 747 billion, a 7% increase year-to-date, while short-term payables to suppliers decreased by 27% to nearly VND 590 billion.

On the UPCoM market, May 10’s stock responded positively to the earnings report, rising nearly 3% to VND 21,200 per share on the morning of October 29. Compared to a year ago, the stock price has remained relatively stable, with a slight 2% decline, but has rebounded over 26% from its early April 2025 lows. Trading volume remains low, averaging around 11,500 shares per session.

| May 10’s Stock Price Performance Over the Past Year |

– 13:35 29/10/2025

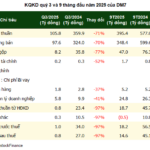

Sabeco Q3 Profit Surges 22%, Gross Margin Hits Decade-High

{“is_finished”:false,”event_type”:”stream-start”,”generation_id”:”c1e6c0ea-afbb-4ef7-a109-fa67b2fcaf61″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Despite”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” revenue”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” decline”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” in”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Q”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”/”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”0″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”5″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Saigon”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Beer”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Alcohol”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”-“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Bever”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”age”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” Corporation”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” (“}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”Sab”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”eco”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” H”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”OSE”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”:”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” SAB”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”)”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reported”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” its”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” highest”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” net”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” profit”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” in”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” quarters”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reaching”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” nearly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”6″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”1″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” trillion”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” This”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” achievement”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” was”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” driven”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” by”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” significantly”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” reduced”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” production”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” costs”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” a”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” gross”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” margin”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” exceeding”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 3″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”7″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”%,”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” and”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” consistent”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” interest”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” income”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” from”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” deposits”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” averaging”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” over”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” V”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”ND”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” 2″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”7″}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” billion”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:” daily”}

{“is_finished”:false,”event_type”:”text-generation”,”text”:”.”}

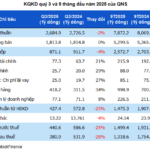

Fami Soy Milk Manufacturer Burns Hundreds of Billions on Promotions, Q3 Profits Drop 28%

In Q3/2025, Quang Ngai Sugar JSC (UPCoM: QNS), the parent company of Fami soy milk, reported a significant decline in profits, reaching a 10-quarter low. This downturn was primarily driven by a sharp increase in sales and promotional expenses. Despite this, the company maintains a substantial cash reserve of nearly VND 7,700 billion, accounting for over 55% of its total assets.

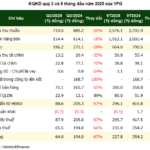

Sài Gòn Beer Central Region Sets Profit Margin Peak, 9-Month Earnings Surpass 18% of Annual Plan

Revised Introduction:

Saigon Beer Corporation – Central Region (HOSE: SMB) reported a record-breaking gross profit margin of 35.35% in Q3, the highest in its history, driving a 24% year-on-year surge in net profit. Over the first nine months, the company has already surpassed its full-year profit target by 18%.