During the first nine months of 2025, Novaland recorded a consolidated net revenue of VND 5,398 billion from sales and service provision. Of this, net sales revenue reached nearly VND 4,956 billion, a 33% increase compared to the same period last year, attributed to handovers at projects such as NovaWorld Phan Thiet, NovaWorld Ho Tram, Aqua City, Sunrise Riverside, and Palm City. Net service revenue stood at VND 442 billion.

Consolidated after-tax profit recorded a loss of VND 1,820 billion, primarily due to reduced financial activity revenue. However, this figure significantly improved compared to the VND 4,376 billion loss in the same period of 2024.

As of September 30, 2025, the Group’s total assets reached nearly VND 239,575 billion. Inventory was recorded at VND 152,285 billion, with land value and projects under construction accounting for 95.1%, while the remainder included completed real estate and properties awaiting handover to customers.

By September 30, 2025, Novaland’s total outstanding debt exceeded VND 64,000 billion, with short-term loans totaling approximately VND 32,000 billion. Cash flow remains challenging, and Novaland is actively seeking solutions, including continued negotiations for restructuring, to safeguard investor interests.

In Q3 2025, Novaland demonstrated positive momentum in key project construction progress, following the completion of critical legal steps in late Q2. Notably, NovaWorld Phan Thiet accelerated the completion of the Floria 3.6 subdivision; Aqua City saw simultaneous construction across the project, particularly in Ever Green 2, River Park 2, Sun Harbor 2, and Phoenix Island Urban Area, alongside the finalization of Nova Mall and Kid Zone amenities for upcoming operations. At NovaWorld Ho Tram, the Habana Island phase progressed vigorously, alongside the completion of Garden Club, Activities Zone Park, and Kid Zone Park. In Ho Chi Minh City, Victoria Village and The Grand Manhattan projects also saw accelerated progress, with Victoria Village on track for completion this year.

Transportation infrastructure is significantly boosting Novaland’s projects, particularly Aqua City.

Alongside construction efforts, product handovers at various projects have been a standout success, with 720 units handed over in the first nine months. At NovaWorld Phan Thiet, the Golf Villas and Florida 3.7 subdivisions in Q3 saw accelerated handovers and are now operating smoothly. To date, over 1,500 properties at NovaWorld Phan Thiet have been handed over, including 750 fully furnished units now available for rental. At Aqua City, more than 1,000 units have been delivered to customers.

Regarding land title issuance in 2025, as of September 30, 1,935 land titles have been granted across projects. Notably, The Sun Avenue project has completed procedures for nearly 550 units, with Novaland collaborating with residents to finalize necessary documentation for swift title issuance and handover. Progress is also accelerating for titles at Lucky Palace (commercial lots), Orchard Garden (Office-tel), Sunrise City North (Office-tel), and GardenGate.

Additionally, new investment plans, promotions, and expedited construction of critical transportation infrastructure—such as Long Thanh International Airport, Long Hung Bridge (Dong Nai 2 Bridge) with an investment of over VND 11,000 billion connecting Ho Chi Minh City and Dong Nai, Bien Hoa – Vung Tau Expressway, Gia Nghia – Bao Loc – Phan Thiet Expressway, and Phan Thiet Airport—will be key drivers for Novaland’s mega-urban projects.

