|

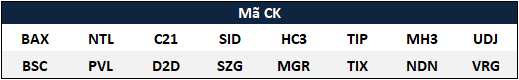

Real Estate Companies Listed with Zero Debt as of June 30, 2025

Source: VietstockFinance

|

Maintaining zero debt among real estate companies can stem from various reasons. One prominent reason is the absence of new projects, eliminating the need for substantial capital mobilization.

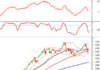

For instance, Danang Housing Development Investment Corporation (HNX: NDN), after commencing the handover of Moarchy Block B units in 2020, reduced its debt to zero by year-end and has maintained this status since.

With this strategy, NDN has kept its current ratio (current assets/current liabilities) above 2 since 2021. However, a significant portion of current assets is in trading securities, raising liquidity concerns during negative market fluctuations. By late June 2025, NDN‘s trading securities were valued at over 524 billion VND, constituting nearly 58% of current assets and over 42% of total assets.

Meanwhile, its core real estate business has stagnated, with unfinished construction value remaining at 11.4 billion VND since 2022, indicating reluctance to pursue new projects or complete existing ones.

Source: VietstockFinance

|

In cases of new projects, debt-free companies often undertake smaller-scale projects or rely on operational cash flows for funding.

Industrial zone (IZ) real estate companies typically fall into this category. Once an IZ project is completed and leased, it generates consistent annual cash flows, enabling investors to plan new projects without relying on loans.

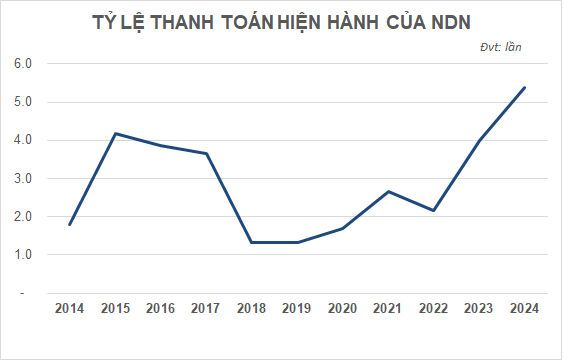

Thong Nhat Corporation (HNX: BAX), after securing stable tenants for Bau Xeo IZ, was permitted by Dong Nai Provincial People’s Committee to develop the Bau Xeo IZ Service Center project in 2014. The project spanned 33.7 hectares with an initial investment of 670 billion VND (later increased to over 842 billion VND in 2019).

Before adjustments, the project’s scale exceeded BAX‘s total assets (488 billion VND in 2014). Despite this, BAX avoided bank loans and has remained debt-free since 2015. The project was completed and began generating revenue in 2019. From 2010 to 2024, BAX‘s after-tax profit mostly ranged between 20-30 billion VND annually, except for 2019-2022, which saw significant fluctuations due to profits from the service center project.

Other financial metrics, such as consistently positive operating cash flows, demonstrate BAX‘s ability to meet financial needs without borrowing.

Additionally, the profit-to-cash flow conversion ratio (operating cash flow/net profit) has often exceeded 1, except during 2020-2021, when it dipped below 1 due to handover and collection activities for the service center project.

Source: VietstockFinance

|

BAX‘s profits primarily benefit its four major shareholders, who collectively own 88.76% of the capital: Dong Nai Rubber Corporation (36.07%), Tin Nghia Corporation (UPCoM: TID) (29.52%), America LLC (16.7%), and Mr. Quách Ngọc Nguyên (6.47%).

Similar to BAX, D2D, a subsidiary of SNZ (UPCoM: SNZ), leases land and infrastructure in Nhon Trach 2 IZ and Long Thanh Market. Since 2017, D2D has been debt-free, even while investing in the Loc An residential project. When the project began generating profits, D2D‘s net profit peaked at over 375 billion VND in 2019.

D2D‘s debt-free status coincides with a current ratio above 2 since 2014. However, operating cash flows were negative from 2020 to 2023, during which D2D recognized profits from the Loc An project.

Zero Debt Due to Inability to Borrow?

Beyond voluntary choices, it’s worth questioning whether many companies’ zero debt results from ineffective operations, where financial leverage not only fails to provide advantages but also imposes cost pressures, leading to consecutive losses.

Additionally, poor asset quality, primarily consisting of receivables, may make borrowing difficult.

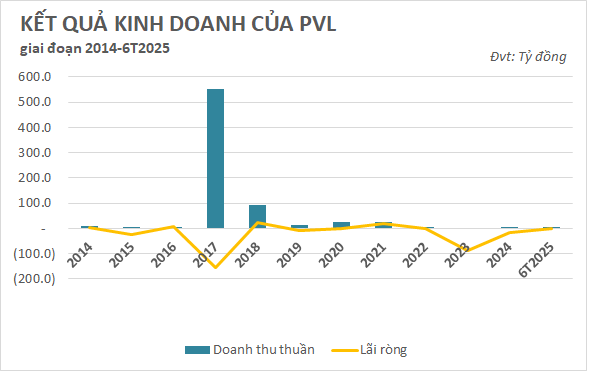

PVL has been debt-free since 2017, a period of rising interest rates. According to its 2017 annual report, PVL‘s management cited difficulties in raising capital from credit institutions, opting instead to mobilize funds from other sources for the Linh Tay Tower project.

However, PVL‘s financial ratios show a current ratio below 1 from 2017 to 2020, only exceeding this threshold in 2021, 2023, and 2024.

The company’s revenue and profits have been lackluster, culminating in an accumulated loss of over 368 billion VND by June 2025.

Source: VietstockFinance

|

Beyond operational results, PVL faces balance sheet issues, leading auditors to issue disclaimers or refusals of opinion.

Most recently, in the 2025 semi-annual audited financial statements, auditors refused to provide an opinion due to insufficient evidence to assess recoverability and provisions for advance payments to Vietnam Petroleum Construction Joint Stock Corporation (17.7 billion VND), its branch (2.3 billion VND), and the Southern Project Management Unit (1.9 billion VND).

Auditors also lacked necessary evidence regarding the cost of commercial floor area in the Linh Tay apartment project, valued at over 23 billion VND as of December 31, 2024, and June 30, 2025. Consequently, they could not opine on the valuation of real estate inventory or assess its impact on financial statements.

Finally, auditors were unable to obtain confirmation letters for other receivables from Quang Phat Co., Ltd., totaling over 18 billion VND as of June 30, 2025, or appropriate evidence of management’s assessment of these receivables’ recoverability.

In addition to these disclaimers, auditors noted that PVL‘s property and infrastructure rental revenue in the first half of 2025 was insignificant, significantly declining compared to the same period in 2024. Combined with an accumulated loss of nearly 370 billion VND, PVL faces substantial going concern risks.

Given its poor financial metrics and negative audit assessments, PVL is likely to face significant challenges in securing new loans.

– 08:14 29/10/2025