I. MARKET ANALYSIS OF THE UNDERLYING STOCK MARKET ON OCTOBER 29, 2025

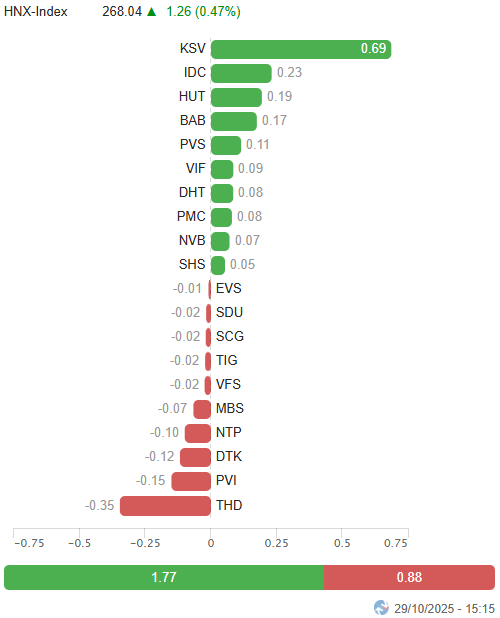

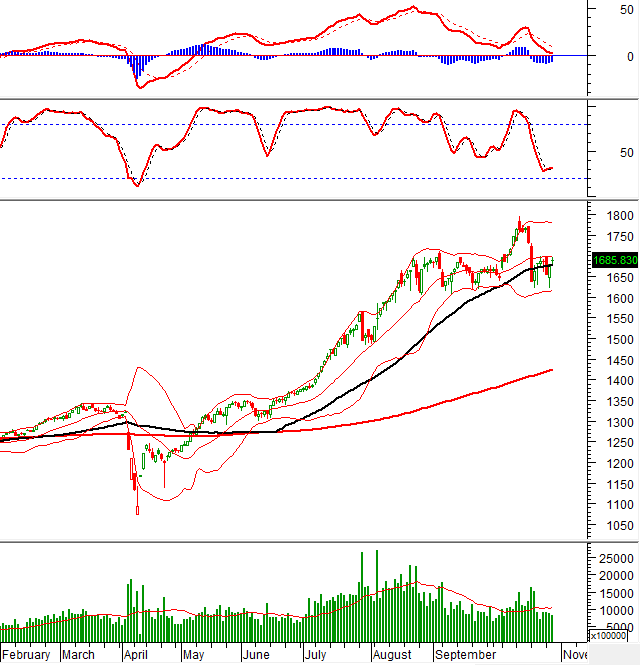

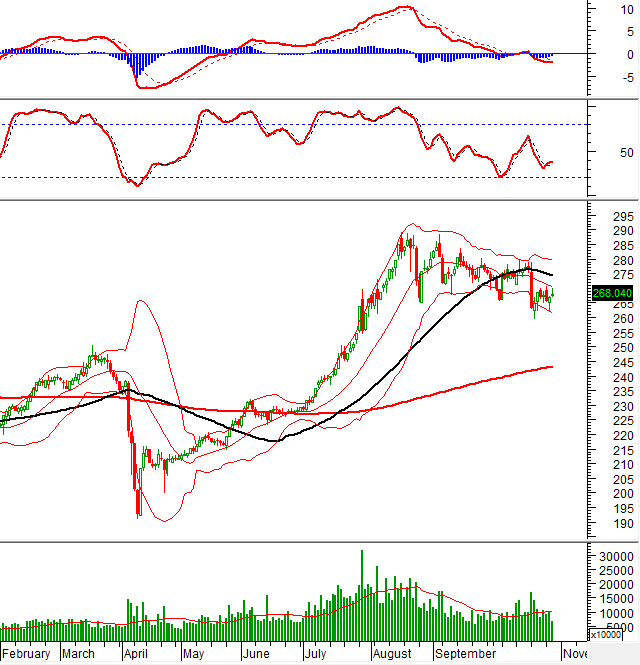

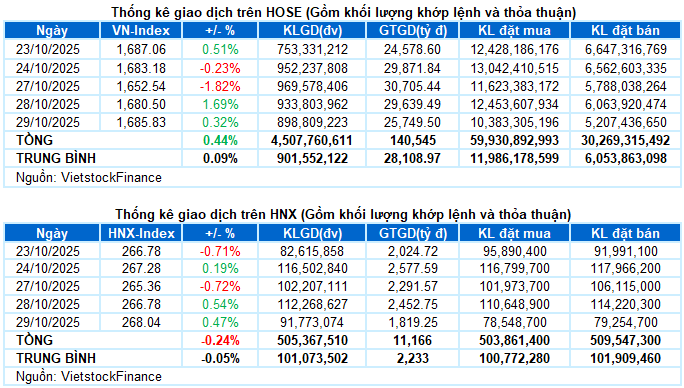

– Major indices maintained their upward trend during the October 29 trading session. Specifically, the VN-Index rose by 0.32%, reaching 1,685.83 points, while the HNX-Index also increased by 0.47%, closing at 268.04 points.