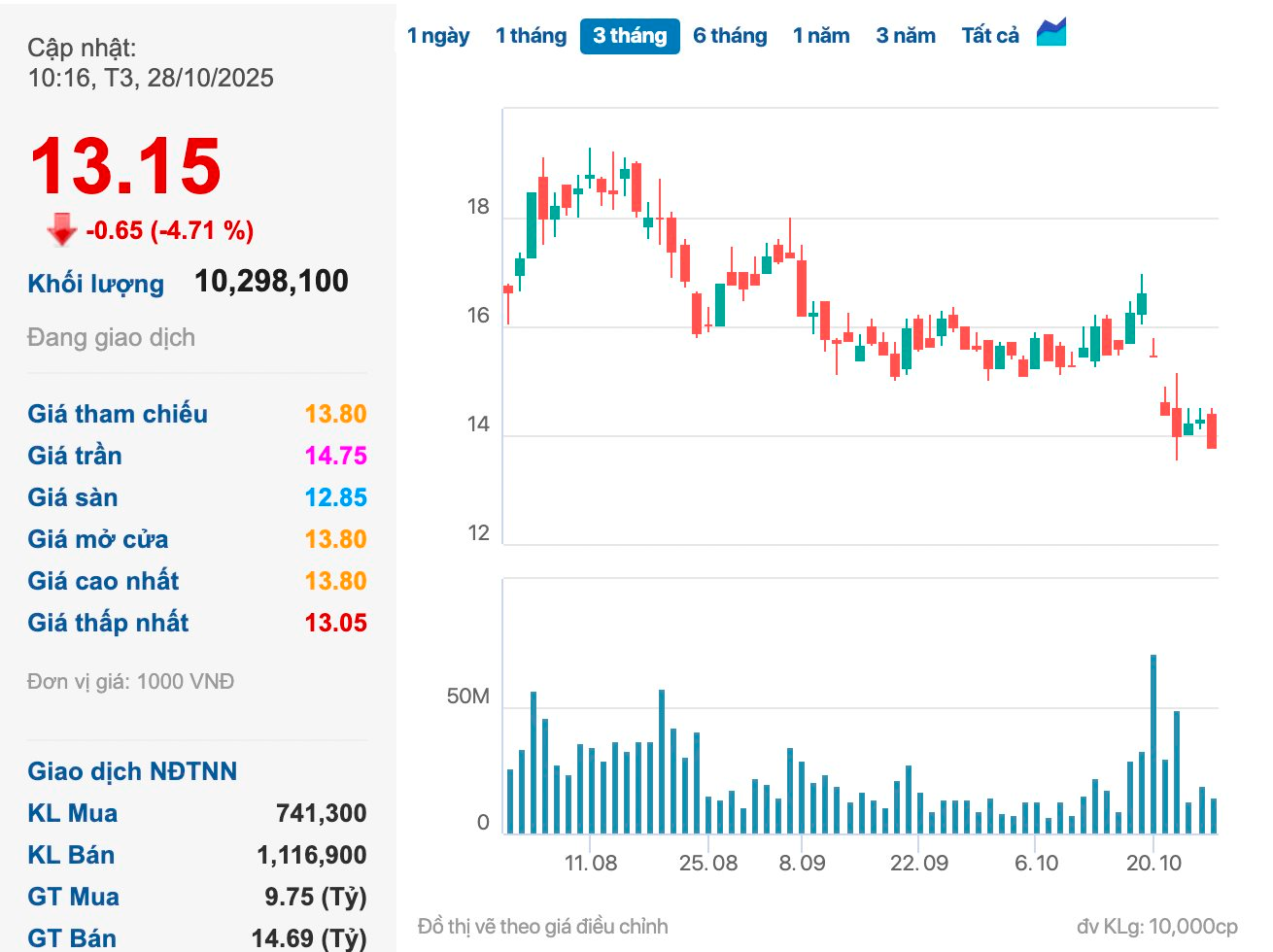

NVL stock prices continue to fluctuate sharply in line with market adjustments.

On the stock market, as of 10:15 AM on October 28, NVL shares traded at VND 13,150, down 4.71% from the previous session.

This marks the lowest price point for the real estate stock in over three months. Novaland’s market capitalization dropped to VND 26,926 billion.

PDR’s Q3 Net Profit Surges 68%, Cash Flow Turns Positive

The Q3/2025 consolidated financial report of Phat Dat Real Estate Development Corporation (HOSE: PDR) paints a positive financial picture, highlighting robust revenue growth, improved profitability, and a return to positive operating cash flow.

Unlocking Broader Capital Access for F88 Through Enhanced Credit Rating Upgrade

F88 unveiled its Q3/2025 results, showcasing remarkable performance metrics and earning a credit rating upgrade to “BBB, Stable” by FiinRatings. This dual affirmation—one from operational achievements and the other from independent assessment—underscores that F88’s secured lending model is entering a new era of enhanced efficiency and reliability.

What Does a Credit Rating Upgrade Mean for F88?

F88 has unveiled its Q3/2025 results, showcasing remarkable performance metrics and earning a credit rating upgrade to “BBB, Stable” by FiinRatings. This dual affirmation—one from tangible operational achievements and the other from an independent assessment—underscores that F88’s secured lending model is entering a new era of enhanced efficiency and reliability.

Hanosimex Returns to Profitability After Two Years of Losses, Stock Surges to Upper Limit

Following the announcement of a return to profitability, shares of Hanoi Textile and Garment Corporation (Hanosimex, UPCoM: HSM) surged to their highest level in 19 months. However, the recovery faces significant challenges as the company still grapples with accumulated losses of nearly VND 153 billion.