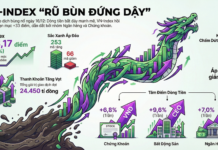

Following a sharp decline, market sentiment turned pessimistic as heavily pressured stocks faced intense selling. The morning session was dominated by selling pressure, but the market unexpectedly rebounded strongly, closing with a notable gain. At the end of the session, the VN-Index rose by 27.96 points (+1.69%) to reach 1,680.50 points. Foreign trading activity was positive, with a net buying value of 1,475 billion VND across the market.

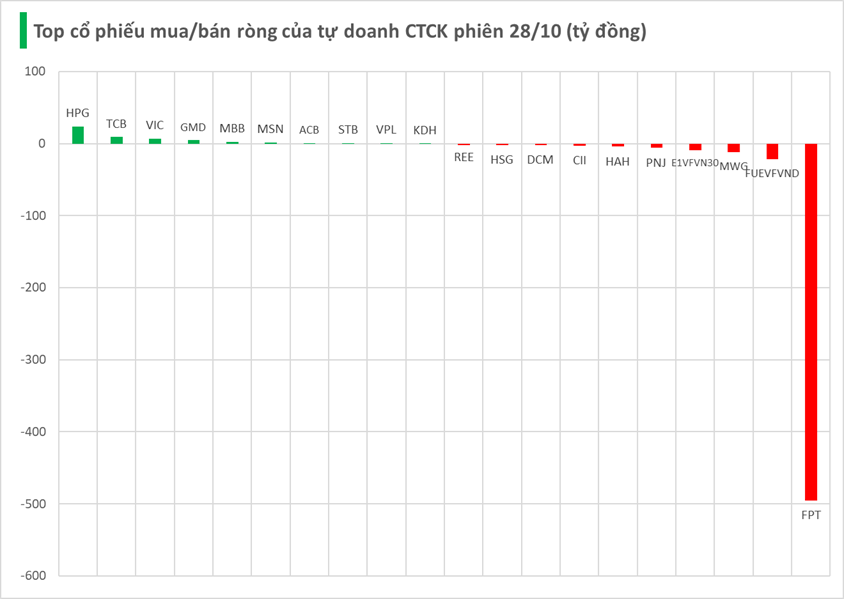

Securities companies’ proprietary trading desks net sold 184 billion VND on HOSE.

Specifically, securities firms recorded the highest net selling in FPT, with a value of -495 billion VND, followed by FUEVFVND (-22 billion), MWG (-12 billion), E1VFVN30 (-9 billion), and PNJ (-6 billion VND). Other stocks also saw significant net selling, including HAH (-4 billion), CII (-3 billion), DCM (-2 billion), HSG (-2 billion), and REE (-2 billion VND).

Conversely, HPG stocks were the most heavily bought, with a net value of 56 billion VND. This was followed by TCB (45 billion), VIC (38 billion), GMD (31 billion), MBB (29 billion), MSN (20 billion), ACB (14 billion), STB (12 billion), VPL (11 billion), and KDH (11 billion VND).

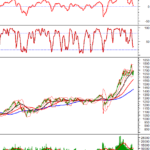

Technical Analysis Afternoon Session 29/10: Stochastic Oscillator Signals Buy Opportunity

The VN-Index has continued its upward trajectory, decisively breaking above the 50-day SMA, while the Stochastic Oscillator reinforces the bullish momentum with a fresh buy signal. Simultaneously, the HNX-Index is gaining ground, poised to test the middle band of the Bollinger Bands, signaling potential further upside.

Market Pulse 29/10: Foreign Investors Resume Net Selling, VN-Index Narrows Gains

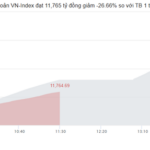

At the close of trading, the VN-Index climbed 5.33 points (+0.32%) to reach 1,685.83, while the HNX-Index rose 1.26 points (+0.47%) to 268.04. Market breadth favored the bulls, with 490 advancing stocks outpacing 211 decliners. Similarly, the VN30 basket saw green dominate, as 22 constituents advanced, 7 retreated, and 1 remained unchanged.

Stock Market Thrills: A Rollercoaster Ride Like No Other

The stock market witnessed a dramatic trading session on October 28th, as the VN-Index staged a remarkable turnaround. After plunging to around 1,620 points, it unexpectedly rebounded, closing above 1,680 points. This rollercoaster-like movement highlighted the emergence of bottom-fishing demand during the afternoon session, fueling a spectacular market reversal.