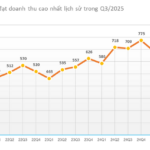

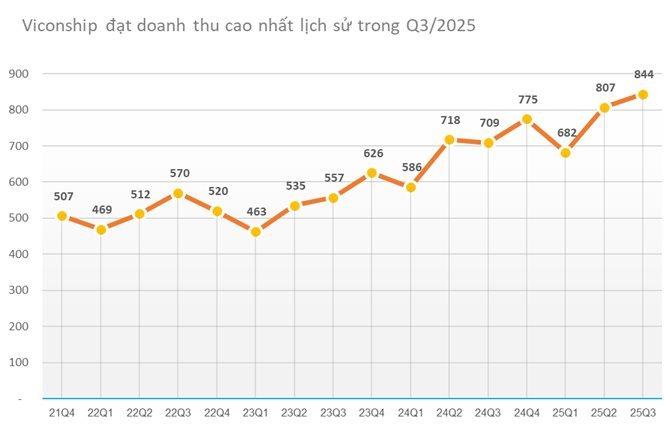

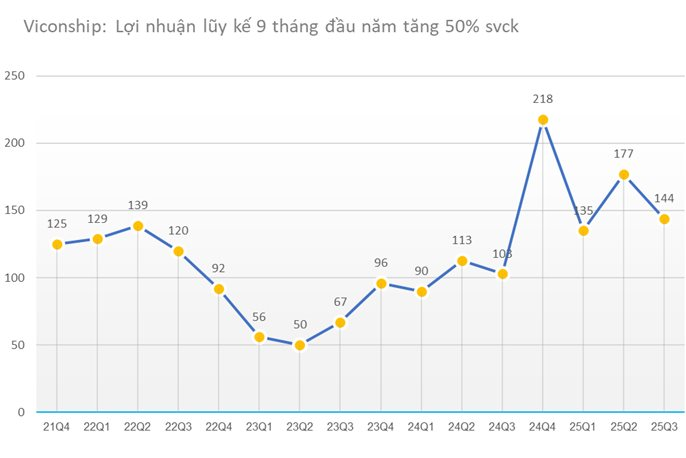

VSC has achieved its highest quarterly revenue milestone in history, with profits continuing to soar after setting a record in Q4 2024.

The consolidated financial report highlights that Nam Hai Dinh Vu Port has emerged as a new growth driver for VSC’s core business operations.

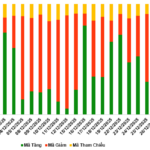

In the first nine months, all three VSC ports (Green, Green VIP, and Nam Hai Dinh Vu) recorded revenue growth. Notably, container volume at Nam Hai Dinh Vu Port surged by 109% year-on-year, significantly contributing to the company’s double-digit revenue growth in Q3.

The acquisition of Nam Hai Dinh Vu Port shares has delivered significant strategic benefits to Viconship.

Nam Hai Dinh Vu is a container port with a design capacity of 500,000 TEU/year, holding a 10% market share in the Hai Phong port cluster. Strategically located downstream of the Cam River, the port features a 450-meter berth and a 250-meter turning basin, capable of accommodating vessels up to 48,000 DWT—the largest in the Dinh Vu area.

According to VSC’s leadership, since completing the acquisition of Nam Hai Dinh Vu Port in July 2024, container occupancy reached over 80% of design capacity by Q3. Additionally, VSC’s major ports, including Nam Hai Dinh Vu and Green VIP, increased service rates by 5-10% in August.

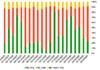

For the first nine months of 2025, Viconship reported consolidated revenue of VND 2,333 billion—a 16% increase year-on-year—and pre-tax profit of VND 456 billion, up nearly 50%. This performance exceeded 115% of the year’s initial profit target, prompting an extraordinary shareholders’ meeting on October 9, 2025, to adjust the profit plan from VND 400 billion to VND 1,250 billion.

In Q3, the sale of a 20% stake in Green VIP Port (stock code: VGR) generated approximately VND 600 billion in profit, explaining the sharp rise to VND 540 billion in Viconship’s standalone financial report. VSC’s leadership plans to reinvest this profit primarily into potential logistics projects and explore opportunities in industrial zones, infrastructure, and real estate in Hai Phong.

Looking ahead, Viconship’s business prospects are underpinned by dual growth drivers.

First, Hai Phong’s GRDP grew by an estimated 11.59% in the first nine months, ranking second nationally and achieving the highest growth rate among six central cities. Budget revenue increased by over 30.6%, and investment attraction surged nearly 12-fold year-on-year. Nine-month export turnover reached USD 36 billion. Recently, the Chairman of Hai Phong People’s Committee approved the establishment of a free trade zone, with development phases extending to 2030 and 2035. This initiative, the first of its kind in northern Vietnam, is expected to boost GRDP growth and restructure the industrial-logistics value chain in Hai Phong and the northern region.

Second, the Ministry of Industry and Trade forecasts that Vietnam’s total import-export turnover in 2025 could reach a record USD 900 billion. MBS Securities predicts that Hai Phong ports, including Nam Dinh Vu, will benefit from rising transportation demand in Central Asia and strong domestic demand for construction materials.

Viconship’s leadership emphasizes continued efforts to expand customer acquisition and enhance production activities, leveraging the market’s positive momentum and the government’s fee adjustments implemented since early 2025.

Swing Villas: The Timeless Legacy of Prosperity for Hai Phong’s Elite

Amidst a real estate market redefining the essence of “luxurious living,” Swing Villas at Vinhomes Royal Island emerge as an exclusive offering tailored for Hai Phong’s elite. More than just a residence, each Swing Villa embodies a collector’s value, symbolizing personal distinction and a vision for enduring wealth.

China’s Leading Construction Conglomerate Joins Vingroup to Build Tu Lien Bridge, Eyeing Major Projects in Vietnam’s Third-Largest Megacity

Pacific Corporation is eager to engage in the research and investment collaboration for the high-speed rail project connecting Hanoi, Hai Phong, and Quang Ninh. Additionally, we aim to participate in the development of the East-West connectivity route, the axis linking Gia Binh Airport to Lach Huyen Port, and various logistics, water treatment, and urban flood control initiatives.

CEO Group to Break Ground on $120 Million Industrial Park in Hai Phong by Year-End

Unveiling the Tien Lang Airport Industrial Park – Zone B, a groundbreaking 186-hectare development with a total investment of over 2.795 billion VND, spearheaded by a subsidiary of CEO Group. This visionary project aims to establish an eco-friendly, high-tech industrial zone, slated to commence construction by year-end.