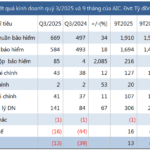

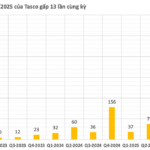

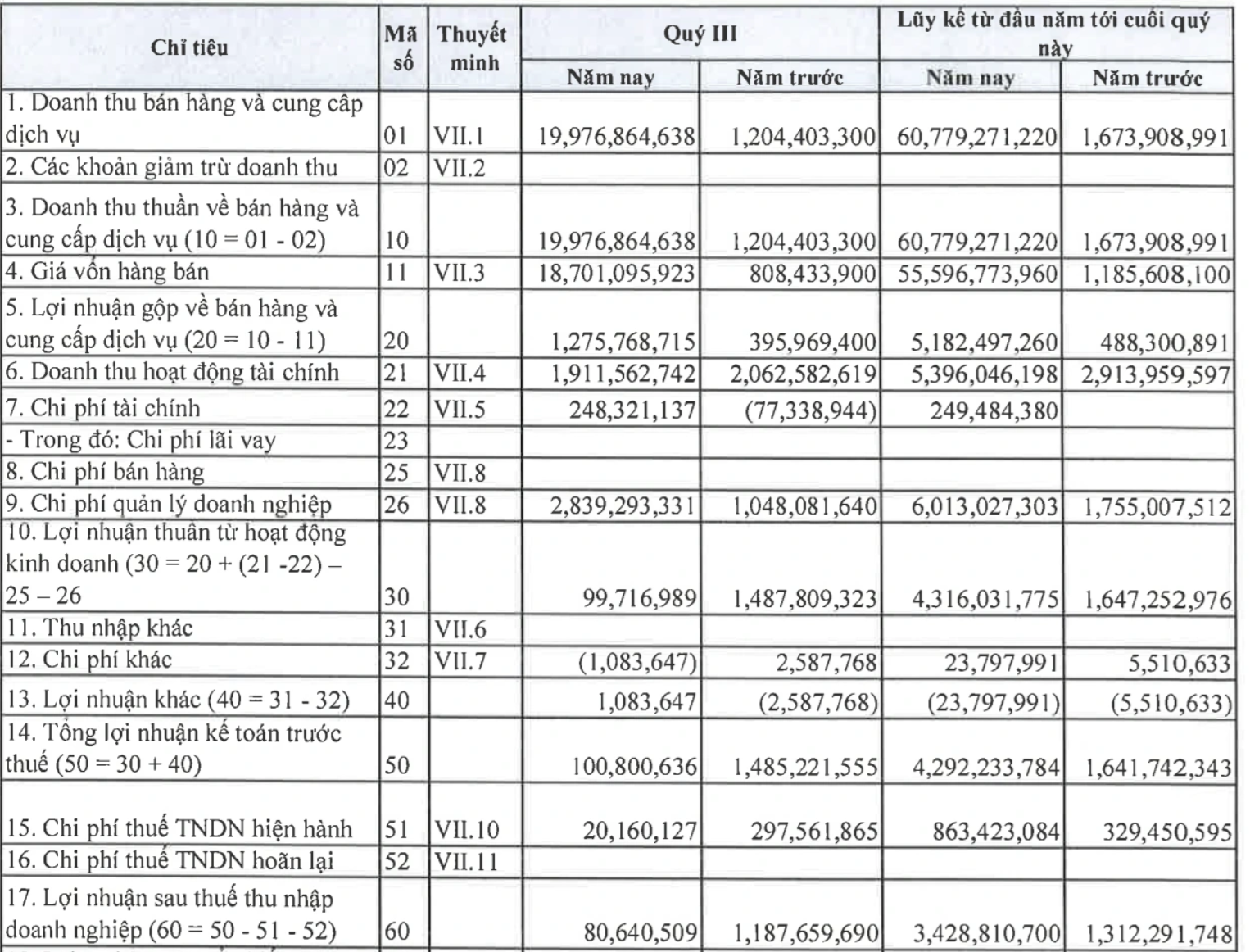

According to the Q3 2025 financial report, HVA Investment Joint Stock Company (HVA Group) recorded a net revenue of nearly VND 20 billion, a 17-fold increase compared to the same period last year. Pre-tax profit reached approximately VND 100 million, a 93% decrease from the VND 1.5 billion recorded in Q3 2024. Post-tax profit stood at over VND 80 million.

During the reporting period, the cost of goods sold was VND 18.7 billion, accounting for about 94% of revenue. The gross profit margin was around 6.4%, significantly lower than the 30% recorded in the same period last year. Despite the substantial revenue growth, increased capital and operational costs led to a decline in net profit compared to the previous year.

HVA’s business results in Q3 2025.

Recently, HVA Group has garnered attention by contributing capital to establish the DNEX Digital Asset Exchange with a cooperative capital scale of VND 10 trillion, headquartered in Da Nang.

As per the plan approved at the extraordinary shareholders’ meeting in September, HVA Group serves as the lead unit, responsible for planning, coordinating implementation, and connecting partners. This project was announced shortly after the government issued Resolution 05/2025/NQ-CP on the pilot program for the cryptocurrency market (dated September 9).

According to the business registration, DNEX Digital Asset Exchange Joint Stock Company was established on September 9, with its headquarters at MISA Building (Da Nang). The CEO is Mr. Nguyen Chi Cong (born in 1984), who also serves as a board member of HVA Group.

Mr. Le Hoa Nha, CEO of HVA Group, stated at a specialized session of the Financial Technology and Digital Asset Committee (under the Private Economic Panorama program – ViPEL) that the technology used for the DNEX project is entirely developed by Vietnam.

The DNEX Exchange is expected to align with the vision of making Da Nang an international financial hub, while attracting businesses and investors in the digital asset sector. Strategic partners of the project include Onus Finance UAB, Alpha Securities (APSC), Pacific Bridge Capital, SFVN, and Vemanti Group.

For the first nine months, HVA Group achieved a net revenue of nearly VND 61 billion, 36 times higher than the same period last year. Pre-tax profit reached over VND 4 billion, nearly tripling. Thanks to the positive results in the first half of the year, the company’s cumulative profit remained robust despite a slowdown in Q3. As of September 30, HVA’s total assets were nearly VND 190 billion, with equity reaching VND 151 billion.

“Aloe Vera King” Sets Profit Record, Achieves 88% of Annual Plan

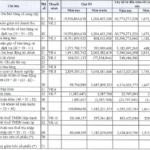

In the first nine months of 2025, the company’s net revenue surged to VND 526 billion, marking a 22% increase. Consolidated after-tax profit reached an all-time high of VND 79.5 billion, up 45% year-on-year, and surpassed 88% of the annual target.