At the press conference titled “Macroeconomic Outlook and Investment Strategies in the Era of Innovation 2.0”, Ms. Nguyễn Hoài Thu, Deputy General Director of VinaCapital, emphasized the significant potential of the stock market, with corporate profits projected to grow at 16% annually and an attractive valuation (P/E of 10.5 times).

Numerous opportunities remain for stocks that haven’t seen price increases in 2026.

Ms. Nguyễn Hoài Thu – Deputy General Director of VinaCapital

|

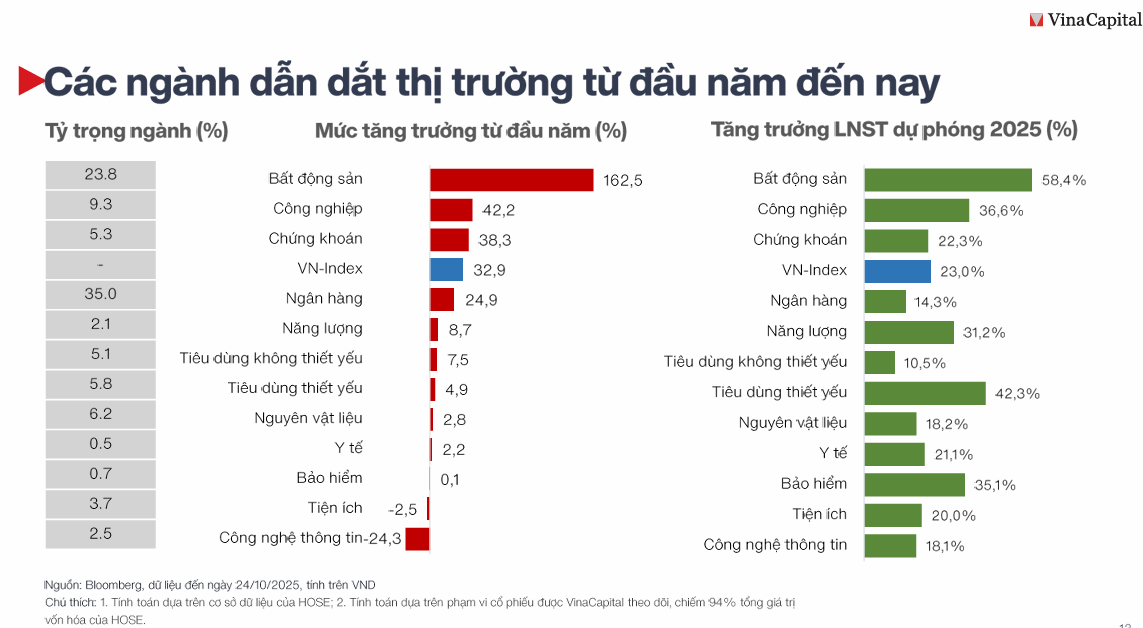

According to Ms. Nguyễn Hoài Thu, Deputy General Director of VinaCapital, the stock market presents ample opportunities for 2026, despite the significant volatility experienced this year. She noted that while the VN-Index has impressively risen by 33% since the beginning of the year (as of October 24), following a 50% recovery from its low point after the U.S. announced a 46% tariff, this growth has been “highly uneven” and driven by a small group of stocks.

Specifically, the rally has been primarily led by a very small group of 12-13 stocks (such as Vingroup and Gelex), while the rest of the market has only increased by 13.4%. Ms. Thu highlighted a paradox where many sectors have seen positive profit growth (ranging from 10% to 58%), yet their stocks have not risen significantly due to capital being concentrated in the leading group. “This indicates that there are still numerous opportunities in stocks that haven’t seen price increases for 2026,” Ms. Thu affirmed.

