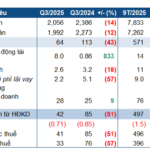

According to the Q3 2025 financial report, Tasco Joint Stock Company (stock code: HUT) recorded a net revenue of VND 9,152 billion, a 14% increase compared to the same period last year. Gross profit reached VND 958 billion, up 41% year-over-year.

Tasco’s financial activity revenue surged to VND 610 billion, three times higher than the same period, while other profits also rose to VND 47 billion.

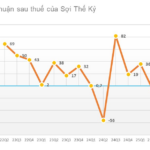

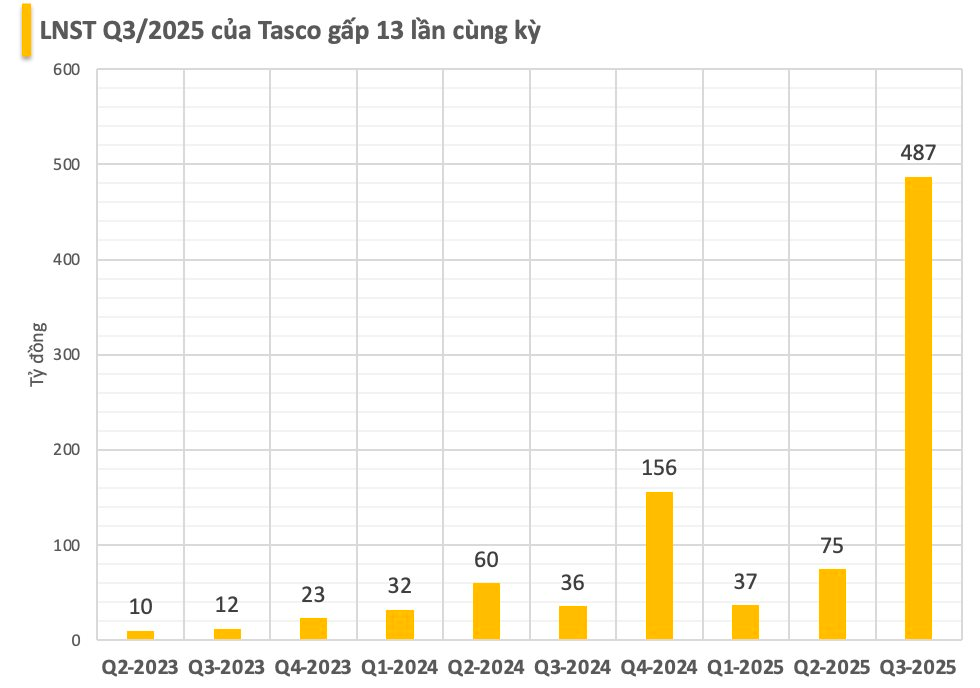

After deducting expenses, Tasco’s post-tax profit reached VND 487 billion, 13 times higher than the same period last year and the highest in the company’s history.

Tasco attributed these results to the positive growth of its core business segments, including automobiles, non-stop toll collection, and insurance, along with a significant increase in financial revenue from capital transfers in real estate projects to restructure resources for key business pillars.

In the financial report’s notes, the Long Hòa – Cần Thơ project no longer recorded basic construction costs (which stood at VND 715 billion at the end of Q2).

On August 1, 2025, Savico, a subsidiary of Tasco, announced the complete withdrawal of its capital contribution from the Cần Giờ High-End Residential Area project (located in Long Hòa commune, former Cần Giờ district), spanning approximately 29.83 hectares. The transferee, Gelex Infrastructure, acquired the project for over VND 619 billion. Savico stated that this move aims to focus on core business activities.

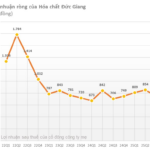

In the first nine months of the year, Tasco achieved a revenue of over VND 24,500 billion, a 24% increase, and a post-tax profit of VND 601 billion, nearly five times higher than the same period. The sales and service segment remained the primary revenue source, contributing over VND 23,000 billion (94%), while the toll collection segment contributed VND 859 billion (3.5%).

Compared to the 2025 business plan, the company has completed 61% of its revenue target and exceeded the profit plan by 5%.

Tasco’s leadership added that, excluding the impact of trade advantage allocation and asset revaluation, the nine-month post-tax profit reached VND 877 billion, surpassing the 2025 annual plan ahead of schedule.

As of September 30, 2025, Tasco’s total assets surpassed VND 35,200 billion for the first time, a 21% increase from the beginning of the year. The company’s total liabilities amounted to nearly VND 21,500 billion.

Tasco currently has a charter capital of VND 10,683 billion, with VII Holding, chaired by Mr. Vũ Đình Độ, as the largest shareholder, owning approximately 30% of the shares. Mr. Độ also serves as the Chairman of Tasco’s Board of Directors.

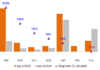

FPT Under Trương Gia Bình’s Leadership Earns $190,000 Daily in Bank Interest

In the first nine months of the year, FPT’s financial activities generated nearly VND 2.424 trillion, with bank deposit interest alone contributing a substantial VND 1.235 trillion.