Vietnam Export-Import Commercial Joint Stock Bank (Eximbank, HOSE: EIB) has released its Q3 and 9-month financial report for 2025, showcasing positive business results, continued expansion in assets and credit, and stable growth in capital mobilization.

Credit Growth at 8.51%

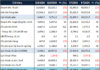

As of September 30, 2025, Eximbank’s total assets reached VND 255,707 billion, a 6.65% increase from the beginning of the year. This highlights the bank’s steady growth, focus on asset efficiency, and optimized investment portfolio.

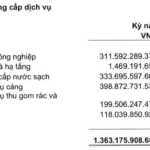

Total mobilized capital stood at VND 224,282 billion, up 6.77% year-to-date. Capital from economic organizations and individuals reached VND 176,165 billion, growing 5.21%, while issued securities rose sharply by 69.97% to VND 18,467 billion. This reflects customer and investor confidence in Eximbank and its flexible strategy to diversify funding sources, supporting future credit growth.

Eximbank’s credit activities continued to grow positively, targeting key economic sectors. By Q3 2025, outstanding credit reached VND 182,552 billion, up 8.51% year-to-date.

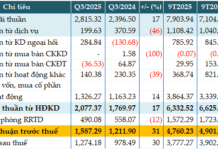

In Q3 2025, Eximbank recorded net interest income of VND 1,465 billion, a slight 4.6% decline year-on-year. Services, foreign exchange, and other activities significantly contributed to revenue. Operating expenses rose 6.98% to VND 924.6 billion, resulting in pre-tax profit of VND 560 billion, down 38.02% year-on-year.

For the first nine months, Eximbank achieved net interest income of VND 4,289 billion. Service and foreign exchange income reached VND 348 billion and VND 464.5 billion, respectively, with other income at VND 332.8 billion. Risk provisioning costs fell 27% due to improved asset quality, but operating expenses rose 18.5% to VND 2,884 billion, reducing pre-tax profit to VND 2,049 billion, down 13.85% year-on-year.

Return on assets (ROA) was 0.65%, and return on equity (ROE) was 6.23%. Eximbank’s loan structure shifted significantly, with long-term loans increasing while short- and medium-term loans remained stable.

During the quarter, Eximbank earned multiple domestic and international awards and implemented practical credit policies to support individuals and businesses, aligning with government and State Bank directives.

As a leader in trade finance, Eximbank responded to rising exchange rates by launching policies to support exporters and importers. The ‘E-ONE’ credit package for large enterprises and FDI offers preferential interest rates, international payment fees, and money transfer fees. Additionally, Eximbank provides interest rate risk insurance for foreign currency loans, helping businesses manage financial costs amid exchange rate fluctuations.

Eximbank offers highly competitive exchange rates to reduce input and output costs for exporters and importers. The ‘Travel the World with Eximbank Forex’ Season 3 program encourages increased foreign exchange transactions.

Recently, Eximbank was honored at the 2025 Asia Pacific Enterprise Awards (APEA), one of Asia’s most prestigious awards. It also featured in the PRIVATE 100 list of top tax-contributing private enterprises in Vietnam, ranked among the Top 50 Most Efficient Vietnamese Companies, and received the 2025 Outstanding Digital Transformation and Technology Product Award for the third consecutive year. The bank also earned the “Excellent International Payment Quality” award, underscoring its commitment to excellence in Vietnam’s financial sector.

Eximbank honored at the 2025 Asia Pacific Enterprise Awards (APEA).

|

Risk Management for Sustainable Development

Eximbank is undergoing a significant transformation, focusing on sustainable development and strengthening its position in Vietnam’s financial system. The bank is accelerating digitalization, improving governance, and enhancing service quality to become a modern, customer-centric financial institution.

Eximbank is also enhancing risk management capabilities, optimizing operations, and aligning with international standards. It is collaborating with reputable advisors and international experts to drive comprehensive restructuring, from organizational models to long-term strategies.

These efforts have strengthened Eximbank’s position, earning recognition from domestic and international organizations. This foundation supports the bank’s sustainable growth and contributions to Vietnam’s economic stability and development.

S&P Global Ratings upgraded Eximbank’s international credit rating to “BB-” with a “stable” outlook, surpassing the industry average of B+. This reflects Eximbank’s positive restructuring efforts and sustainable growth, reinforcing market, partner, and customer confidence in its transformation journey.

– 15:01 30/10/2025

HDBank Surpasses 14,800 Billion VND in 9-Month Profit, Maintains Lead in Profitability, Dividends, and Bonus Shares Up to 30%

HDBank (HOSE: HDB) has reported a consolidated pre-tax profit of VND 14,803 billion for the first nine months of 2025, marking a 17% year-on-year growth. The bank continues to lead the industry in profitability metrics, boasting an impressive ROE of 25.2% and ROA of 2.1%, underscoring its operational efficiency and robust financial foundation.

FTSE CEO: Vietnam Poised for Deeper Integration into Global Capital Markets

The forum titled “Emerging Vietnam: Beyond the Upgrade,” hosted by SSI Securities on October 30th, offered profound insights into the prospects of Vietnam’s economy and stock market following its elevation to emerging market status.

Hallmark Achieves Vietnam’s First WiredScore Platinum Certification

On October 29th, The Hallmark, a premier Grade A+ office building in the heart of Ho Chi Minh City, proudly achieved Platinum certification—the highest level in the WiredScore system. This prestigious recognition marks The Hallmark as the first building in Vietnam to attain this global benchmark for digital infrastructure excellence.

Keynote Address by General Secretary To Lam at the University of Oxford

As part of his official visit to the United Kingdom of Great Britain and Northern Ireland, General Secretary To Lam delivered a pivotal policy address at the University of Oxford, a leading academic and research institution in the UK. His speech outlined a vision for the Vietnam-UK relationship framework and highlighted Vietnam’s innovative development trajectory during this era of national ascent. The Government’s Electronic Information Portal is honored to present the full text of General Secretary To Lam’s address.

The World is Set to Vote for the Next “Urban Wonder”—What’s Vietnam’s Potential?

The New7Wonders Foundation, renowned for recognizing Ha Long Bay as one of the “New 7 Wonders of Nature,” has officially launched its global campaign, “7 Wonders Cities of the Future.”