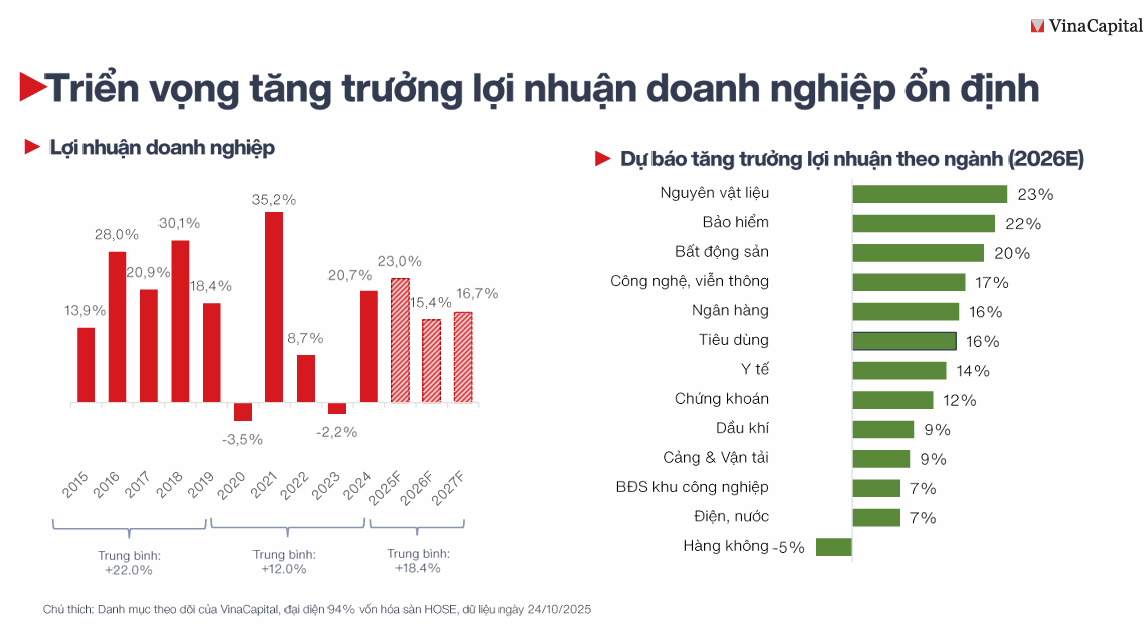

This outlook is further supported by VinaCapital‘s forecast that the average profit growth of listed companies will reach 16% per year during 2026-2027, following a 23% increase in 2025. This growth is considered sustainable, as the expansion cycle in capital expenditure (Capex) is up by an impressive 30%, yet companies are not overleveraging, opting instead for cautious expansion.

