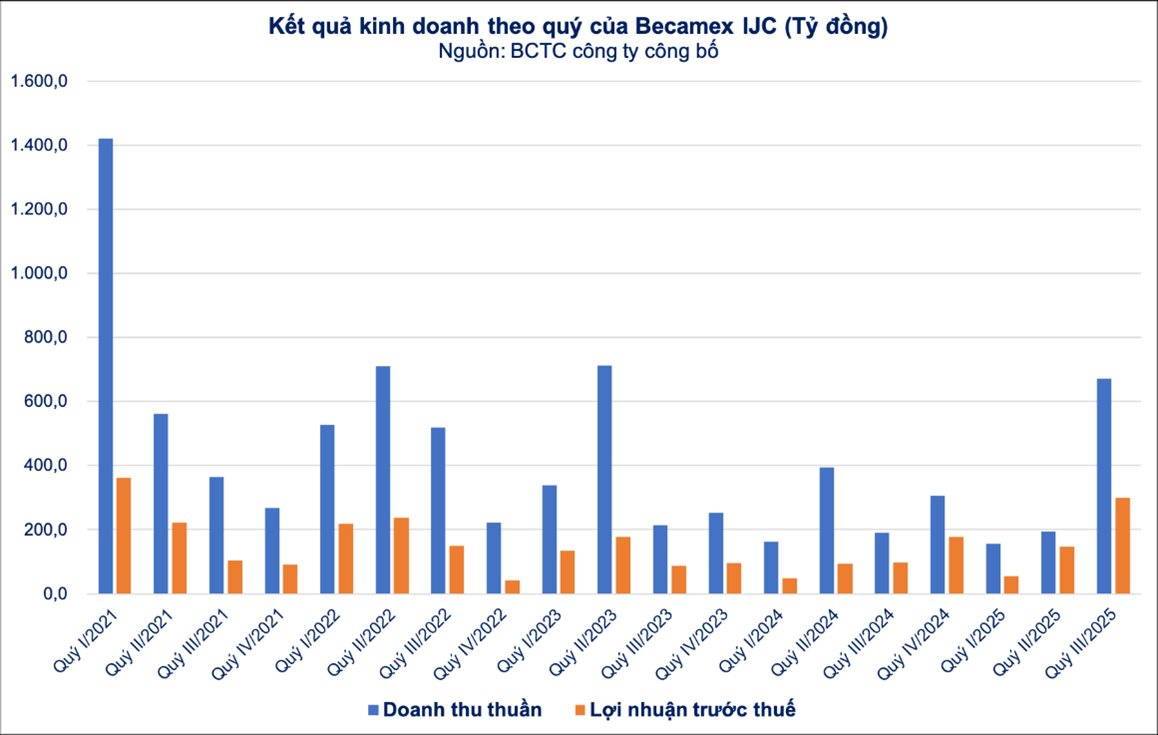

Impressive Business Results, Highest Profit in 18 Quarters

In the last quarter, Becamex IJC recorded a total revenue of VND 671.6 billion, 3.5 times higher than the same period last year. This remarkable result stems from the real estate segment, as the company handed over properties to residents.

With optimized costs, the real estate business in Q3 recorded an after-tax profit of approximately VND 108 billion, while the infrastructure segment continued to operate steadily. Revenue from toll road tickets in Q3 reached over VND 85.3 billion, contributing VND 60 billion in after-tax profit to the company’s overall Q3 performance.

After deducting operating expenses and corporate income tax, Becamex IJC recorded an after-tax profit of over VND 254 billion in Q3/2025, three times higher than the same period last year. This is the best business result for Becamex IJC in the last 18 quarters, since the first quarter of 2021.

In the first nine months of this year, Becamex IJC’s net revenue and after-tax profit reached VND 997 billion and VND 397 billion, respectively, up 40% and 99%. The 9-month EPS reached VND 1,007, nearly double the VND 580 recorded in the same period last year.

At this year’s annual general meeting, Becamex IJC shareholders approved a business plan with a consolidated after-tax profit of VND 429 billion. Thus, after three quarters, the company has achieved 93% of its planned target. With the real estate segment’s profit peak expected by year-end, Becamex IJC is likely to significantly exceed its profit plan.

The above is positive news about Becamex IJC’s business results. In terms of scale, as of September 30, the company’s total assets reached VND 8,206 billion, with inventory value at VND 4,179 billion, primarily from work-in-progress (VND 4,164 billion). Completing real estate projects and delivering products in the coming period is expected to help Becamex IJC maintain its positive business momentum.

