Hóa An Corporation (Stock Code: DHA) has released its Q3/2025 financial report, revealing a remarkable 68% year-on-year surge in net revenue to nearly VND 104 billion. Cost of goods sold increased at a slower pace, driving a 118% growth in gross profit to approximately VND 43 billion. Gross margin improved significantly, reaching 41% in Q3.

Additionally, financial revenue climbed by over 43%, contributing more than VND 6 billion, primarily from dividends received from Bien Hoa Construction and Building Materials JSC (Stock Code: VLB). Meanwhile, administrative expenses rose by 86% to nearly VND 7 billion.

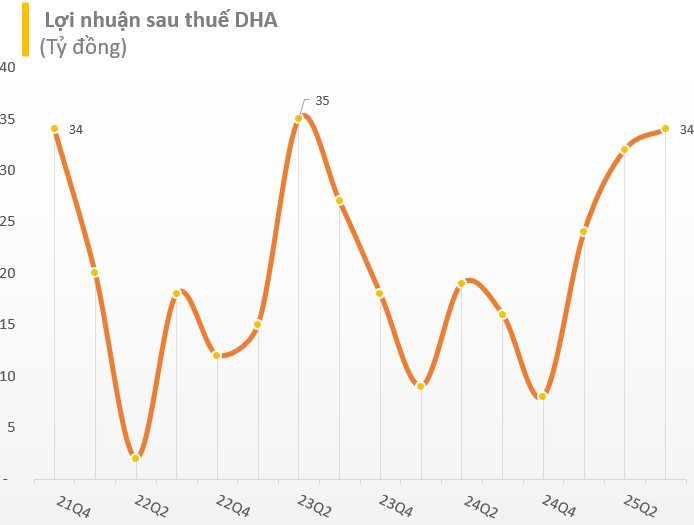

As a result, Hóa An recorded an after-tax profit of over VND 34 billion, a 111% increase compared to the same period last year.

For the first nine months of the year, DHA achieved a net revenue of over VND 300 billion and an after-tax profit of nearly VND 91 billion, representing year-on-year increases of 33% and 106%, respectively.

With these impressive results, the company has fulfilled 98% of its revenue target and exceeded its after-tax profit goal by nearly 60% for 2025.

As of September 30, 2025, Hóa An’s total assets reached over VND 522 billion, an 11% increase year-on-year. Cash, cash equivalents, and deposits totaled VND 84 billion, accounting for 16% of total assets.

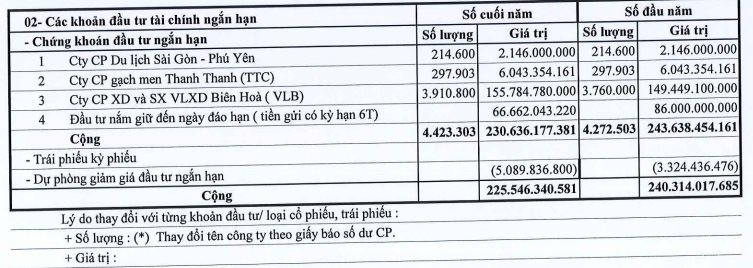

The company allocated nearly VND 164 billion to securities investments, with its stock portfolio remaining unchanged since the beginning of the year. The largest holding continues to be VLB of Bien Hoa Construction and Building Materials JSC, with over 3.9 million shares, an increase of approximately 150,000 shares since the start of the year.

Notably, the impairment allowance for the entire investment portfolio rose to VND 5.1 billion, equivalent to a 3% provision.

Source: DHA Q3/2025 Financial Report.

Established in 1980 as Hóa An Stone Enterprise, Hóa An Corporation specializes in mining and processing construction materials. Since transitioning to a joint-stock company in 2000, it has managed three high-quality quarries in the Southeast region. Annually, the company extracts and processes over 1.5 million m³ of various stone materials.

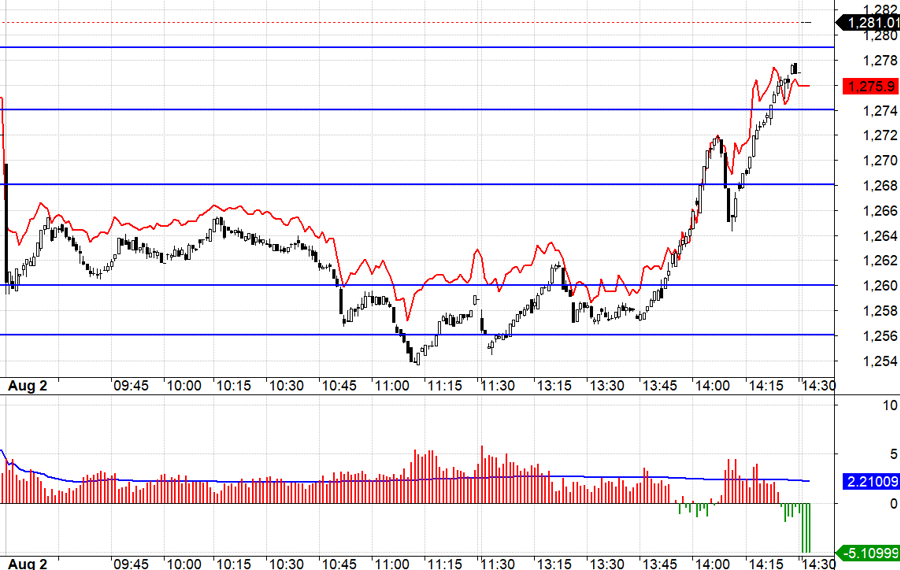

On the stock market, DHA shares surged nearly 2% on October 28 to VND 55,300 per share, setting a new all-time high. The stock price has risen by nearly 40% since the beginning of the year.

Unveiling Insights: Novaland’s Q3 2025 Financial Report Highlights

Novaland has released its Q3/2025 financial report, highlighting significant cash flow challenges. A notable achievement during this period was the successful handover of 720 units and the issuance of 1,935 land-use right certificates.

Electric Quang Group Overcomes Stock Warning and Control Status

Electrical Equipment Joint Stock Company Dien Quang (DQC) has released a report detailing its efforts to address the warning and periodic control status of its stock for Q3/2025.