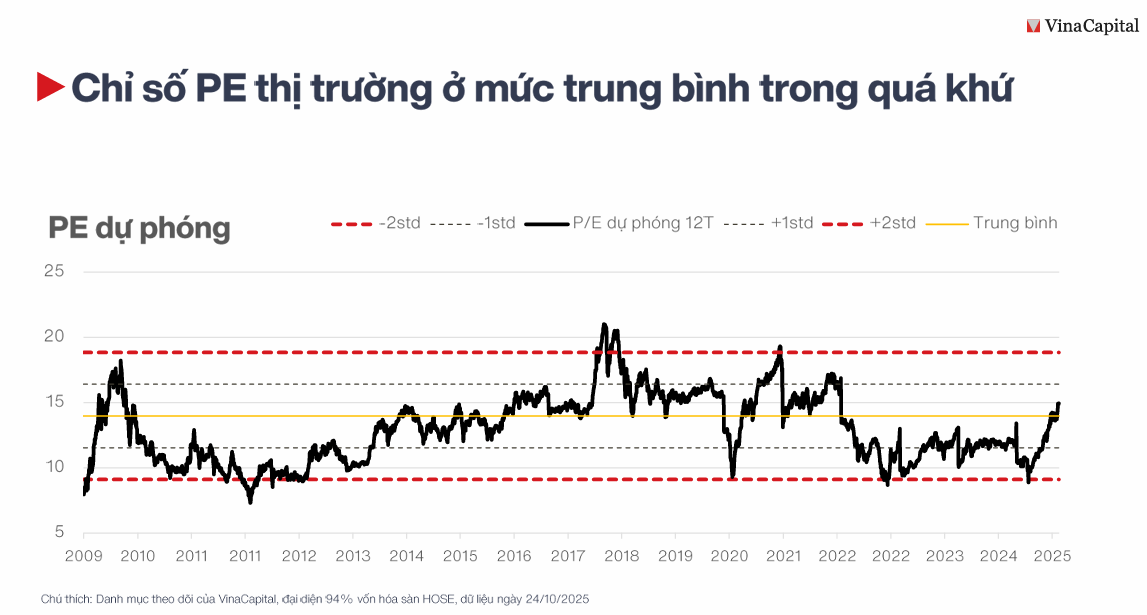

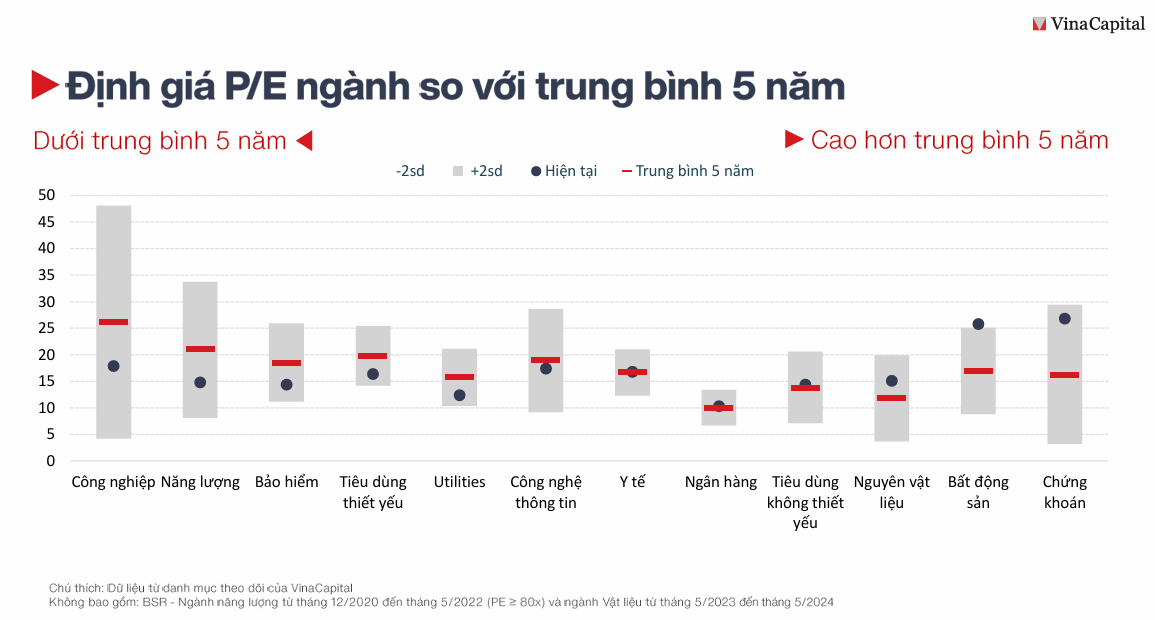

In terms of valuation, Ms. Thu also pointed out similarities. The projected P/E for the entire market is 15 times, which is no longer cheap. However, excluding the 13 leading stocks, the P/E for the rest of the market is only 10.5 times. “A valuation of 10.5 times is very attractive,” Ms. Thu remarked. This underscores that a proactive investment strategy, focusing on stocks with strong fundamentals (P/E of 9-10 times), will yield long-term benefits as the market “normalizes.” Looking at sector valuations (compared to the 5-year average), sectors such as Energy, Insurance, and Essential Consumer Goods are attractively priced. Meanwhile, based on the PEG (<1) and ROE (>15%) criteria, attractive sectors include Materials, Banking, Consumer, Healthcare, and Technology.

3 Key Drivers of Investment in 2026

When synthesizing opportunities, VinaCapital focuses on three main investment themes for 2026.

First is the recovery of domestic consumption, focusing on retail companies that have achieved “economies of scale” (such as Bách Hóa Xanh of MWG or PNJ).

Second is the Banking sector, benefiting multi-dimensionally from public investment and real estate recovery, which improves asset quality, reduces credit costs, and increases ROE; high credit growth (18-20%) coupled with the removal of credit growth limits and real estate recovery will benefit large, well-managed banks with strong capital (TCB, MBB).

Third is the infrastructure group and real estate companies serving real needs (mid-range segment) that benefit from major government projects.

