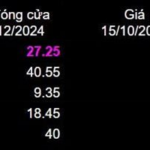

The stock price of SVC, owned by Saigon General Service Corporation (Savico), has experienced nine consecutive trading days of reaching the upper limit on HoSE as of October 28, 2025. Closing at VND 36,450 per share on October 28, SVC’s market capitalization reached nearly VND 3.2 trillion.

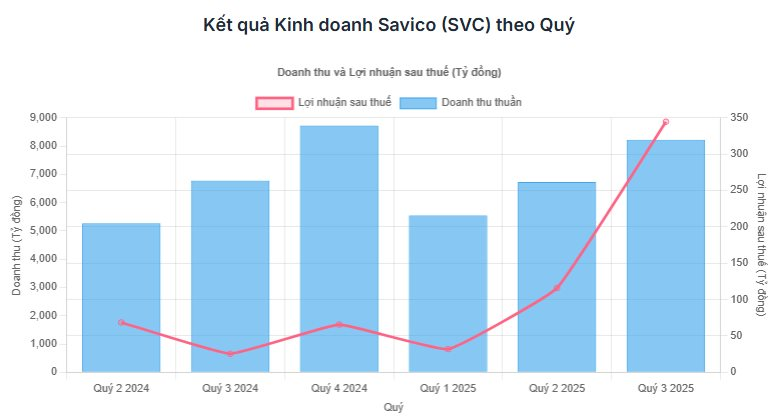

The surge in SVC’s stock price began after the company released its Q3 2025 Consolidated Financial Statements on October 15, revealing exceptional business performance.

Savico attributed the price movement to market supply and demand dynamics, while acknowledging that positive business results also played a significant role in attracting investor attention.

SVC hit the upper limit for 9 consecutive sessions starting October 16, 2025

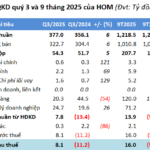

In Q3, Savico reported a post-tax profit attributable to the parent company’s shareholders of VND 363.9 billion, a staggering 58-fold increase compared to the same period in 2024 (VND 6.18 billion), marking a record quarterly profit. Consolidated pre-tax profit reached VND 443.4 billion, an 11.6-fold increase.

As Vietnam’s largest automobile distributor, Savico’s market capitalization significantly surpasses that of other automotive companies listed on the stock exchange.

However, this exponential growth was not driven by automobile retail sales, as Q3 net revenue from this segment rose only 21.3% to VND 8,217 billion. Instead, the 33-fold surge in “Financial Activity Revenue” to VND 668.7 billion was the primary catalyst.

Rendering of the Can Gio High-End Residential Area project

Of this, VND 537.3 billion was attributed to “Profit from Investment Sales.” Subsequent reports confirmed that this profit stemmed from Savico’s sale of a 50% stake in the Can Gio High-End Residential Area project to Gelex Infrastructure on August 1, 2025, generating VND 619.4 billion.

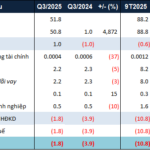

Despite record profits, Savico’s cash and cash equivalents as of September 30, 2025, decreased by 35.4% year-to-date to VND 567 billion, with a negative operating cash flow of VND 1,018 billion for the first nine months.

The unrealized profit is reflected in short-term receivables, which surged 103.4% to VND 4,268 billion, particularly in “Investment Cooperation Contract Receivables” soaring to VND 1,611 billion, potentially including the VND 619 billion from the Can Gio transaction.

To support a 34.6% increase in total assets (to VND 12,067 billion) over nine months, Savico increased its financial leverage. Total liabilities rose 37.4% to VND 9,055 billion, with total loans increasing 38% to VND 5,608 billion, primarily from banks and Tasco Auto, the parent company.

Thanks to the project sale, Savico’s nine-month accumulated pre-tax profit reached VND 636 billion, a 4.6-fold increase year-over-year and 2.46 times the annual plan. Record profits boosted shareholders’ equity by 27% to VND 3,011 billion.

VICEM Hoang Mai Cement Records Highest Profit in 13 Quarters

Through enhanced clinker production efficiency, utilization of alternative raw materials, and additional revenue from waste treatment, Xi măng VICEM Hoàng Mai reported a Q3/2025 profit of over 8 billion VND—its highest in 13 quarters and surpassing its full-year profit target after just 9 months.

GEE Stock Surges to Upper Limit for Three Consecutive Sessions, Pushing Market Cap Beyond $2 Billion Milestone

The surge in GEE’s price is fueled by its record-breaking Q3 financial results, boasting triple-digit profit growth, alongside heightened anticipation surrounding the IPO of its subsidiary company.