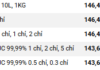

According to data from Phu Quy Jewelry Corporation, silver prices have declined today, with 999 silver (1 tael) listed at VND 1,851,000 (buy) and VND 1,908,000 (sell). This marks a 7.3% drop over the past week, yet buyers have still profited by 50% over the past year.

Meanwhile, 999 silver bars (1 kg) have also decreased, priced at VND 49,359,210 (buy) and VND 50,879,873 (sell), as of 09:01 on October 27.

Globally, silver prices have fallen to $48.25 per ounce.

Amid anticipation of the upcoming FED meeting, the silver market is in a holding pattern, with key resistance levels at $49.46 per ounce and $47.53 per ounce determining the metal’s next move.

Notably, significant pressure is mounting on the physical silver market, concentrated between two major global trading hubs: COMEX in New York, the largest U.S. futures exchange, and the London market, the world’s leading physical silver trading center.

Robert Gottlieb, former precious metals trader and CEO at JPMorgan Chase & Co., stated that physical silver withdrawals from COMEX warehouses are accelerating, signaling substantial strain on the global metal delivery system.

“In the past two weeks alone, 29 million ounces of silver have been withdrawn from COMEX warehouses,” he noted.

He added that this physical silver withdrawal follows a volatile week, during which gold plummeted nearly 5.5% on Tuesday, from over $4,360 per ounce to nearly $4,120 per ounce before rebounding; silver also saw a sharp 7.5% decline in the same session.

According to Gottlieb, surging demand has depleted the “free-floating” silver inventory in London vaults.

“Free-floating silver in London has dropped from 305 million ounces to just 125 million ounces. This has created significant tension,” he explained.

The expert noted that the London shortage has triggered a dramatic reversal in metal flows. Higher spot silver prices in London enable banks to profit by transferring silver from COMEX to the UK.