– Trading volume on the HOSE continued to decline by 6.1%, totaling over 823 million units. The HNX recorded nearly 67 million matched units, a 33.7% decrease compared to the previous session.

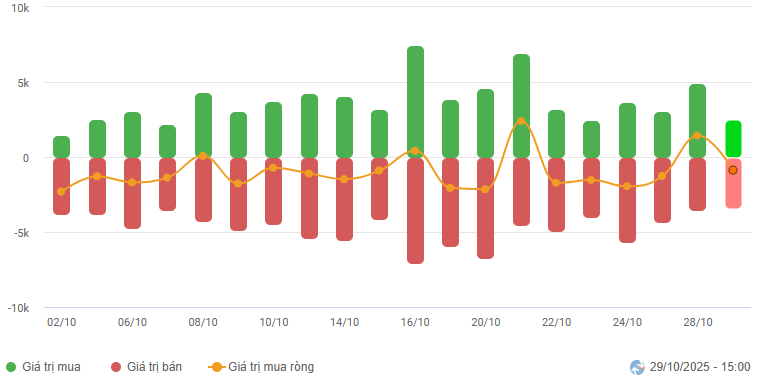

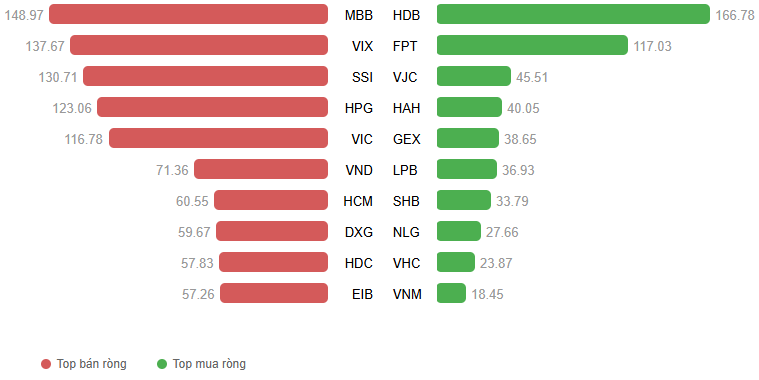

– Foreign investors turned net sellers on both the HOSE, with a value of nearly 806 billion VND, and the HNX, with over 67 billion VND.

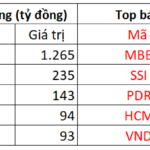

Foreign Investors’ Trading Value on HOSE, HNX, and UPCOM by Date. Unit: Billion VND

