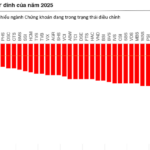

Technical Signals of the VN-Index

During the morning trading session on October 28, 2025, the VN-Index continued its sharp decline, falling below the 50-day SMA.

The previous low from August 2025 (equivalent to the 1,605-1,630 point range) is currently being tested in the short term, as the MACD drops below the zero line.

Technical Signals of the HNX-Index

During the morning trading session on October 28, 2025, the HNX-Index is in a precarious state, consistently trading below the Middle Bollinger Band.

Trading volume remains below the 20-day average, indicating investor caution in the short term.

ANV – Nam Viet Corporation

During the morning trading session on October 28, 2025, ANV shares fell for the third consecutive session, forming a Three Black Candles pattern and testing the 50-day SMA, reflecting investor pessimism.

Additionally, the stock price remains below the Middle Bollinger Band, while the MACD indicator continues to decline toward zero after issuing a sell signal, further exacerbating the negative short-term outlook.

BID – Bank for Investment and Development of Vietnam

During the morning trading session on October 28, 2025, BID shares reversed course, rising with a small-bodied candle pattern accompanied by increased trading volume, suggesting reduced investor pessimism.

BID is retesting the August 2025 low (equivalent to the 36,000-37,600 range), with volume consistently below the 20-day average in recent sessions.

However, the stock remains close to the Lower Bollinger Band, while the MACD indicator forms lower highs and lows, indicating that short-term negative prospects persist.

(*) Note: The analysis in this article is based on real-time data as of the end of the morning session. Therefore, signals and conclusions are for reference only and may change by the close of the afternoon session.

Technical Analysis Department, Vietstock Advisory Division

– 12:07 October 28, 2025

Market Pulse 28/10: External Funds Return, Triggering a Spectacular Market Reversal

Defying early-session pessimism, the market transformed dramatically during the afternoon trading session. At the close, the VN-Index settled at 1,680.5 points, surging nearly 28 points. Meanwhile, the HNX-Index climbed 1.4 points to reach 266.78.

Vietstock Daily 29/10/2025: Surging Powerfully from Previous Lows

The VN-Index staged an impressive rebound after successfully testing its August 2025 lows. Short-term prospects have improved as the index broke above its 50-day SMA, while the Stochastic Oscillator also signaled a buy. If trading volume surpasses its 20-day average in upcoming sessions, the upward momentum will be confirmed.