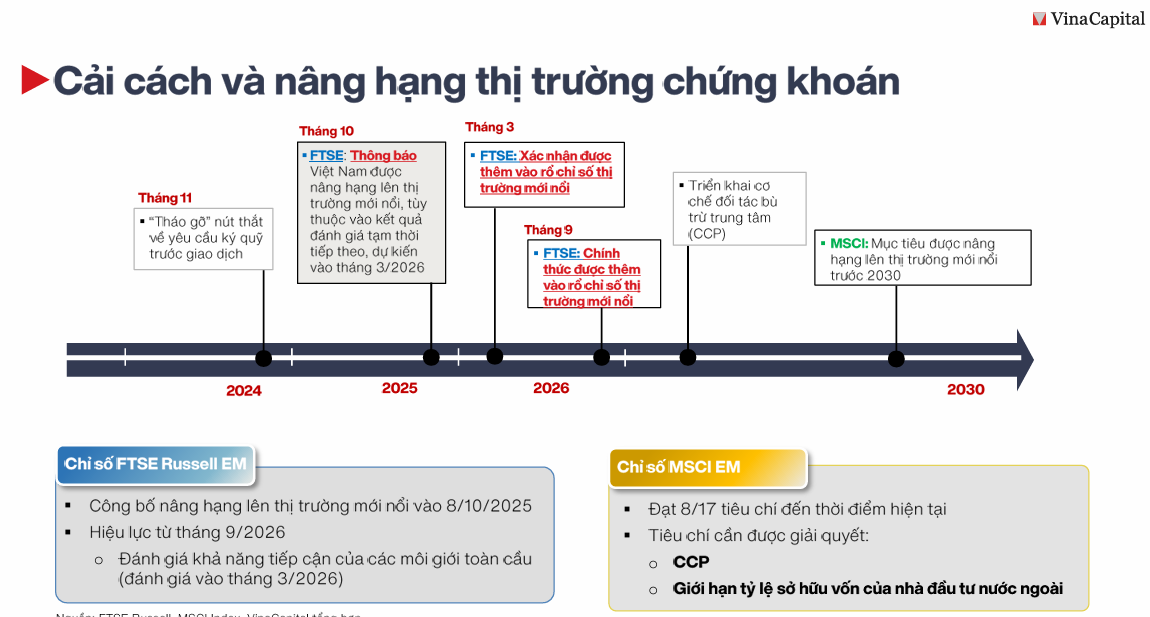

Looking further ahead, Ms. Thu believes that the FTSE upgrade (expected in 2025) is just the beginning. The larger goal is to achieve MSCI upgrade within the next five years, which could attract capital inflows dozens of times larger, although challenges remain with the central clearing mechanism (CCP) and foreign ownership limits (FOL).

The return of the IPO wave (such as TCBS) and the expected listings of FDI enterprises will also deepen the market.

However, the market also faces risks. The largest is exchange rate pressure, with the VND weakening by 12-13% compared to other Asian currencies, raising concerns for foreign investors and potentially forcing policymakers to raise interest rates in 2026 (currently at historic lows).

Explaining the recent liquidity decline and volatility (such as the 5% drop on October 20), Ms. Thu attributed it not to a shift of capital to gold. Instead, the “volatility” in the gold market due to significant price differences and informal market exchange rates has created risk aversion, negatively impacting stock market investor sentiment.

Overall, Ms. Thu believes the stock market holds significant potential (with corporate profits growing at 16% annually) and very attractive valuations (P/E of 10.5 times excluding the leading group).

– 20:39 28/10/2025

Vietstock Daily 29/10/2025: Surging Powerfully from Previous Lows

The VN-Index staged an impressive rebound after successfully testing its August 2025 lows. Short-term prospects have improved as the index broke above its 50-day SMA, while the Stochastic Oscillator also signaled a buy. If trading volume surpasses its 20-day average in upcoming sessions, the upward momentum will be confirmed.

Real Estate Firms Reap Massive Profits Through Strategic Stock Market Investments

Despite a slowdown in its core business, Da Nang Housing Development Investment Corporation (HDIC) reported a remarkable post-tax profit of over VND 145 billion in the first nine months, a 3.5-fold increase compared to the same period last year. This impressive performance was largely driven by gains from its stock portfolio, which includes 23 stocks with investments ranging from a few hundred million to under VND 100 billion, such as HPG, VHM, DGC, FPT, VPB, VCG, EIB, and CTG.

What Triggered the Sudden 30-Point Plunge in VN-Index at Session’s Close?

This development starkly contrasts with the bullish trend observed in Asian stock markets, fueled by expectations of a Federal Reserve interest rate cut and easing U.S.-China tensions.