Net Trading Value by Stock Code. Unit: Billion VND

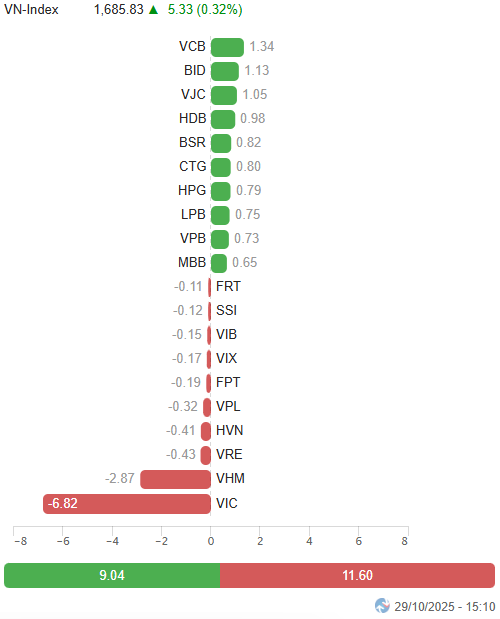

– Continuing the strong recovery momentum from the previous session, the market opened on October 29 with a positive sentiment. Despite resistance from major VinGroup stocks, which posed challenges in the first half of the morning session, the overall market breadth still favored buyers. Capital flowed into mid-cap and small-cap stocks, though liquidity remained unchanged. The afternoon session witnessed familiar late-session volatility, as the VN-Index, initially up by 15 points, narrowed its gains due to increased pressure from blue-chip stocks. The VN-Index closed at 1,685.83 points, up 5.33 points from the previous session.

– In terms of influence, VCB, BID, and VJC were the top contributors, adding a combined 3.5 points to the VN-Index. Conversely, the VinGroup quartet (VIC, VHM, VRE, and VPL) were among the top five stocks exerting the most pressure, subtracting nearly 10.5 points from the index.

Top Influencing Stocks. Unit: Points

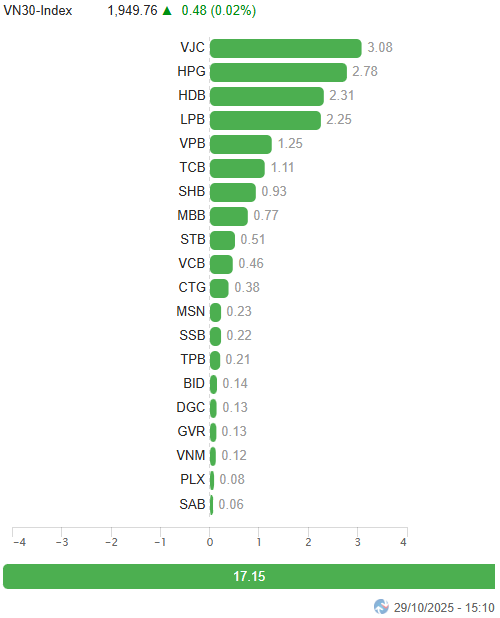

– The VN30-Index experienced significant volatility, returning close to the reference level by the end of the session, closing at 1,949.76 points. Buyers dominated with 22 advancing stocks, 7 declining stocks, and 1 unchanged stock. VJC led the gains with a remarkable 4.1% increase, followed by HDB, SHB, LPB, and GVR, all rising over 2%. Conversely, VIC, VHM, and VRE faced strong profit-taking pressure, declining by 3.7%, 3%, and 2.3%, respectively.

Most sectors maintained their upward trend. The energy sector stood out with a gain of over 3%, primarily driven by BSR hitting its ceiling price, and notable increases in PVS (+1.27%), PVT (+2.02%), PLX (+1.32%), PVD (+1.49%), OIL (+1.92%), and PVP (+2.99%).

Several stocks in the materials and essential consumer goods sectors also traded actively, including HPG (+1.68%), DPR (+3.6%), DDV (+4.19%), BFC (+3.73%), DCM (+1.15%), DPM (+1.05%), AAA (+5.65%), VHC (+3.74%), DBC (+3.68%), MCH (+3.54%), ANV (+2.25%), HNG (+10.34%), and HAG, which hit its ceiling price. Additionally, the financial and industrial sectors recorded gains of over 1%.

On the downside, the real estate sector underperformed with a 2.07% decline, primarily due to pressure from the VinGroup trio. However, several stocks within the sector still attracted positive demand, such as KDH (+2.69%), KBC (+1.01%), NLG (+4.91%), IDC (+2.71%), TCH (+1.14%), NVL (+1.12%), SCR (+2.36%), and KHG, which also hit its ceiling price.

The VN-Index formed a Doji candlestick pattern with trading volume remaining below the 20-day average, indicating prevailing hesitation. The Middle line of the Bollinger Bands remains a short-term challenge that the index must overcome to consolidate its recovery.

II. PRICE TREND AND VOLATILITY ANALYSIS

VN-Index – Doji Candlestick Pattern Emerges

The VN-Index formed a Doji candlestick pattern with trading volume remaining below the 20-day average, indicating prevailing hesitation.

