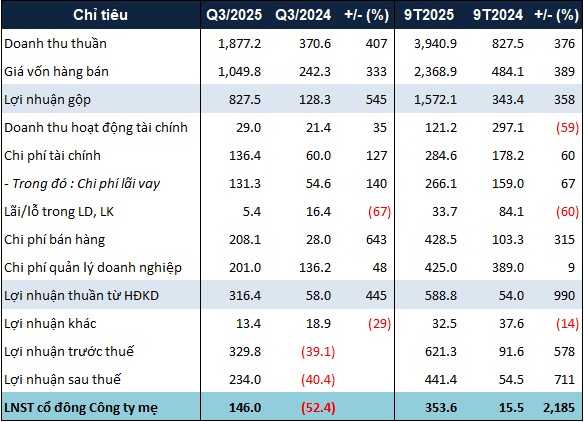

NLG’s net revenue skyrocketed in Q3, reaching over VND 1.877 trillion, a fivefold increase compared to the same period last year. Financial revenue also surged by more than 35%, hitting VND 29 billion. After deducting expenses, NLG reported a net profit of nearly VND 146 billion.

With these impressive results, NLG’s revenue and net profit for the first nine months of 2025 were nearly five times and 23 times higher, respectively, than the same period in 2024, totaling approximately VND 3.941 trillion and VND 354 billion. The revenue was primarily driven by the handover of projects such as Akari (VND 967 billion), Can Tho II Central Lake (VND 1,529 billion), and Southgate (VND 983 billion). The high gross profit margin of 40% was maintained due to the delivery of low-rise products.

|

NLG’s Q3 and 9-month business results in 2025. Unit: Billion VND

Source: VietstockFinance

|

In terms of sales, NLG’s 9-month sales figure exceeded VND 5 trillion, equivalent to the entire year of 2024, with the majority coming from the Southgate (VND 3.1 trillion) and Can Tho (VND 1 trillion) projects.

NLG’s Q4 2025 results are expected to remain positive, as the company announced the signing of a 15% transfer of the Izumi City project in July, with potential profits to be recognized in the final quarter.

As of September 30, 2025, NLG’s total assets stood at nearly VND 28.4 trillion. The largest portion was inventory, amounting to almost VND 17.9 trillion, while short-term cash holdings were maintained at approximately VND 3.9 trillion.

– 1:28 PM, October 29, 2025

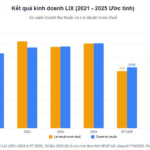

LIX Detergent Powder: Q3 Revenue Rises 9%, Yet Net Profit Declines, Prompting Full-Year Profit Target Revision

Lix Detergent JSC (HOSE: LIX) has released its Q3/2025 financial report, revealing a rise in revenue but a decline in net profit due to escalating cost pressures. Notably, the Board of Directors has revised downward the full-year profit target.