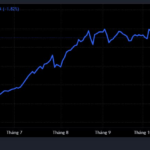

The stock market exhibited a bearish tone during the morning session, with the negativity intensifying post-lunch as Vingroup’s stocks—VIC, VHM, and VRE—all hit their lower limits, while VPl also saw a sharp decline. These four stocks alone caused the VN-Index to shed nearly 20 points. At its lowest point, the VN-Index dropped over 23 points, with nearly 20 points attributed to the Vingroup cluster.

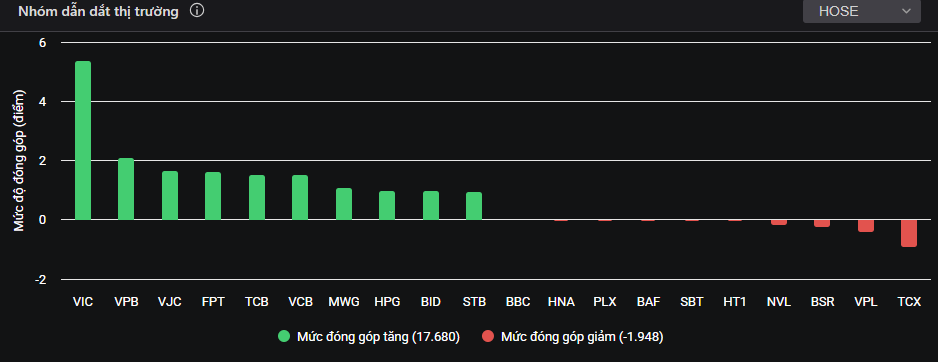

By 1:30 PM, the downward trend of the Vingroup family had eased, and sectors such as securities, steel, and banking began showing signs of recovery. This led to optimism that the session could mark a mid-term bottom for the VN-Index. Large-cap stocks spearheaded the rebound, with VIC reclaiming its leadership role in the market, impressively turning green with a 2.9% gain.

VPB, VJC, FPT, TCB, MWG, VCB, HPG, BID, and others further bolstered the index’s recovery. Notably, VJC surged to its ceiling price of VND 187,500 per share. Several VN30 basket stocks, including FPT, VIB, VPB, MWG, and STB, recorded gains exceeding 4%.

VIC reclaimed its market leadership position.

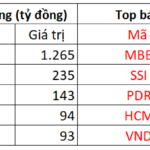

The banking sector significantly contributed to the benchmark index’s rise, with all bank stocks on HoSE closing in the green. Securities stocks also rebounded, with leading names like SSI, VIX, HCM, VND, and SHS recovering notably after trading below reference prices earlier in the afternoon session.

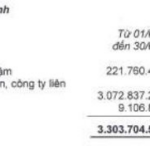

Meanwhile, newcomer TCX continued to underperform, falling 3.8% to VND 43,900 per share. Since its listing just over a week ago, TCX has seen five consecutive sessions of decline, with its market price dropping over 6% from its IPO price. Amid this lackluster performance, the wife of a TCBS branch director intends to offload her entire TCX holdings.

Specifically, Mrs. Nguyễn Thu Trang, spouse of Mr. Nguyễn Tuấn Anh—Director of TCBS’s Hanoi branch—has registered to sell 115,000 TCX shares. If successful, she will no longer hold any shares in TCBS. The transaction is expected to take place between October 29, 2025, and November 27, 2025, potentially yielding her over VND 5 billion.

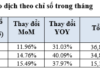

At the close, the VN-Index gained 27.96 points (1.69%) to 1,680.5 points. The HNX-Index rose 1.42 points (0.54%) to 266.78 points, while the UPCoM-Index dipped 0.28 points (0.25%) to 110.96 points. Trading volume on HoSE exceeded VND 29.5 trillion.

Wife of TCBS Securities Branch Director Seeks to Sell Entire Stake in TCX Shares

TCX’s debut on the HOSE has been less than stellar, with a near 5% surge on its first trading day followed by four consecutive sessions of decline.

Technical Analysis for the Afternoon Session of October 28: August 2025’s Previous Low Under Test

The VN-Index continues its steep decline, now trading below the 50-day SMA. The August 2025 low is being tested in the short term. Meanwhile, the HNX-Index remains in a precarious position, consistently hovering beneath the Middle Bollinger Band.