Abundant Potential Post-Capital Increase

As of September 30, 2025, Becamex IJC holds approximately 56 hectares of clean land inventory ready for development. This land is strategically located in Binh Duong Ward, Ho Chi Minh City, and surrounding areas, home to major industrial zones such as VSIP, My Phuoc, and Dong An.

This is a long-term competitive advantage, as land prices in traditional industrial areas have surged, and supply is scarce. Particularly with Ho Chi Minh City’s expansion following its merger with Binh Duong and Ba Ria-Vung Tau, Becamex IJC’s vast land bank will provide a significant competitive edge over other Southern real estate developers.

In the short term, the Sunflower II and Hoa Loi Residential Area projects will be the primary profit drivers. Sunflower II, with 1,442 apartments and 87 villas, totaling VND 3,000 billion in investment, has completed its first legal phase and is expected to be handed over by late 2025 – early 2026. The IJC-Hoa Loi housing project, comprising 906 townhouses, continues to record strong sales due to its proximity to VSIP 2, Dong An 2, and My Phuoc 3 and 4 industrial zones.

“Real estate profits typically concentrate in Q3 and Q4. This year, revenue and profit will mainly come from Sunflower II and Hoa Loi. These projects not only deliver positive business results but also lay the foundation for a new growth cycle in 2026–2027,” said a company representative.

Notably, with its upcoming capital increase, Becamex IJC will have ample resources to deploy real estate projects and strengthen its infrastructure position.

Specifically, the company is offering an additional 251.8 million shares to existing shareholders at VND 10,000 per share, with a rights ratio of 3:2. Post-issuance, the company’s charter capital is expected to rise from VND 3,777 billion to approximately VND 6,296 billion. The total funds raised, estimated at VND 2,518 billion, will be allocated to strategic goals tied to infrastructure development and financial consolidation.

According to the plan, the capital will be used to invest in key transportation projects, including the Ho Chi Minh City – Thu Dau Mot – Chon Thanh Expressway and Ho Chi Minh City Ring Road 4. Additionally, IJC will continue investing in Becamex Binh Phuoc to expand the Becamex Binh Phuoc Industrial Zone and settle financial obligations. The remaining funds will be used to repay maturing bonds, bank loans, and directly invest in large-scale real estate projects like Sunflower II (expansion) and Prince Town II (expansion).

According to Ms. Vo Thi Huyen Trang, Deputy CEO and Board Member of Becamex IJC, this capital increase is a strategic move to strengthen equity and enable the company to participate in large-scale projects. “With the new capital, IJC can ensure counterpart funds for PPP projects, expand its land bank, and accelerate housing project progress. This foundation will enhance our competitiveness, reduce debt pressure, and solidify our market position,” she said.

Infrastructure Development Corporation (Becamex IJC, HOSE: IJC) announced the issuance of over 251.8 million shares at VND 10,000 per share, with a rights ratio of 3:2. The additional shares offered to existing shareholders will be unrestricted for transfer. SSI Securities Corporation is the advisor for this transaction.

Cần Giờ Transformed: Mega Projects and Infrastructure Revitalize the Region

As the groundbreaking Can Gio Coastal Urban Area project and key transportation initiatives take shape in Ho Chi Minh City, the local economy and community are experiencing a remarkable transformation and renewed vitality.

Risk-Free Investment Solution with the 5-Right Townhouse Product: Homie City

Amidst declining lending rates and preferential credit for genuine homebuyers, Homie City emerges as a perfectly timed market opportunity. This offering stands as an ideal choice for prudent investors seeking both stable residence and efficient business exploitation, while also building long-term, sustainable value.

SkyM’s Soaring Journey: Celebrating Remarkable Trading Milestones

On the morning of October 25, 2025, at the InterContinental Halong Bay Resort, the event “The Signature Harmony – Dấu ấn thăng hoa” celebrated SkyM’s remarkable achievements. Nearly 100% of its units found owners within just five months, marking a significant milestone in its journey.

Elevating Southern Living: Văn Phú Brings the “Living for People” Philosophy to Southern Customers

At Văn Phú, our guiding philosophy is “human-centric real estate,” ensuring every project we develop harmoniously integrates people, environment, and space. This core principle is consistently embedded in our strategic development across key Southern market projects, setting a new standard for thoughtful and sustainable living.