A woman examines a printed circuit board for defects through a magnifying glass at a factory in Bac Ninh province, Vietnam, in May 2018. The electronics sector is a rapidly growing area within this Southeast Asian nation’s economy. © Reuters

|

“We’ve seen very few cases of early lease terminations or cancellations, while demand from new businesses—particularly investments from China and the U.S.—along with renewals and expansions from existing clients remains robust,” said Lance Li, CEO of BW Industrial Development JSC, Vietnam’s largest industrial warehouse provider.

This Warburg Pincus-backed company leased over 1.2 million square meters from January to August, a 42% increase compared to the same period last year.

Electronics Sector Leads the Charge

“Electronics is the fastest-growing sector,” Li noted. BW Industrial recently signed a contract with a magnet supplier for Apple in Bac Ninh, where Samsung established its first phone manufacturing facility in 2009.

In Dong Nai, BW welcomed new tenants including Coherent, a U.S.-based manufacturer of optical materials and semiconductors, and Marmon Fastener, a Berkshire Hathaway company specializing in assembly solutions for the automotive, electronics, and construction industries.

“Vietnam has clearly become an ideal manufacturing hub to serve global demand and remains a top choice for many Chinese supply chain manufacturers looking to expand overseas, whether voluntarily or due to external pressures,” Li emphasized.

Vietnam’s proximity to China provides a significant advantage. The drive from Guangzhou to Bac Ninh takes only 14 hours. A planned 160 km/h rail line connecting the China border to Hai Phong port, expected to be completed by 2030, will further enhance this advantage.

According to BW Industrial, many companies are seeking second manufacturing bases, often in Mexico to serve the U.S. market or in Poland and Hungary for the European market.

Industrial Zones Expand Rapidly

Data from Sufex Trading shows that 49 industrial zones with a total area of 13,841 hectares were approved in the first nine months, a 44% increase in number and 26% in area compared to the entire year of 2024.

Akira Miyamoto, CEO of Sufex Trading, commented: “Despite uncertainties from Trump’s tariffs, some companies are more cautious—opting to lease rather than buy—but demand remains strong.”

A worker at a shoe manufacturing factory in Hanoi on December 29, 2020. © Reuters

|

Bruno Jaspaert, General Director of DEEP C Industrial Zones, observed: “The era of Chinese companies setting up simple assembly plants in Vietnam and keeping profits in China is over. When they leave China now, they relocate their entire production chain, making projects much larger.”

“China used to be the world’s factory. Today, China supplies machinery to all factories worldwide,” Jaspaert added, noting strong demand in renewable energy, electric vehicle charging equipment, and logistics.

Since 2018, Vietnam’s machinery imports from China have increased 2.5 times, reaching nearly $29 billion in 2024. In the first nine months of 2025, this figure has already hit $28 billion.

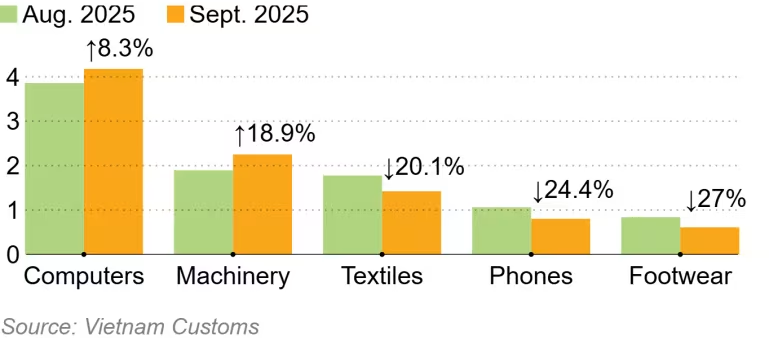

Since Trump’s tariffs took effect on August 7, affected exports have varied. In September, textile exports to the U.S. dropped 20.1% month-on-month to $1.4 billion, while footwear (including Nike and Adidas products) fell 27% to $612 million.

“Apparel, sportswear, furniture, and footwear share low profit margins, reliance on cheap labor, and low technology—making them vulnerable when end-user markets face issues,” Jaspaert said. “Vietnam’s future no longer lies in companies coming for cheap labor, a factor that will disappear within the next decade.”

Export Value by Product Category

Unit: Billion USD

Exports to the U.S., accounting for 30% of total exports in 2024, are expected to remain strong in the final quarter as manufacturers ramp up production for the holiday season. The Vietnamese dong’s 3.4% depreciation against the USD since the start of the year and more competitive tariffs compared to India, Thailand, and Malaysia are supporting export growth.

“In September, we saw a surge in inquiries after a slow summer period. We predict 2026 will be very dynamic. Regardless of where manufacturers set up, they face tariffs,” said John Campbell, Director of Industrial Services at Savills Vietnam.

“Many businesses are confident in Vietnam’s long-term momentum: its manufacturing story, growing skilled workforce, dynamic environment, and 100 million-strong market,” Campbell added, highlighting the network of free trade agreements as an attractive factor.

“Encouragingly, high value-added manufacturing sectors are thriving, such as electronics, optical products, auto components, and solar panel production. Most growth sectors focus on electronics and high value-added products—aligning with Vietnam’s development goals,” Campbell further noted.

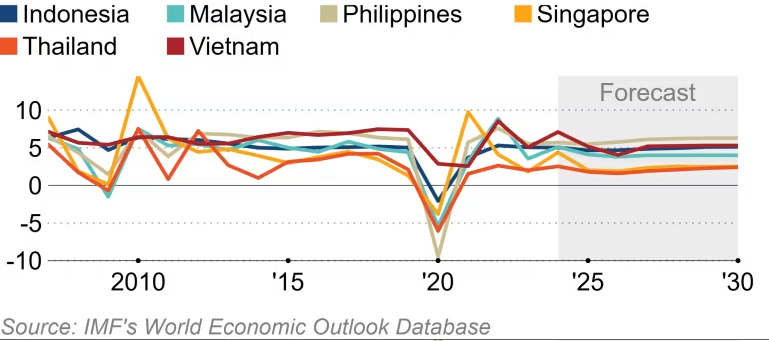

Financial institutions are adjusting their growth forecasts for Vietnam positively. HSBC recently raised its 2025 GDP growth forecast for Vietnam to 7.9%, up from 6.6%. Citi also increased its forecast to 8%, citing limited impact from U.S. tariffs, up from 5% in April 2025.

|

GDP Growth Forecasts for ASEAN Countries

|

“The outlook for 2026 is positive, with strong domestic demand potentially offsetting any export declines, along with improved capital efficiency,” said Trung Hoang, Sales and Enterprise Solutions Director at Citi Vietnam Markets. He forecasts Vietnam’s GDP to grow by 8% in 2026.

– 16:00 28/10/2025

Urgent Solutions Needed to Curb Polluting Vehicles in Major Cities Like Hanoi and Ho Chi Minh City

The Supervisory Delegation proposed a solution during the National Assembly session to address environmental pollution in major cities such as Hanoi and Ho Chi Minh City.

Unlocking Growth: 700 Billion VND FDI Project Approved for Khanh Hoa Industrial Zone

On October 9, 2025, the Management Board of Economic and Industrial Zones of Khanh Hoa Province approved the investment project for the Derun Spandex Fabric Manufacturing Plant in Thuan Bac Industrial Zone, Khanh Hoa Province. The project boasts a total investment capital of 681 billion VND (approximately 26 million USD).