The Middle line of the Bollinger Bands remains a short-term challenge that the index must overcome to consolidate its recovery.

HNX-Index – Continues to Struggle Below the Bollinger Bands Middle Line

The HNX-Index narrowed its gains and continued to struggle below the Middle line of the Bollinger Bands. Fluctuating trading volume in recent sessions indicates unstable investor sentiment.

Currently, the MACD indicator is narrowing its gap with the Signal line. If a buy signal re-emerges in upcoming sessions, the index’s outlook could turn more positive.

Capital Flow Analysis

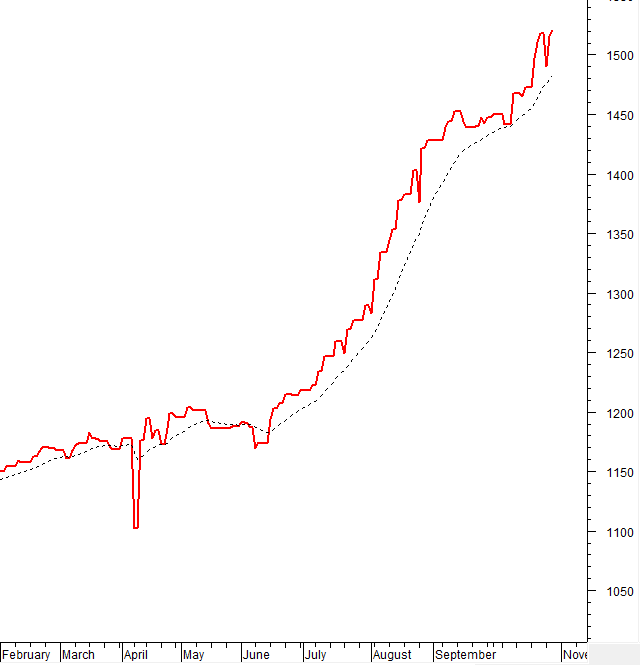

Smart Money Movement: The Negative Volume Index of the VN-Index is above the 20-day EMA. If this condition persists in the next session, the risk of a sudden downturn (thrust down) will be mitigated.

Foreign Capital Movement: Foreign investors were net sellers in the October 29, 2025 session. If foreign investors continue this trend in upcoming sessions, market volatility is likely to persist.

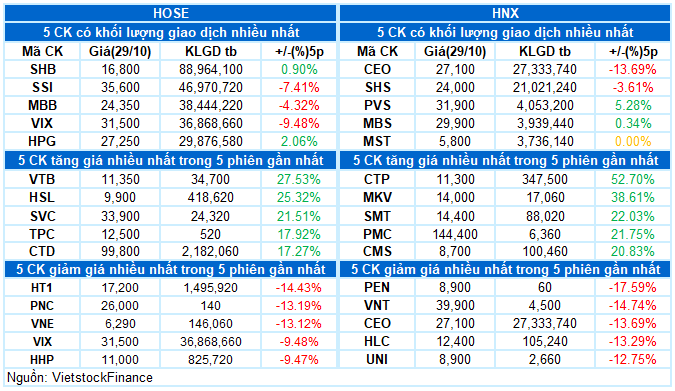

III. MARKET STATISTICS FOR OCTOBER 29, 2025

Economic Analysis & Market Strategy Department, Vietstock Consulting Division

– 17:02 October 29, 2025

On His 63rd Birthday, Billionaire Bầu Hiển’s Wealth Surges by Tens of Billions of Dong

The combined stock assets of the three father-son members of the Hiển family are estimated to reach approximately VND 6,947 billion, marking a remarkable 100% increase compared to 2024, when their holdings were valued at around VND 3,400 billion.

Stock Market Thrills: A Rollercoaster Ride Like No Other

The stock market witnessed a dramatic trading session on October 28th, as the VN-Index staged a remarkable turnaround. After plunging to around 1,620 points, it unexpectedly rebounded, closing above 1,680 points. This rollercoaster-like movement highlighted the emergence of bottom-fishing demand during the afternoon session, fueling a spectacular market reversal.

Foreign Investors Reverse Course, Net Buying Nearly VND 1.3 Trillion in Blue-Chip Stock on October 28 Session

Foreign investors actively traded, reversing to net buying with a total value of VND 1.475 trillion across the entire market.